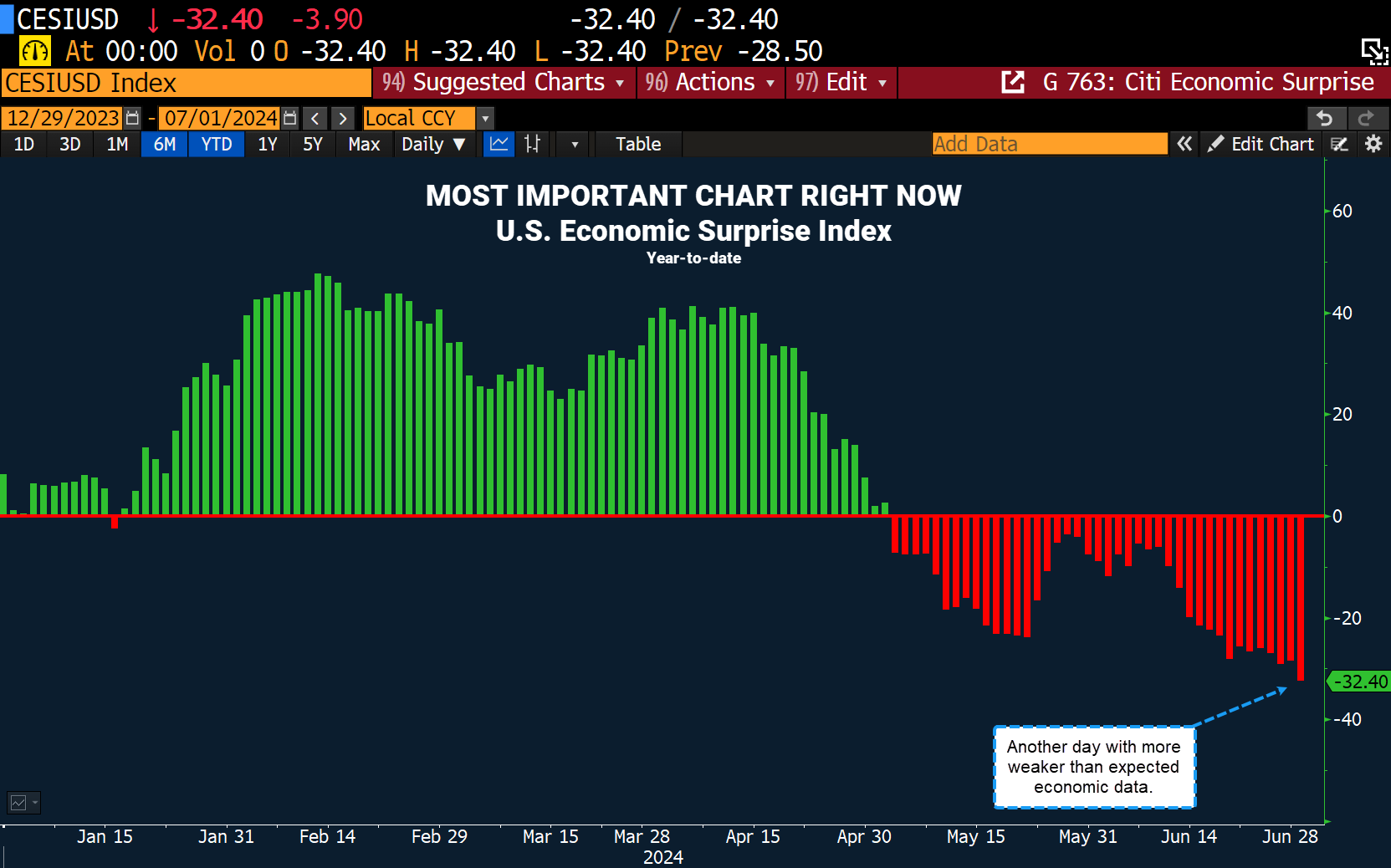

This week's chart shows the year-to-date evolution of the Citi Economic Surprise Index (CESI) in the United States.

Until May, economic indicators were better than expected.

The situation then changed abruptly and, in recent weeks, economic indicators have continued to disappoint against expectations:

U.S. unemployment figures are pretty good, but as explained in my last article, they are blurred by inflation.

The recently published positive figures are largely attributable to the increase in public sector jobs, masking the continuing decline in private sector jobs:

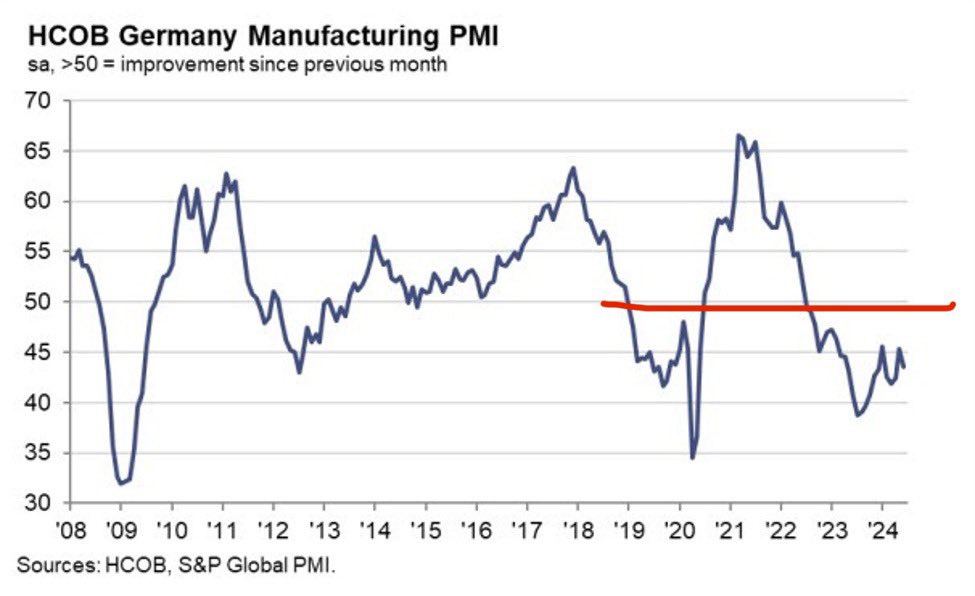

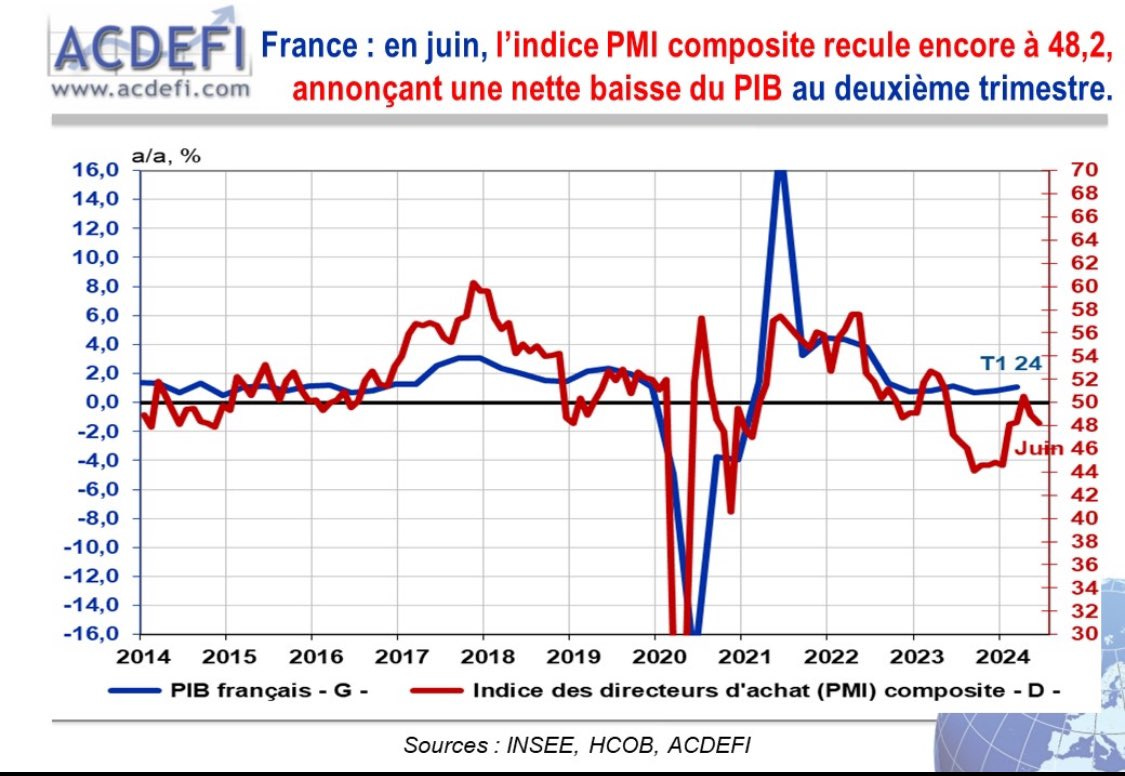

The United States is slowing down, while Europe is mired in a persistent contraction from which it is unable to emerge.

In June, the German PMI index stood at 43.5, remaining below the contraction threshold of 50. German industry is struggling to recover, with energy costs still too high to return to normal:

France's PMI index fell back down in June:

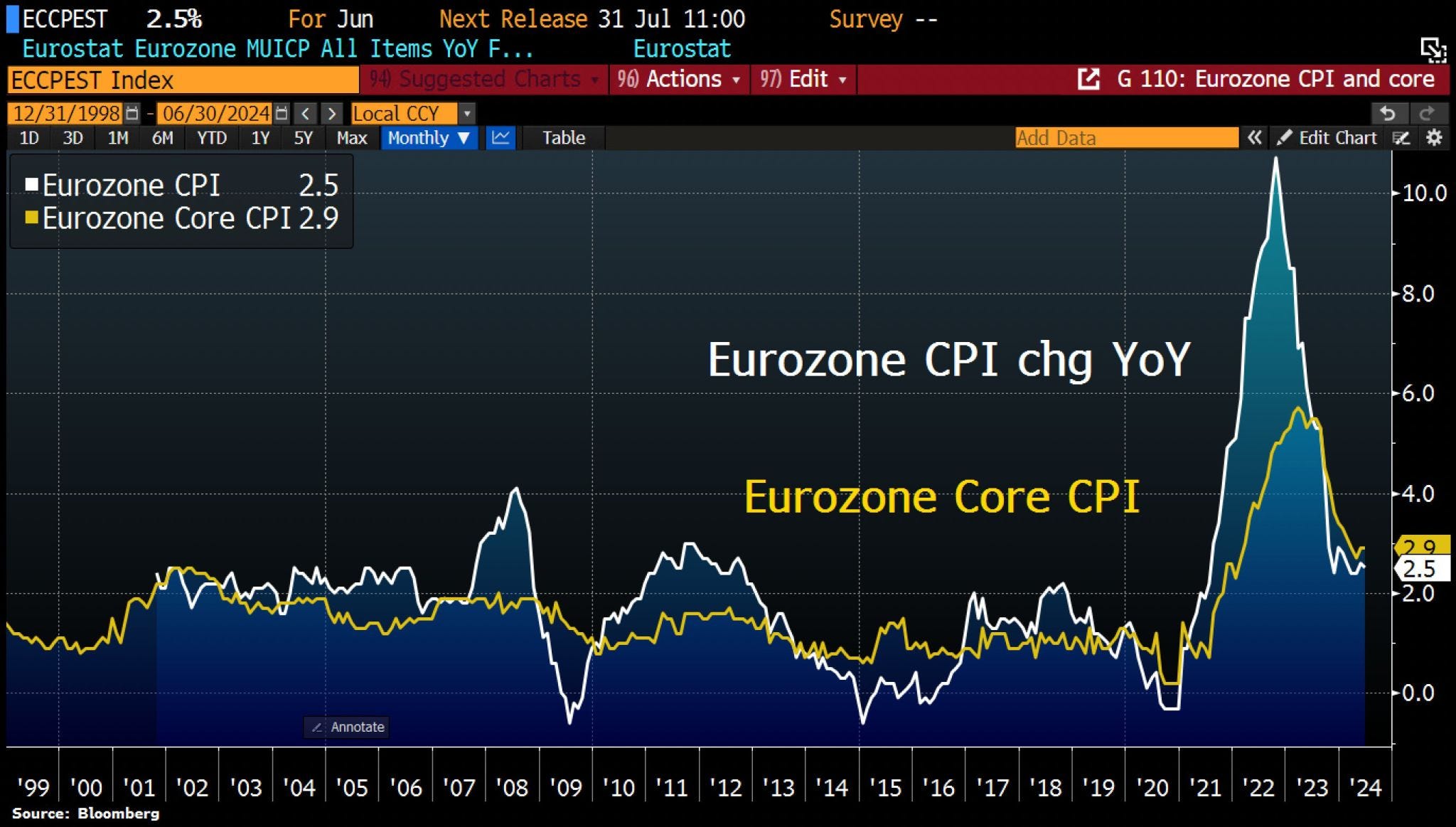

Europe, in addition to experiencing a slowdown in industrial activity, remains mired in a stubborn inflationary context:

Stagflation persists in Europe as we enter the summer of 2024.

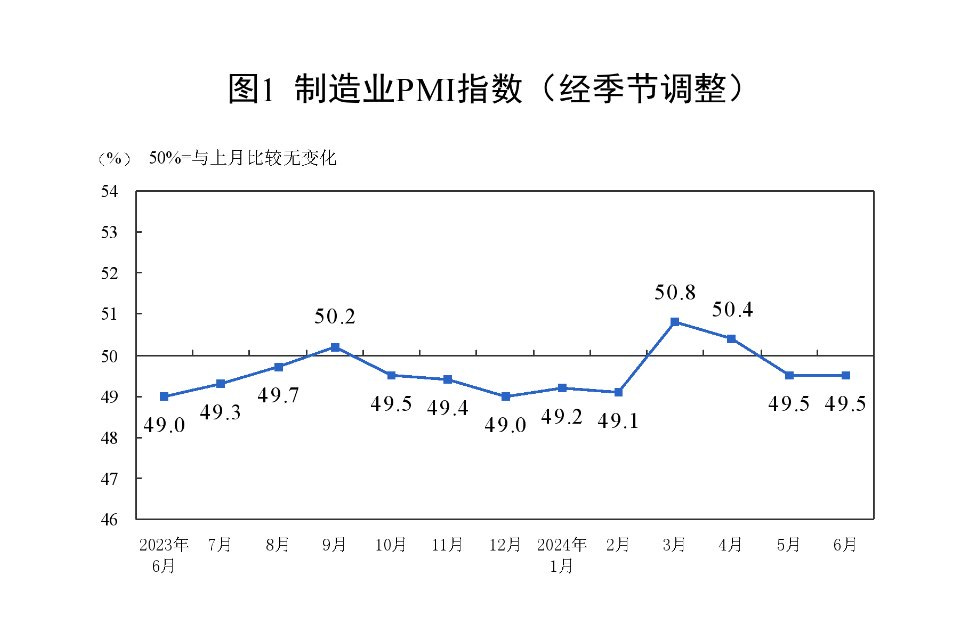

China's PMI also falls for the second month running:

This official survey reveals that large state-owned manufacturing companies are experiencing difficulties. The PMI index of the National Bureau of Statistics remained at 49.5, indicating a contraction.

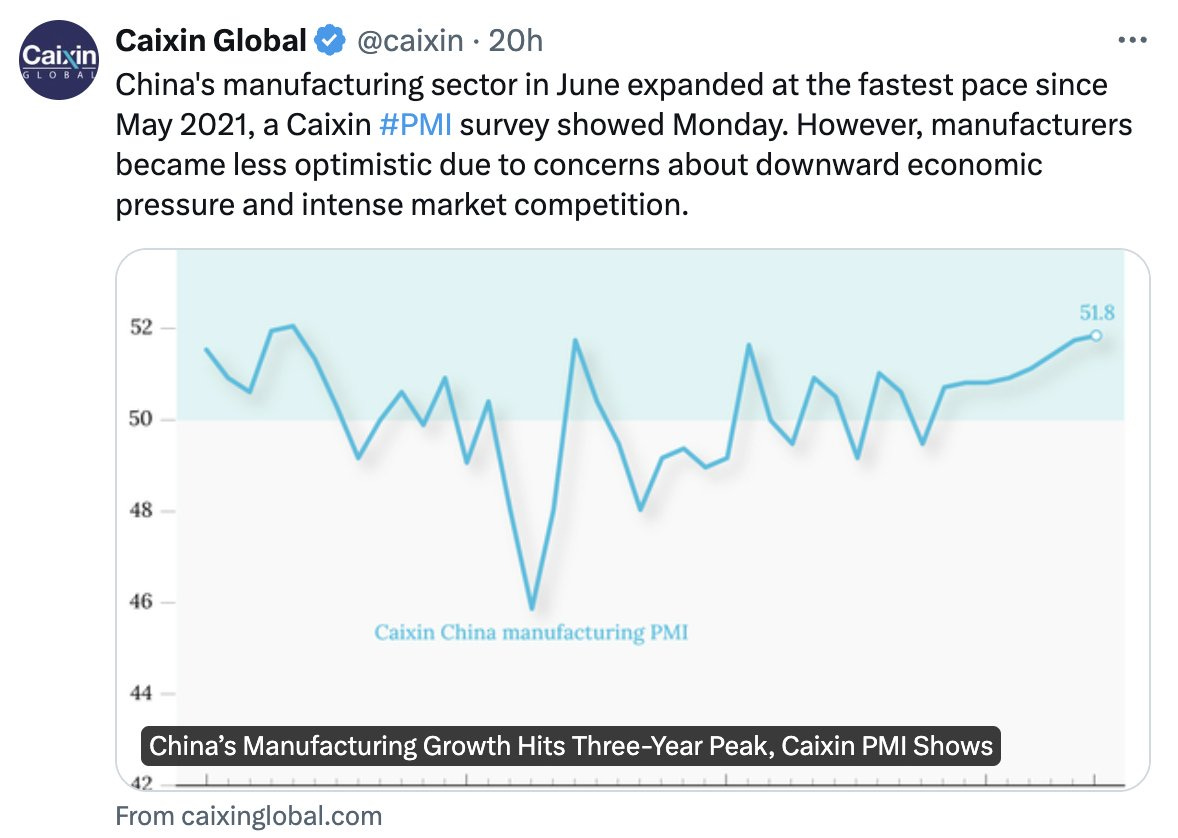

By contrast, the other PMI index published by the CAIXIN agency did not show any contraction, even though the survey highlighted a decline in optimism among Chinese manufacturers:

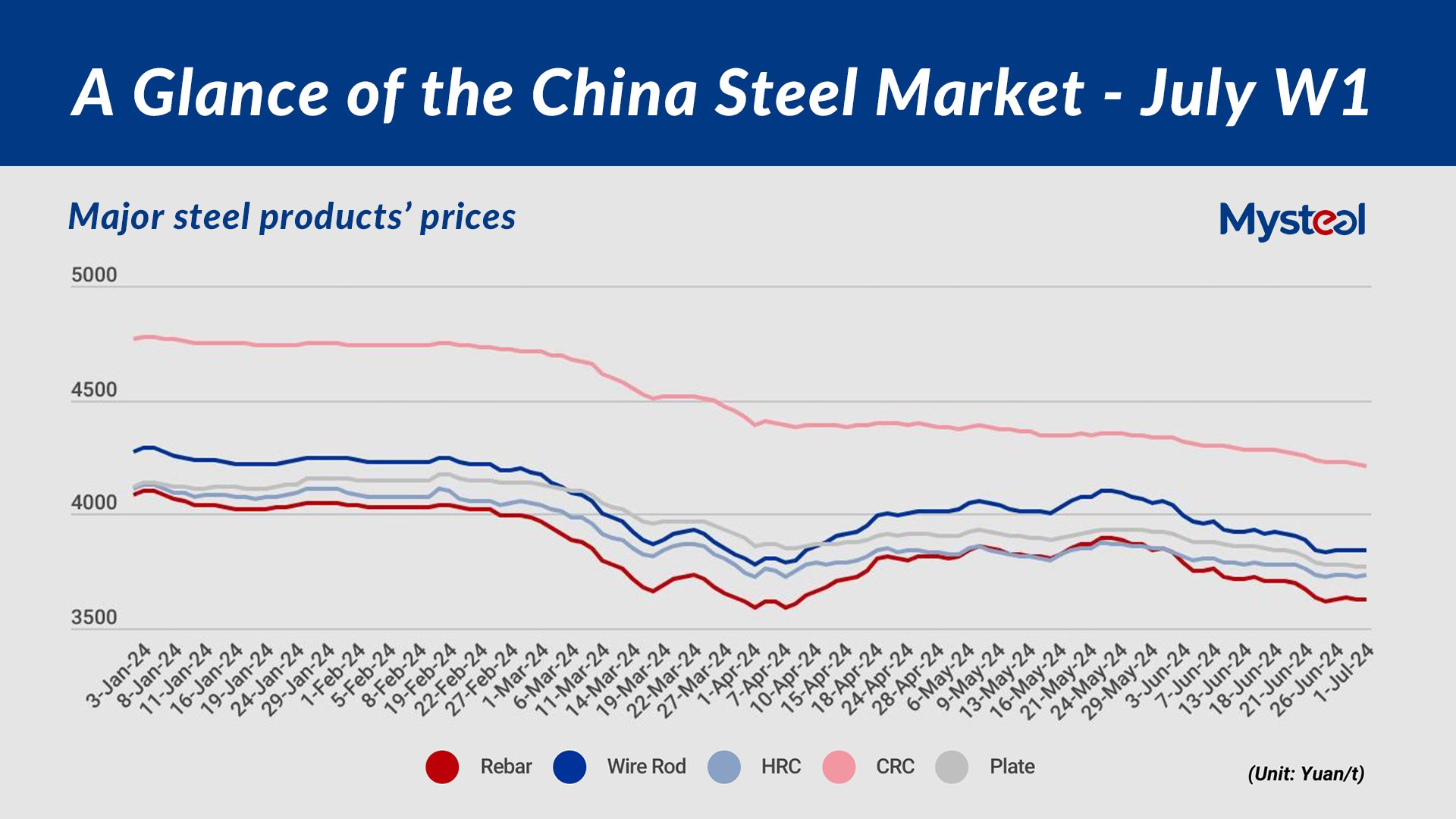

In China, steel production figures continue to fall, indicating a further decline in demand in the construction sector:

The United States is slowing down, Europe is in the grip of stagflation, and China is also slowing down.

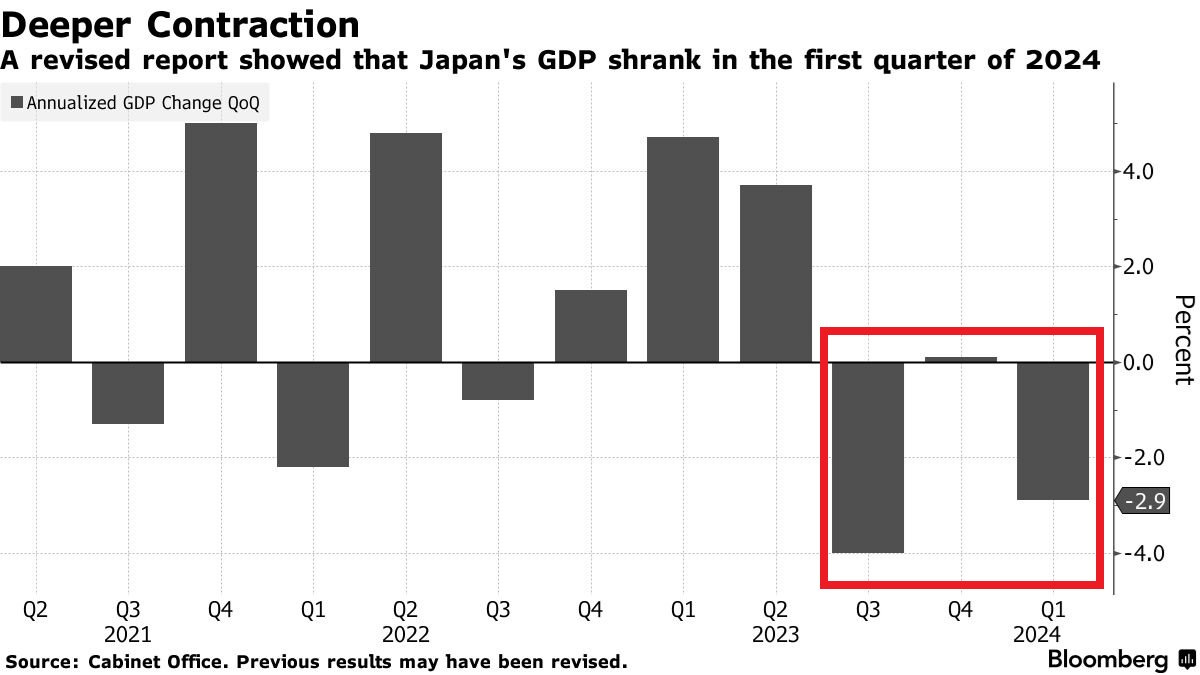

But it's Japan that seems to be most affected by the global economic slowdown.

Japanese GDP shrank at an annualized rate of 2.9% in the first quarter of 2024, a downward revision on the previous figure of -1.8%. Over the last three quarters, the Japanese economy has suffered a marked contraction:

The Japanese economy measured in dollars has reached its lowest level in 30 years.

In 1995, Japan's share of nominal world GDP was 17.8%, around 71% of that of the United States.

What a change 30 years later!

The USA has a GDP of $28.783 trillion, China $18.536 trillion, Germany $4.590 trillion, Japan $4.112 trillion and India $3.942 trillion.

India is in the process of overtaking Japan... and in 30 years, the country has fallen from 71% to 14% of US GDP!

This decline has accelerated in recent years, with Japan's GDP falling by -20% in just a decade.

This impoverishment has been accompanied by a massive increase in the country's indebtedness; Japan now has the highest debt-to-GDP ratio in the world.

The policy of debt monetization has never stopped; Japan is fighting its economic slowdown with debt, while the Japanese Central Bank (BoJ) is helping the state to finance by printing money.

The Japanese currency is obviously suffering the consequences of this headlong rush.

It now seems that the global economic slowdown is having a direct impact on the acceleration of the Japanese currency's depreciation.

The yen has continued to fall against the dollar in recent weeks, reaching record lows not seen for almost 40 years!

The USD/JPY exchange rate is returning to levels not seen since 1986.

The Japanese currency has fallen 14 times in the last 17 sessions!

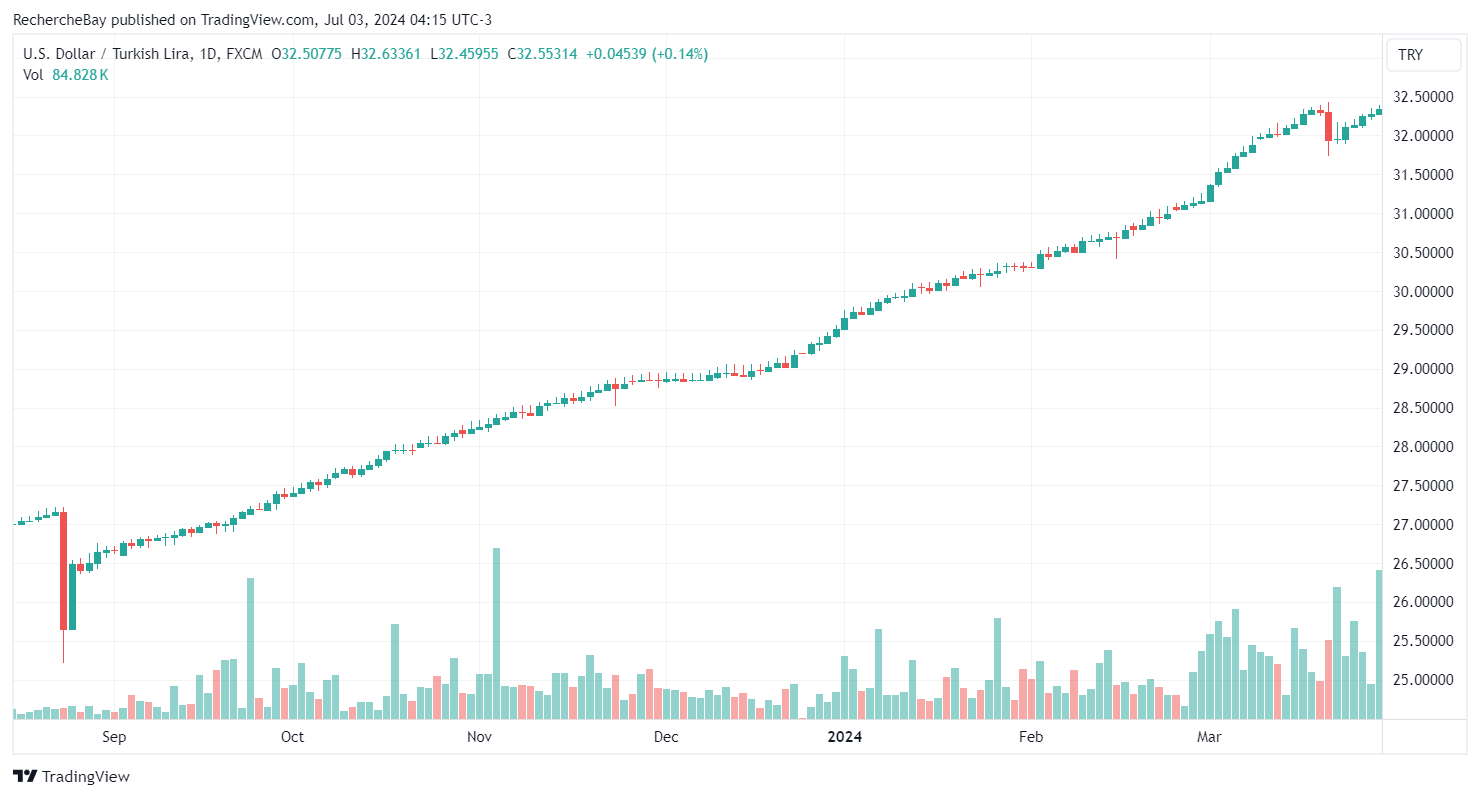

The yen is on a very slippery slope: in a similar configuration last September, the Turkish lira slumped.

The dollar's chart against the yen since May is beginning to resemble that of the Turkish lira last autumn, when the Turkish Central Bank's intervention failed...

Under these conditions, the price of gold in yen continues its parabolic ascent:

To combat the growing recession and prevent it turning into a depression, the BoJ refuses to back its currency and continues to monetize its debt.

The BoJ's policy of money creation has contributed to a rise in the price of gold, and this upward trend continues.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.