The Fed's sharp rate hike to fight inflation is having an effect on housing prices, but not yet on employment numbers.

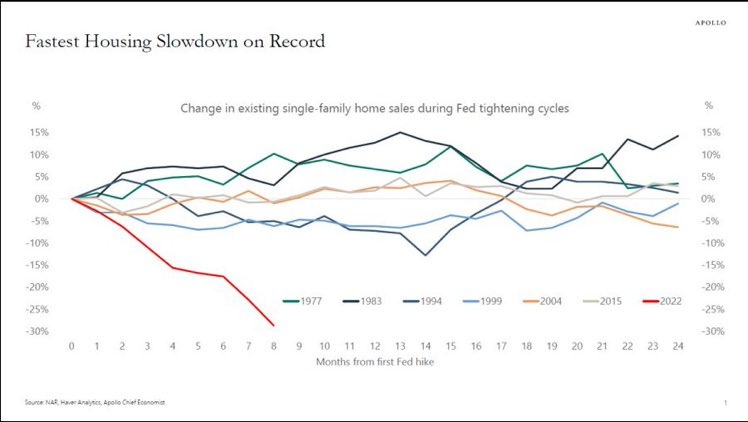

The housing slowdown is the largest ever seen in a tightening cycle by the Fed:

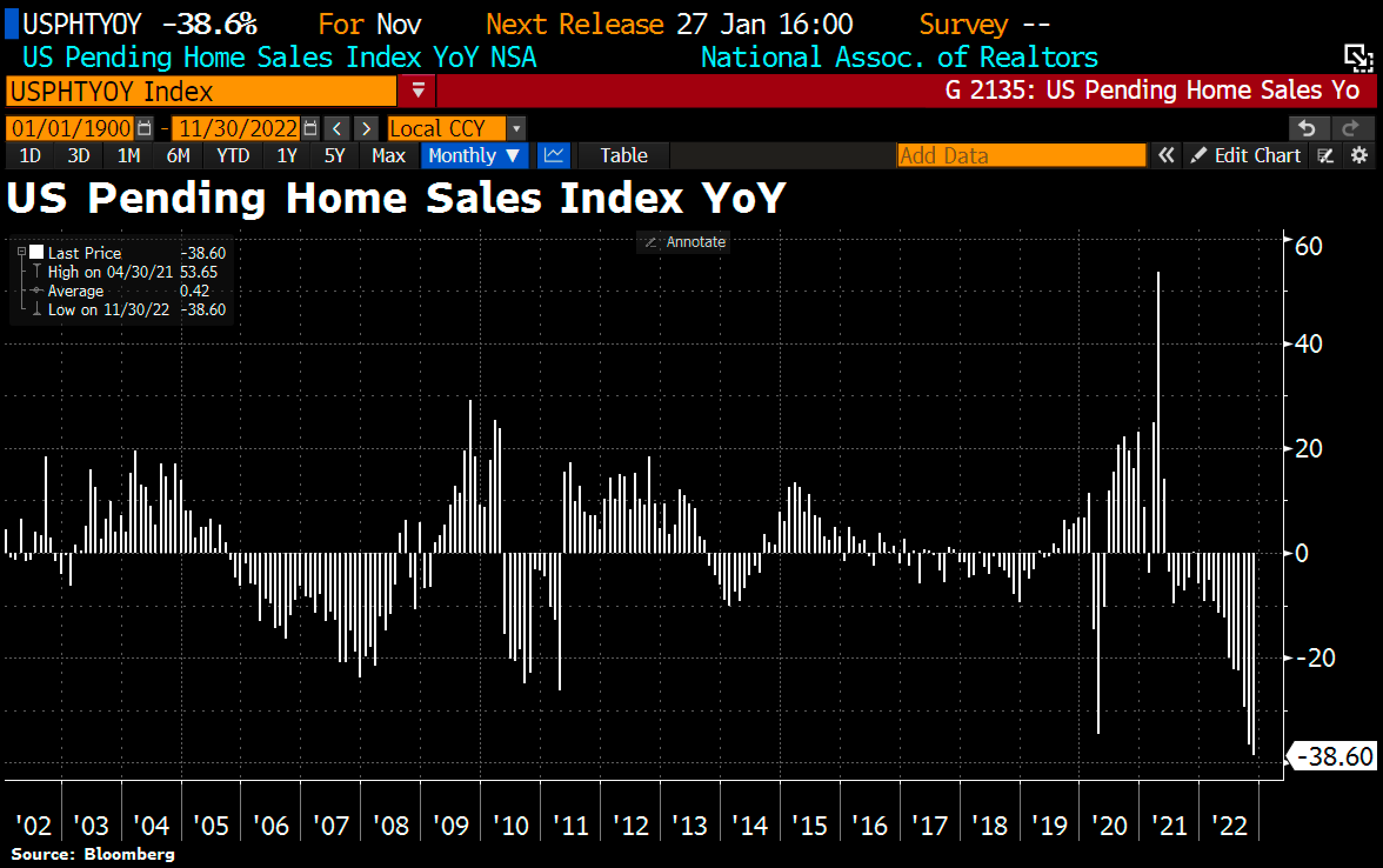

Each month brings its own record decline in the U.S. housing sector. The drop in pending home sales is historic:

U.S. pending home sales fell another -4% in November, a -38.6% year-over-year drop, after declining -36.7% year-over-year the previous month. November breaks October's record as the month with the fastest pace of decline.

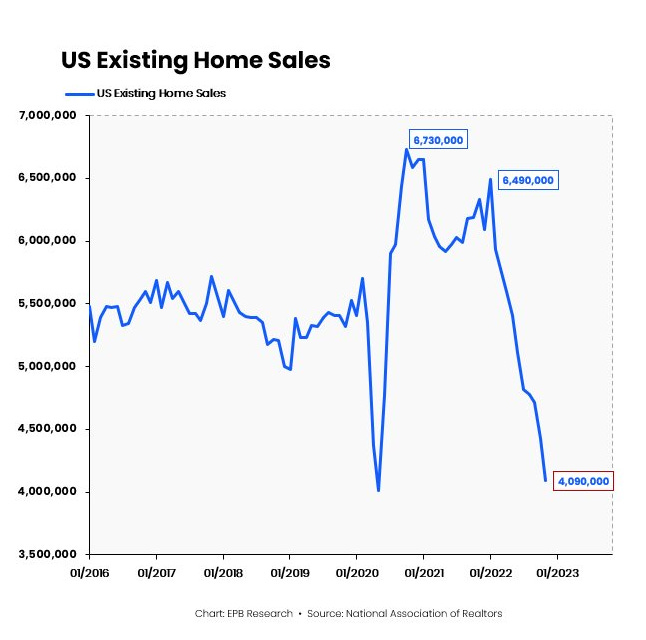

In just a few months, existing home sales have fallen even more sharply than they did at the time of the pandemic. We are already back to a number of sales comparable to the 2020 low:

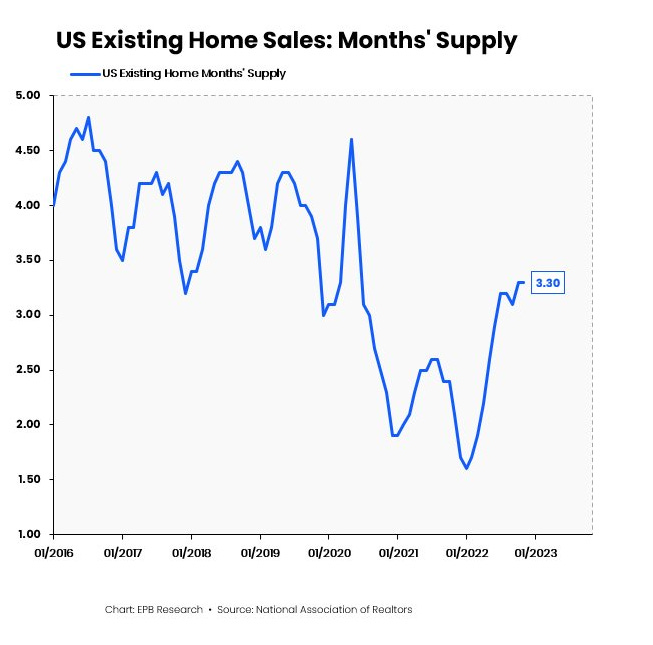

This time, however, the drop in sales has been achieved in a completely different context. The inventory of homes for sale is far lower than it was in 2020 or during the 2007 housing crisis:

The drop in home sales is related to rising rates, which make it grossly impossible to buy at current prices, not to a large supply of properties for sale.

Unlike in 2007, U.S. homeowners are not being strangled by variable rates and toxic loans that are pushing them to sell their properties. This time, fixed-rate loans are shifting losses to the banks that originated the loans, which are taking the full brunt of the rate hike. The drop in sales does not translate into pressure on owners, but professionals (real estate agents) are on the front line and are directly affected by this slowdown in activity. The state is also a collateral victim, as the Treasury records a significant drop in taxes related to these sales.

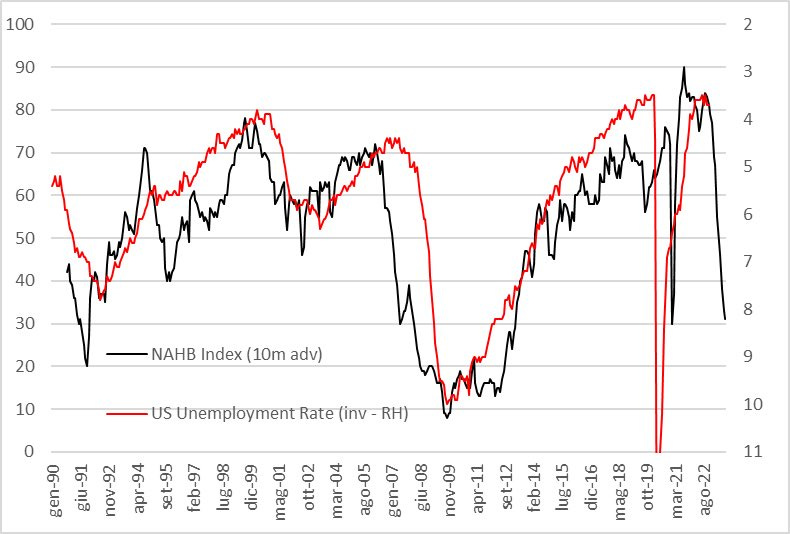

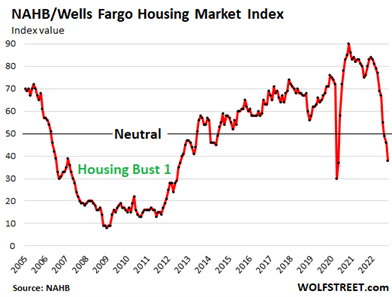

The last housing market correction in 2007 was less drastic, and right after that, unemployment figures exploded upwards:

Will it be the same this time?

Of course, that is what Fed economists are hoping for, as the wage component is the most insidious part of the inflation numbers. The Fed is desperate to ease the upward pressure on wages in order to avoid further harmful inflationary effects.

But here again, things are different from 2007.

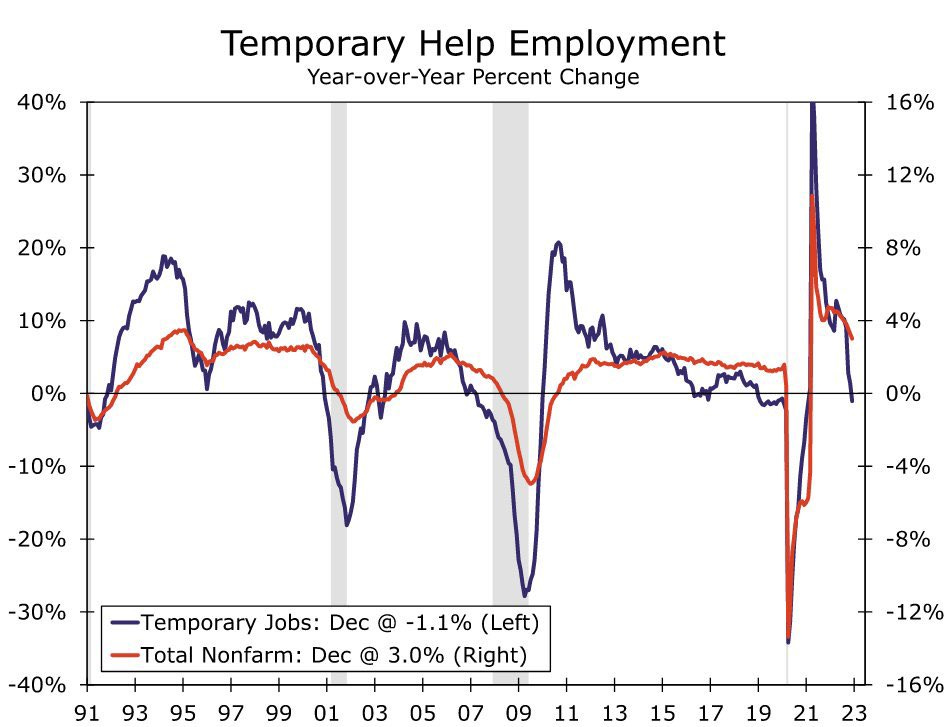

Employment numbers remain quite solid. Despite a slight decline in wages, U.S. employment still appears strong. Total non-farm payroll employment rose by 223,000 in December and the unemployment rate fell slightly to 3.5%, according to the latest figures from the U.S. Bureau of Labor Statistics. There was notable job creation in leisure and hospitality, health care, construction and social assistance. However, these temporary figures suggest that unemployment will rise again in the coming weeks.

The rise in unemployment is not as great as expected, and this is due to several factors.

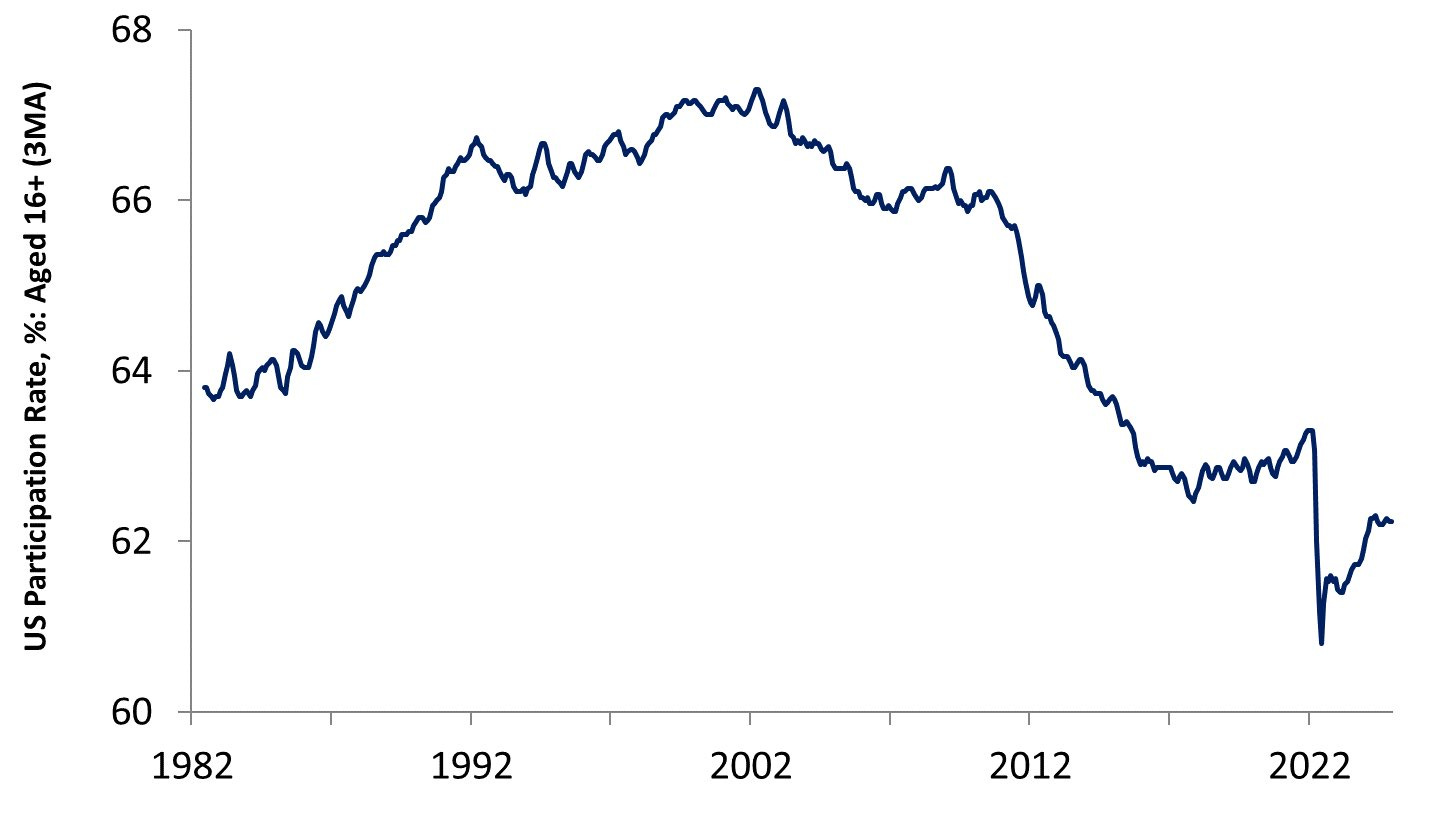

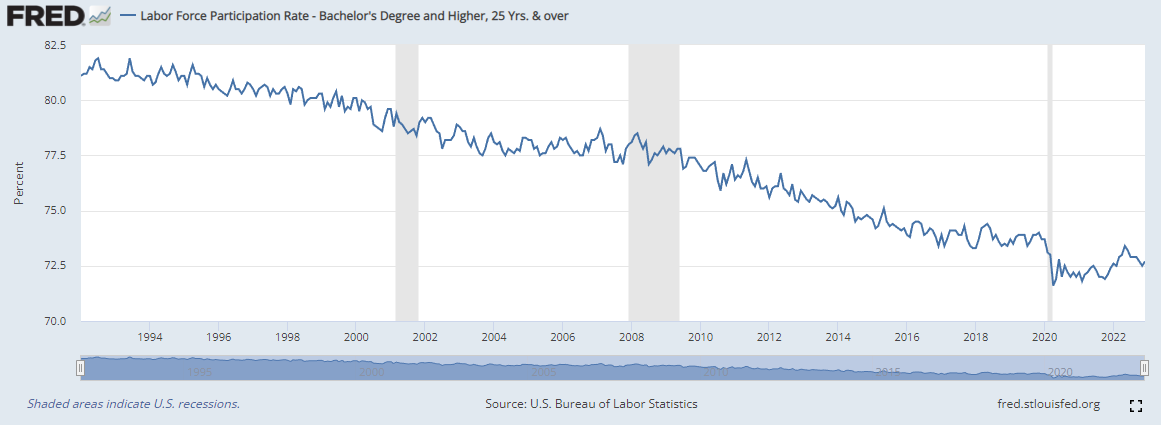

First, the available labor force is still at very low levels, below pre-Covid levels:

When we look at this chart over a longer period of time, we realize the extent of the decline: in one generation, the country has lost 10% of its labor force!

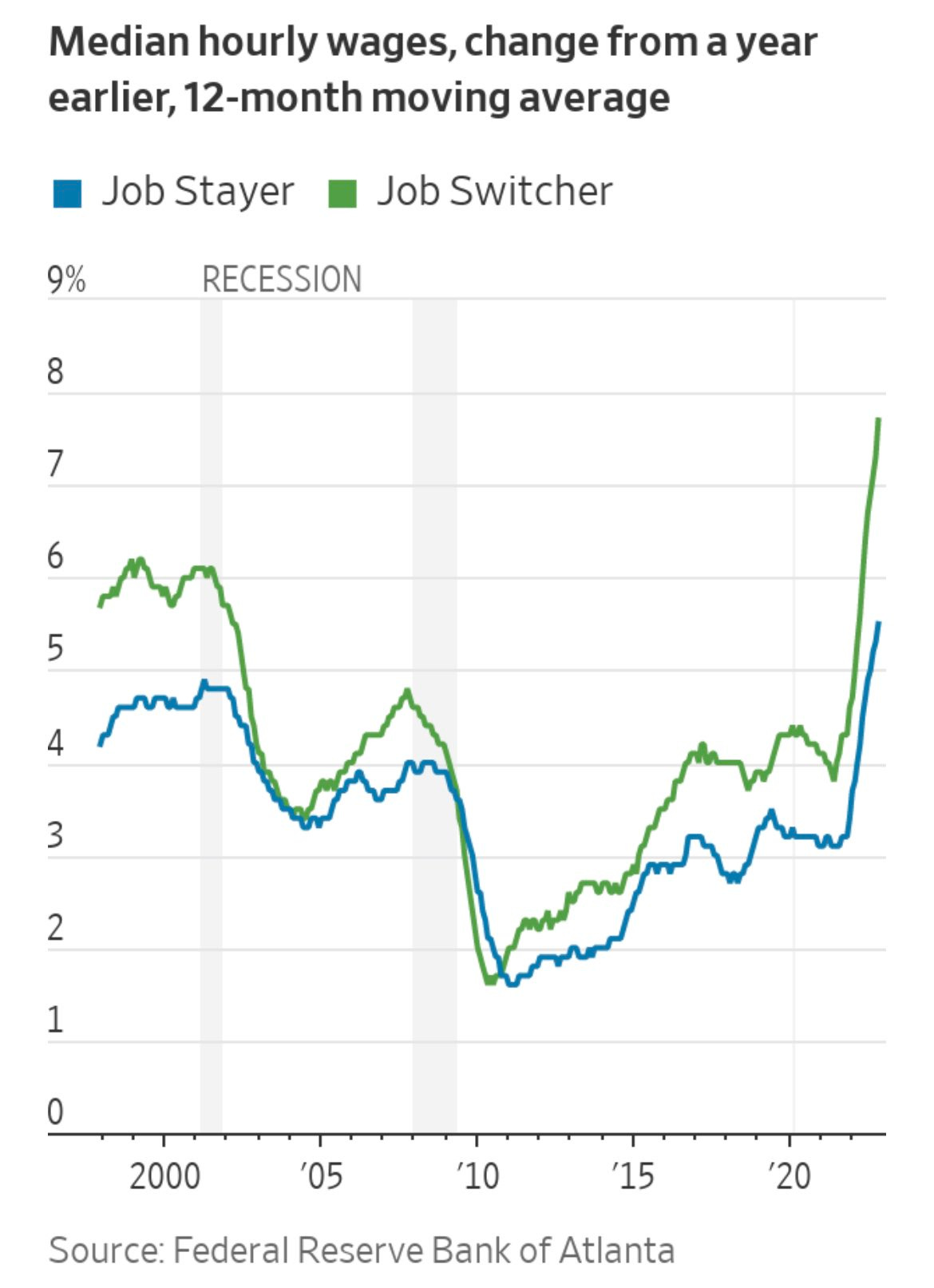

Secondly, the job-switcher phenomenon has increased in recent months. By regularly changing jobs, the new generation has found a way to maximize their income and ride the recent wave of rising wages:

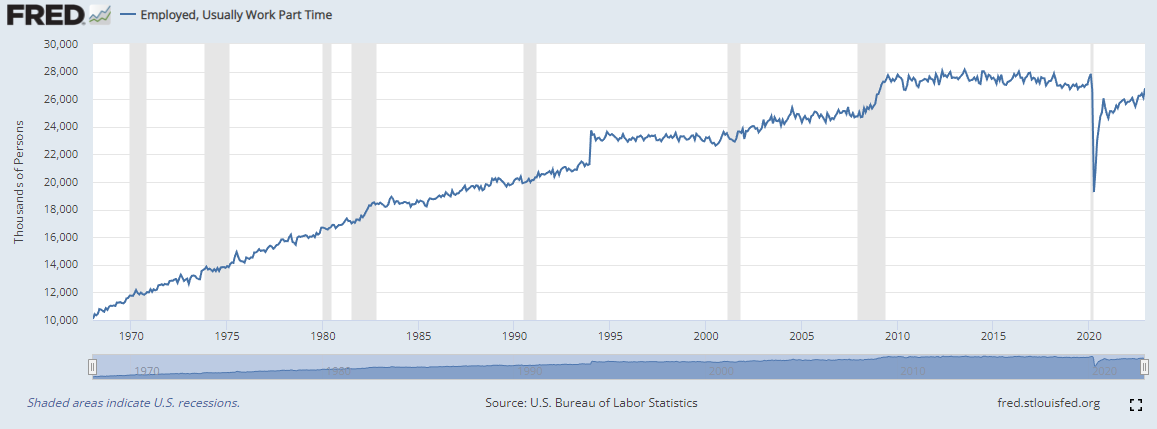

This growing number of job switchers should be seen in a particular context: part-time work is a trend that has developed among the new American generation.

Currently, to resist inflation, it is better to hold down several jobs or change jobs as often as possible. Those who cling to the stable employment model of the previous generation are the big losers in this inflationary period!

Under these conditions, the Fed's action on interest rates has not yet had an impact on the employment sector and wage levels are still too high.

The much hoped-for "Fed pivot" will certainly be delayed.

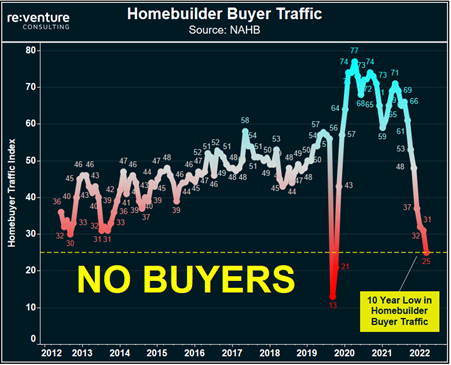

For its part, the real estate sector is likely to experience a longer-than-expected desert crossing: the decline in prices is expected to be very slow, as homeowners are not in a hurry! Real estate agents will also have to think about finding a second job quickly... especially since the source of potential buyers is in free fall. The NAHB index measuring the flow of potential buyers is plunging to its lowest level since the Covid crisis:

Compared to the previous real estate crisis, this indicator still has a downward margin...

A better-than-expected job market, a receding Fed pivot: all indications are that the U.S. real estate crisis is likely to be long-lasting, with a still high margin of decline for the sector.

If real estate is no longer a safe haven, it is logical that gold will once again become the preferred tangible asset for investors.

As I wrote in my monthly newsletter for Or.fr clients only: "Since the November 3 low, gold has risen about $200 in just two months, although there is little evidence of institutional buying. Only five tons have been added to the GLD ETF and the first COT report of the year shows no substantial increase in hedge fund purchases of long contracts.

The net long position in gold in the Managed Money category is only one third of the positions held by speculators at the beginning of 2022 and only one quarter of what they held when gold was at its peak in 2020. The number of open interest contracts in gold is also very low at this time."

China is on vacation next week, so speculation is likely to fall further: the Chinese New Year is historically a period of high volatility for gold due to the closure of the Shanghai market.

Weak speculation from hedge funds, weak futures volume, weak Chinese activity: historically, this type of market sets the stage for a sharp rise in the price of gold.

Under these conditions, a high for gold in dollars in 2023 would not be surprising.

But back to the comparison between gold and real estate:

The XAUUSD/VNQ chart, which measures gold's performance against one of the major U.S. real estate ETFs, is breaking out of a 12+ year consolidation triangle:

As we emerge from an accommodative monetary cycle, gold is regaining its status as the benchmark safe-haven asset versus real estate.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.