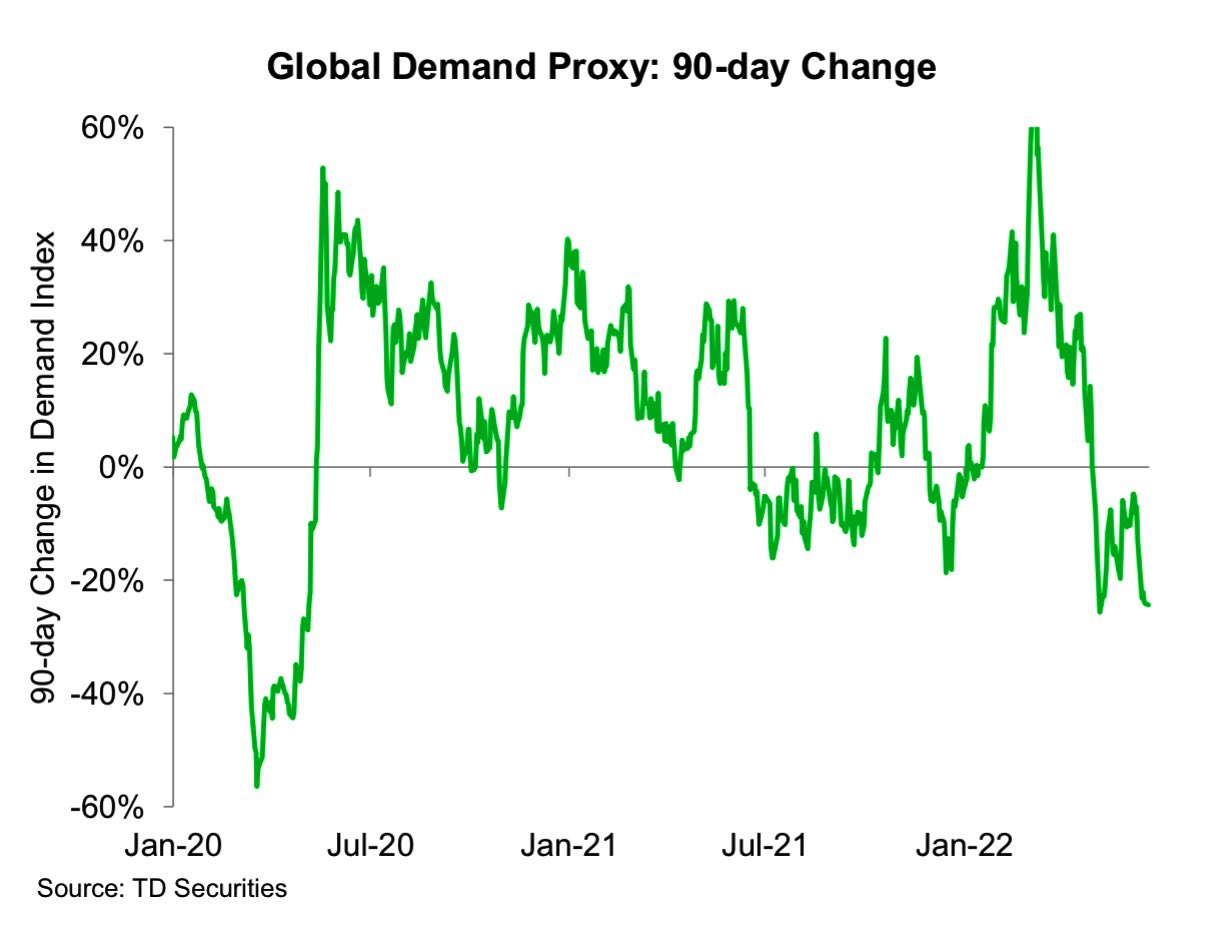

The Fed's rate hikes are beginning to have the expected effect: demand in the U.S. is falling toward the levels that forced the Fed to intervene in 2020.

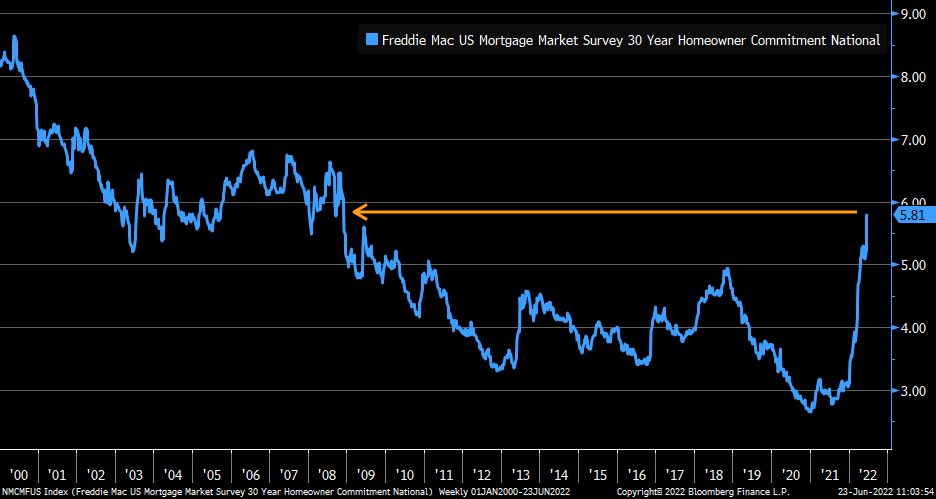

The collapse in demand is even more noticeable in the US housing market.

It must be said that the sharp rise in rates has pushed the average 30-year borrowing rate to 5.81%, according to the latest figures from Freddie Mac.

Simple calculation: for the monthly payments of a loan of this type to be identical to what they were at the beginning of the year, the price of the property would have to fall by 23%!

The fall in real estate prices is therefore assured in the coming months, and the effect on demand will suffer all the more. It will be very difficult with these figures to avoid a recession in the United States as the importance of the real estate sector is crucial to the country's economy.

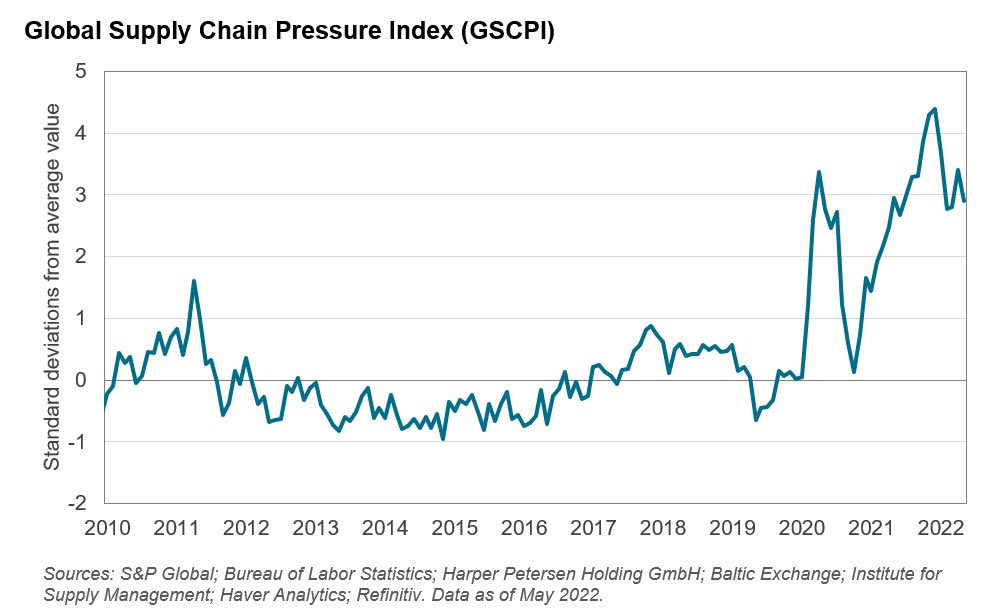

Despite this drop in demand, commodity prices remain at levels far too high to bring inflation down in a sustainable way.

In Europe, diesel prices are at historic highs:

Natural gas prices are also on the rise again after a short lull:

Simple calculation: for the monthly payments of a loan of this type to be identical to what they were at the beginning of the year, the price of the property would have to fall by 23%!

The fall in real estate prices is therefore assured in the coming months, and the effect on demand will suffer all the more. It will be very difficult with these figures to avoid a recession in the United States as the importance of the real estate sector is crucial to the country's economy.

Despite this drop in demand, commodity prices remain at levels far too high to bring inflation down in a sustainable way.

In Europe, diesel prices are at historic highs:

In the short term, there is no sign of a return to pre-crisis conditions of fluidity, which will not allow inflation to return quickly to acceptable levels.

Falling demand, accelerating energy price rises... stagflation is likely to take hold for a long time in Europe.

Stagflation is when prices rise in the middle of a recession. This is a nightmare for governments and central banks.

If this scenario is confirmed, desperate political decisions are to be expected.

In France, the government has sacrificed its flagship EDF to limit the rise in electricity prices: the state-owned company is going into debt to limit the impact of rising prices on the consumer. This policy directly threatens the company, which will probably be nationalized as a last resort.

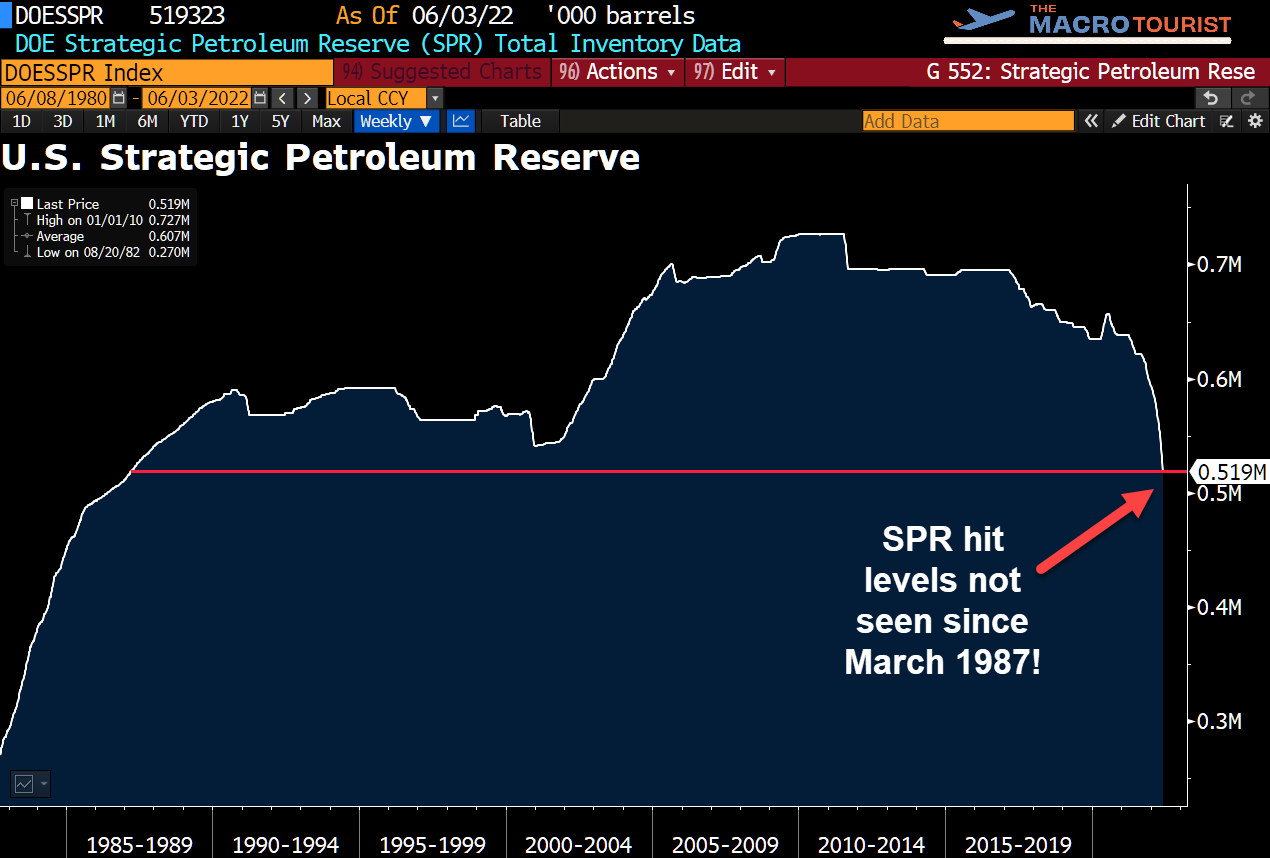

In the United States, the Biden administration is also trying to limit the impact of rising gasoline prices by flooding the market with U.S. strategic reserves.

What if the fight against stagflation is only just beginning?

We can now expect much stronger action: price controls, additional taxes on producers, customs barriers. The classic weapons of attempted price controls will soon resurface. Logically, all these decisions will do absolutely nothing on the price level, because commodities are a global good and blocking a price somewhere only encourages arbitrage operations elsewhere. On the other hand, these price blocking operations will just as logically lead to shortages, and these local supply problems are an additional catalyst for recession. Let's hope that those who are about to make these decisions have this risk in mind!

Gold is the safe haven asset par excellence in case stagflation takes hold, especially since the supply of physical gold is decreasing.

On the one hand, this is due to the difficulties of the mining companies, which are warning one after the other about their future production cuts. South African gold production, for example, is down nearly 30% from last year.

Furthermore, the current geopolitical tensions are likely to severely constrain the supply of physical gold. The G7 countries have just boycotted Russian gold, a decision that cuts them off from gold mined or refined in Russia. The world is dividing into two blocks: on the one hand the Western countries, on the other the BRICS, which do not have the same attitude as the G7 towards Russia.

Argentina and Iran have just applied for membership in the BRICS.

What will happen if we learn tomorrow that some Russian gold is used for trade between Russia and the BRICS? Will we also have to cut ourselves off from the supply of physical gold from these countries?

The commitment we have made on gold risks having the same effects as on oil, in terms of price. By imposing a boycott, we create a supply problem, which increases the price.

Imposing barriers and price controls increases inflation and poses a risk of recession, especially in Europe.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.