This week's market news is dominated by the consequences of the new strategy of Japan's central bank.

The BoJ is loosening its control over bond yields by widening the range for yield fluctuations in the benchmark government bonds. The central bank will now allow 10-year Japanese Government Bond (JGB) yield to rise to around 0.5%, up from the previous limit of 0.25%, while keeping both short- and long-term interest rates unchanged, according to a policy statement Tuesday.

Not a single economist had anticipated such a decision. Everyone surveyed by Bloomberg before Monday expected the BoJ not to change its monetary policy.

The dollar literally collapsed against the yen in the hours following the announcement. The Japanese currency has recovered more than 15% against the dollar since the beginning of November:

The BoJ seems to have changed its strategy following the return of inflation in the country. The consequences were not long in coming: the Japanese bond market collapsed after this announcement, forcing the central bank to launch a new emergency bond buyback program.

The collapse extended to the entire bond market in a few hours.

The US 10-year bond is back on the rise, breaking the consolidation line that began in early November:

US 10-year yields are rising towards the 4% mark.

It was this attractive interest rate that had pushed so many Japanese investors into US bonds in recent weeks. In a few hours, the fall of the dollar against the yen undermined this strategy.

This strategy is encouraged by a rather rare combination: for the first time in a long time, investors are now being paid to be patient. They are getting yields above 4% to put their money into short-term bonds and then to evaluate the evolution of macroeconomic and market opportunities.

This is radically different from previous years, when the lack of yield on these bonds forced these investors to try to find hypothetical returns by following risky investment strategies.

Alas, this strategy did not work for Japanese investors. This time, U.S. bonds did not act as a safe haven.

This realization comes at a time when China is turning away from these savings products on a massive scale: China's holdings of U.S. Treasury bonds have fallen by a third since their peak. China has liquidated $400 billion of U.S. government bonds, and the movement has even accelerated in recent weeks:

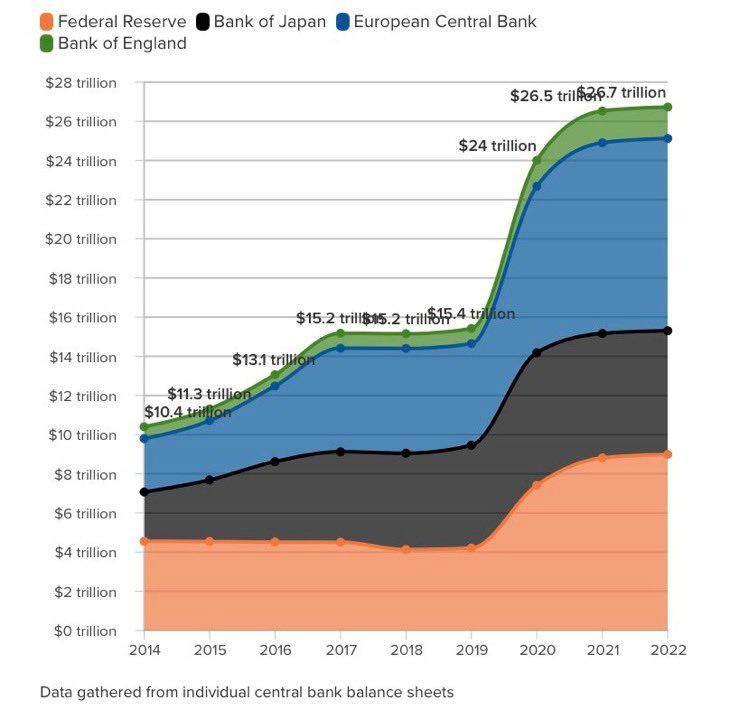

The U.S. central bank has also stopped its bond-buying program and is even starting to reduce its balance sheet, while other central banks continue to monetize their debt:

It remains to be seen whether the BoJ's decision will force Japanese investors to change their strategy: won't this decision encourage them to turn away from US Treasuries? Hasn't the BoJ just drained a crucial new source of buyers of these Treasuries? If so, the timing is very bad: the U.S. government is facing a mountain of debt, and rising rates will mean even more debt issuance next year...

The speed of the dollar's fall against the yen is historic. Even in 2020, when the Fed announced a new infinite quantitative easing (QE) program, the correction of the American currency was less strong.

This rebound of the Japanese currency against the dollar is bad news for the markets, especially for the growth stocks which has benefited from this situation in recent years: the low Japanese yields have encouraged many investors to invest in technology stocks by drawing on a reserve of liquidity maintained by the BoJ's free money policy.

This reversal of situation is an additional threat to technology stocks. The Nasdaq is now in a dangerous graphical situation as the year ends:

When money is free, we don't wonder too much about the value of assets, we focus instead on growth opportunities. The context has changed, the era of low rates is over, and these technology stocks are now under the microscope.

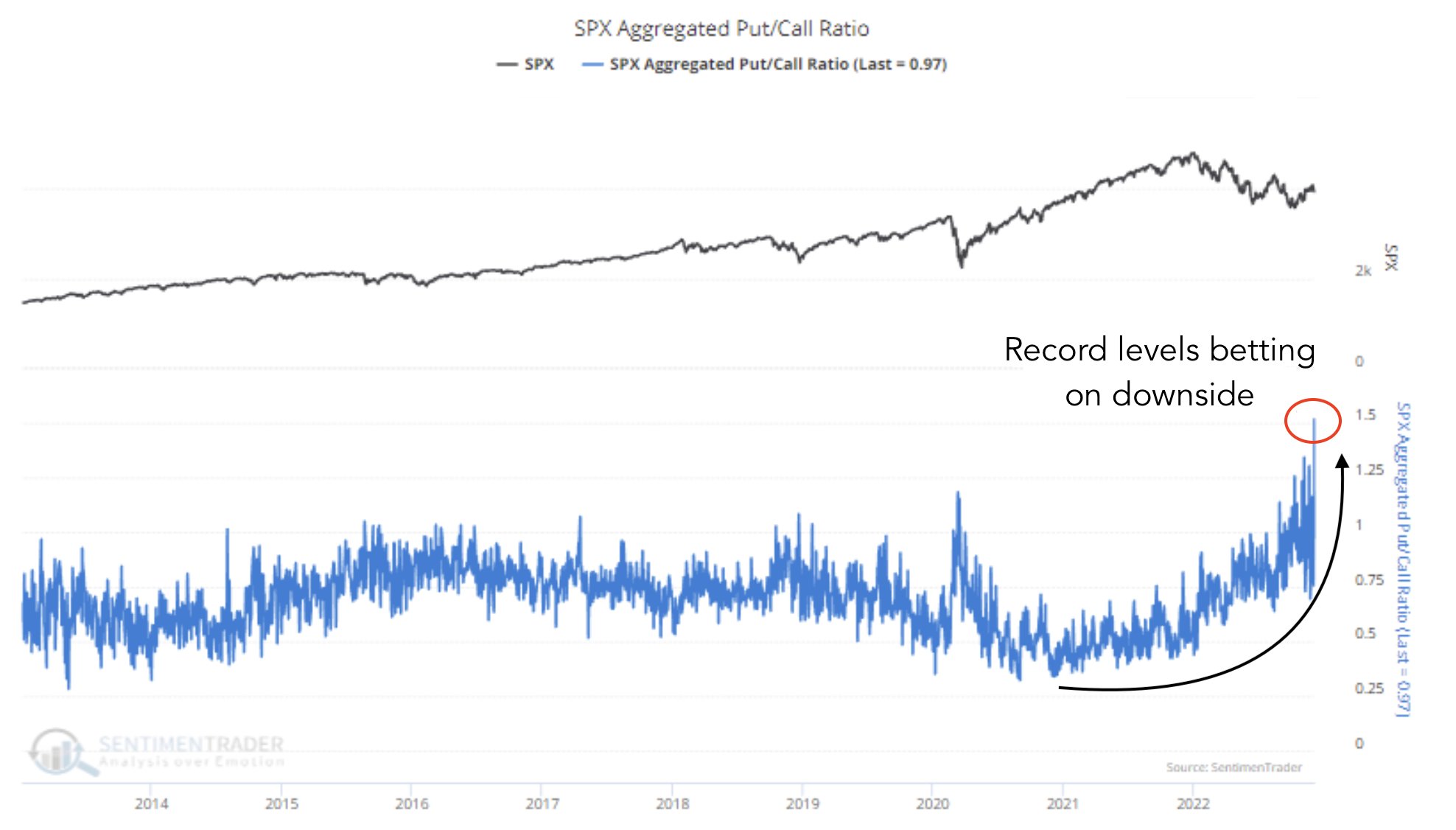

In the short term, the markets are under the threat of a major short squeeze in view of the record short positions that anticipate a brutal correction. Under these conditions, a rebound is not excluded:

Nevertheless, the entire technology sector is now subject to multiple questions.

Despite a very significant drop in some stocks, aren't the prices of the sector's leaders still too high?

In my November 24 bulletin, I wrote: "Elon Musk's takeover of Twitter is another highlight for the tech sector. Whether one is for or against Elon Musk's brutal decision to cut half of Twitter's workforce, this move may completely redefine investors' expectations of the profitability of tech companies, which have benefited greatly from the Fed's accommodative policy in recent years. Despite a halved workforce, Twitter is working well and even managed to process an average of 20,000 messages per second this Tuesday, on a particular hashtag (related to the World Cup). A record."

This week, the ChatGPT phenomenon is revolutionizing the use of search engines: the company OPENAI has developed a tool based on the construction of individualized knowledge from artificial intelligence resources. Thanks to a sequence of questions and answers, each Internet user is able to build a precise knowledge according to his own pattern and at his own pace. The very relevance of traditional search engines is already seriously questioned. It is one of the pillars of Google that is directly challenged. Who could have predicted this just a few months ago? The record adoption of the application by millions of users confirms it: artificial intelligence is about to shake up once again a digital sector that will have to adapt very quickly, in its businesses, its products and its services. All this implies a complete rethink of the valuations of the sector's stocks.

This valuation review is taking place at a time when the cryptocurrency sector, which is closely tied to tech stocks, is going through an existential crisis. Once again, the tech sector is on the verge of a major upheaval...

Behind the two crucial events of this end of year (Twitter, ChatGPT), there is one man: Elon Musk. Whether you are for or against the businessman's methods, you have to admit that his influence on the media and information sector is likely to change the rules of the game, and therefore force new strategies. The radical nature of his decisions leads to transformations that deeply affect the economic sectors in which he operates.

Why do we emphasize this point so much in this article? I'm coming to that!

To secure the supply of his electric vehicles, Elon Musk has not hesitated to invest directly in mining companies, especially lithium and nickel producers.

It is certainly no coincidence that lithium prices started to soar around the time the entrepreneur entered the market. Even if his share is insignificant compared to the size of the market, Elon Musk is also causing investors to reconsider their own investment decisions in relation to the businessman's strategy.

What is Elon Musk's next target?

One of the markets most likely to undergo a radical adjustment when Elon Musk decides to invest in it is silver.

If he wants to secure his supply of silver, the need for which will explode as the electric vehicle fleet grows, the Tesla boss has no choice but to go straight to the source.

The silver market is tiny, and we have already entered a period of pronounced deficit in the sector: demand far exceeds supply and physical stocks on the futures markets are dwindling. At the end of the year, we are witnessing a real run on the COMEX, which is being used by more and more participants (investors and industrialists) as a source of supply for physical metal.

The announcement of Elon Musk's acquisition of a silver mine would propel silver prices higher, with the same force as lithium recently.

As a sign of his interest in metal, the billionaire just followed the famous Twitter account @WallStreetSilv:

This rise will not be due to one person. The real trigger for the silver squeeze could be the realization by other industry players that they have an interest in investing upstream in the production chain.

Meanwhile, silver is still stuck in a consolidation channel:

But when you look at the Nasdaq price relative to silver, there is a break in the uptrend, unseen since the 2011 silver correction:

As Elon Musk reshuffles the deck in tech, alongside his strategy of securing resources, this chart suggests a significant rise in silver prices in 2023, this time uncorrelated with a likely continuation of the market correction.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.