A recent study by the National Bureau of Economic Research (NBER) shows the close link between the price of gold and the level of real interest rates. This study has attracted criticism for gold, and a Bloomberg article entitled "Gold is no Longer a Safe Haven" has caused a stir. In this paper, we will demonstrate that the arguments put forward are not complete and sufficient. Furthermore, the real-rate model is not valid in a situation of high inflation or on a long time scale. As a result, the detailed facts presented here confirm that gold remains a safe-haven asset.

Gold and real rates

The real rate is the interest rate adjusted for inflation. As such, the real rate corresponds to the real return on capital. An interest rate of 5% with inflation at 4% implies that capital is "really" enriched by 1%. A recent NBER study states that "for investors, gold is an asset without a yield that is attractive in times of low and negative real interest rates".

There's no doubt that a fall in the real return on capital will make it more attractive for investors to position themselves in non-yielding assets such as gold. But this statement needs to be put into perspective. On the one hand, it necessarily assumes that demand for gold is the only component capable of driving the price. But this is structurally false, and in the long term the impact of demand is more negligible than the role of supply. What's more, this assertion is verified on rather short time scales and in low interest rate environments.

The real link between real rates and gold prices

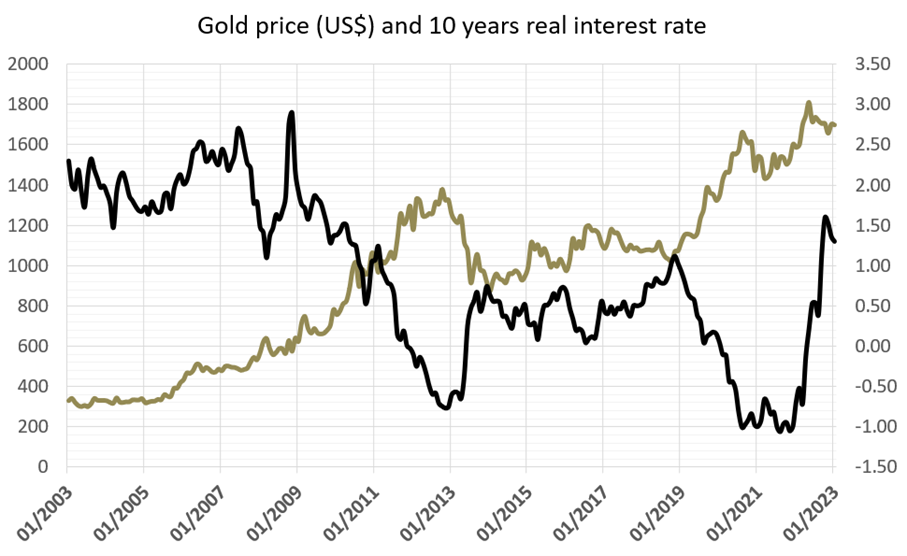

The graph below shows the gold price and real 10-year rates for the United States. The absolute correlation between the two variables is high, at -85% over the period 2003-2023. A rise in the gold price is therefore generally accompanied by a fall in real rates, and vice versa. Nevertheless, the 2-year correlation between the two variables shows a totally different behavior in recent years. At the beginning of 2023, the 2-year correlation between gold prices and real interest rates was +70%! This is not only positive (as gold prices rise, so do real interest rates), but also very high.

The NBER report states that, "Such high numbers make it clear that long-term real rates can be considered the main driver of gold prices during the low-rate periods. During high-rate periods the correlation between changes in gold prices and yields is typically lower, for monthly changes the correlation disappears." In fact, the correlation between changes in real interest rates and changes in the price of gold is almost non-existent over the period 2003-2023 (-10%).

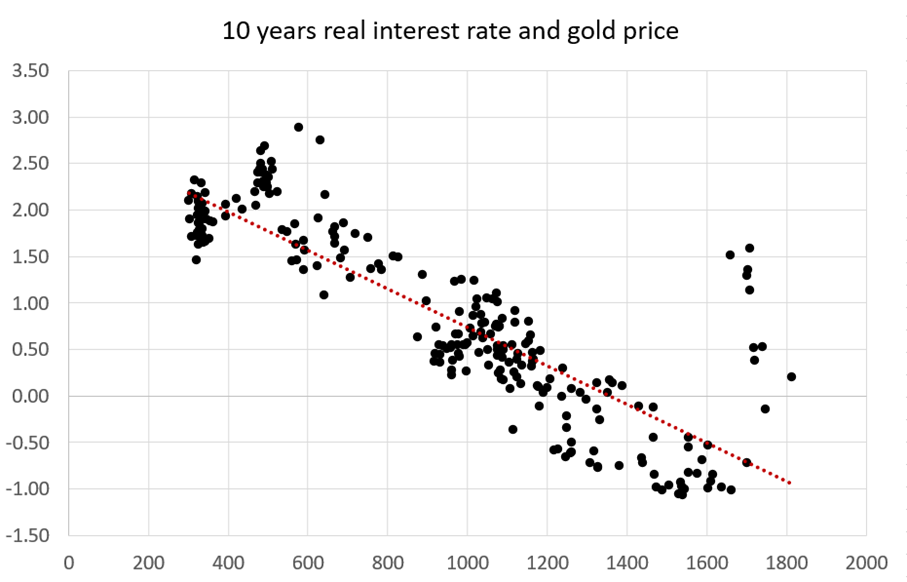

Under these conditions, it is clear that while real rates can be a major determinant of gold price trends, they are only so in certain special circumstances. Higher rates, and often higher inflation, contribute to the lack of relationship between the two variables. The graph below summarizes the lack of connection between real rates and the gold price in recent times. The bottom axis represents the gold price since 2003, while the left-hand axis represents the level of 10-year real rates.

While it is clear that a fall in the real rate often translates into a rise in the gold price, this link has been broken since 2022. In fact, the presence of very low real rates in 2013 and 2020 necessarily implied that real rates could not go any lower, on pain of major systemic risks. Excessive bearishness on real rates cannot be paid for by a fall in the price of gold, which would have absolutely nothing to do with the fundamental situation (rising production costs). The current environment is therefore completely devoid of any link between real rates and the gold price. Consequently, if the gold price is pushed up by falling real rates without seeing its value fall when these rates rise again, then it is logical that this relationship should be in favor of the gold price, rather than against it.

Is gold a systemic asset?

We have shown that gold is linked to real rates. But this relationship is not true in the long term, and significant disconnects can exist. A June 28, 2023 article published on the renowned Bloomberg media and written by Professor Tyler Cowen asserts that "the precious metal has become just another cyclical asset, no longer a useful harbinger of social and economic collapse". The article's author asserts that gold is "a little boring", and he also criticizes the instability of the gold price in 1980, supposed evidence of its speculative nature. He argues that "even if it’s trading around a record high of $2,000 these days, gold is a little boring and likely to remain so for the foreseeable future".

But to describe the gold price as boring is to flatter it of its main quality. Similarly, the instability of the gold price in the late 1970s was mainly due to the end of the gold standard and the return to free gold pricing. He also argues that, instead of having a gold price as a safe haven, it is "perfectly acceptable to have a high or rising gold price. [...] These big changes in the relative value of gold would be disastrous under a gold standard, but under the status quo, they are not so important. Gold, like many other commodities, is fairly inelastic in short-term supply". But this is to misunderstand the profound nature of the gold price.

While it is undeniable that massive money creation, rising financial markets and falling real interest rates have contributed to the rise in the gold price, this in no way demonstrates that gold does not protect against crises. On the contrary, many countries in hyperinflationary crises have seen the value of gold rise considerably. What's more, gold purchases by central banks are at record levels, and inflation is forcing institutions to hedge in yellow metal. This is clear proof that gold remains a safe haven.

In 2022, central banks bought more than 1,000 tons of gold, a record that accounts for almost 23% of all gold demand! In a WEF article published on November 10, 2022, the latter states that "gold is considered an effective hedge against inflation, although some analysts believe this is only true over extremely long time horizons extending over a century or more".

Correlation with stock market indices

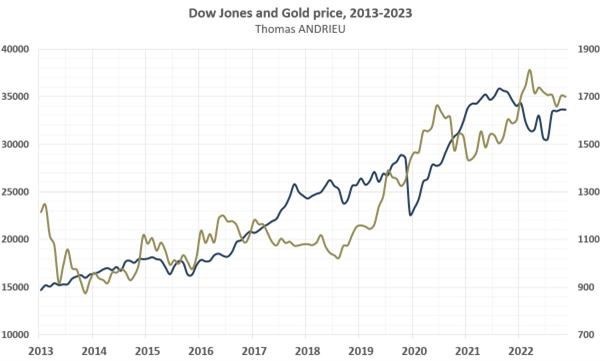

It's also worth noting that the monthly correlation between gold and the S&P 500, for example, is +71% between 2003 and 2023. But then again, there is almost no correlation between the variations of the two assets. The chart below illustrates, for example, the comparative level of the gold price and that of the Dow Jones. Consequently, one could just as easily argue that there is a correlation between gold and real rates, as between the stock market and gold.

Gold's correlation with the stock market has led some to claim that gold is a systemic asset. That is, it would fall in the event of a major crisis. But this is rarely true, as this correlation is mainly observed in bull markets. On the contrary, when stock market indexes fall sharply, gold tends to rise eventually.

The central importance of supply

As we have seen, the arguments that gold is no longer a safe-haven asset are not well-founded enough. On the contrary, they appear to support gold's double role, and hence its stability. Beyond the lack of rigor in the arguments put forward, there is a bias in the consideration of the other elements that explain the variation in the gold price. In a dedicated article, we showed that the importance of demand explained gold's short- and medium-term variations. Thus, "a rise in gold demand (or a fall) translates into a greater rise (respectively fall) in the gold price". Similarly, "a small increase in the gold price translates into a large increase in the supply of mined gold".

As a result, investment demand is highly sensitive to the price of gold. But at the same time, the vast majority of this demand can only be absorbed through mining supply. The simple fact is that the gold market is largely determined by the supply of physical gold over a sufficiently long time scale. Periods of social, monetary, fiscal or political instability often have the effect of disrupting production conditions, as is currently the case with inflation. As a result, the correlation between real interest rates and the price of gold no longer has any effect in these supply-driven conditions.

The failure to take supply into account is therefore a serious error of judgment. Gold remains a safe-haven asset insofar as material constraints are persistent and increasing, unless innovations or discoveries reduce production costs. Of course, monetary, social or political effects are also likely to worsen production conditions (higher costs, production stoppages, etc.), which ultimately has a very beneficial effect on the price of gold. Gold is sufficiently responsive to inflation, and its stability once again demonstrates its current insensitivity to real interest rates and stock market indices.

In conclusion

Legend has it that gold critics often presage lows in the gold price. Bloomberg's critical article, published on June 28, 2023, predicted a June 29, 2023 low of $1,893 an ounce. Nevertheless, this article is based on a study by the NBER. Without denying the safe-haven nature of gold, this study shows a strong correlation between real interest rates and the price of gold. This correlation is all the stronger when rates are low or negative and inflation is low. Nevertheless, variations in long-term real interest rates do not explain variations in the price of gold.

The lack of correlation between real rates and the gold price is clear today. Real interest rates have reached positive levels not seen for many years, yet the price of gold has also risen! Clearly, then, the real rates model only works under certain assumptions. Similarly, gold is sometimes criticized for its correlation with financial markets. This observation, verified during bull markets, is generally reversed when stock markets correct. Finally, the presence of high inflation in many countries shows that gold retains purchasing power in these regions. Central banks have also been buying gold in record quantities. All this clearly contradicts the claim that gold is no longer a safe haven.

Gold is a safe haven precisely because it's boring. Gold's strength, while undeniably linked to real rates and financial markets in the medium term, is that it is generally independent of the system in times of stress. It's fair to say that gold is correlated with the system, but all the evidence suggests that when the economic and financial system falters, this correlation disappears or is reversed. In the light of these facts, gold remains a safe haven.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.