US markets break all-time records.

Record close for the Nasdaq :

Record close also for the SP500:

The Nikkei hit a 34-year high:

Meanwhile, the Hang Seng is falling back to its 1997 level, a far cry from its 2017 peak:

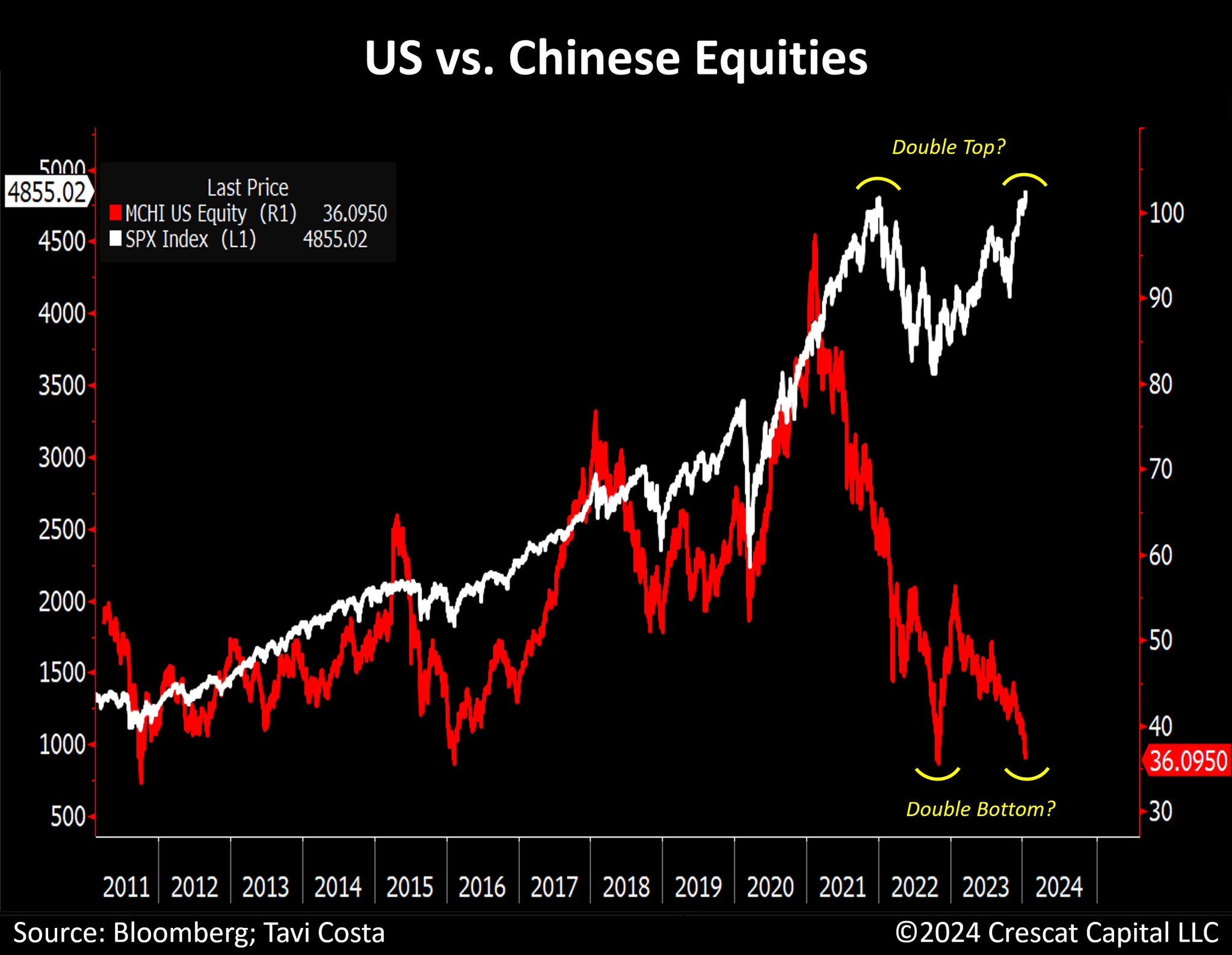

The underperformance of Chinese markets over the past year is remarkable:

The outperformance of US markets relative to Chinese markets can be explained by the growing appetite of Chinese investors for ETFs linked to US markets.

At the start of the year, unusual buying volume was observed on some of these ETFs accessible to Chinese investors.

The E Fund MSCI USA 50 Index ETF exploded on the upside this week:

Exposure to the Japanese market has also been particularly sought-after in recent weeks.

The China AMC Nomura Nikkei 225 has also been in a buying frenzy:

Chinese investors are abandoning their own stock market and seeking exposure to growth in the US and Japanese markets.

Optimism about the US economy is attracting more and more international investors.

American Express CEO Stephen Squeri reported last week that his company had seen "good consumer spending" over the Christmas holidays, signalling an overall robustness in US spending. Squeri pointed out that delinquency rates were "lower than they were in 2019". Despite persistent inflation, he expressed confidence in a "soft landing" for the US economy, anticipating a slowdown in spending and a reduction in inflation without triggering a recession. When the CEO of American Express displays such optimism, it becomes difficult for Chinese investors to doubt the robustness and resilience of the US economy in the face of the challenges ahead in 2024.

With consumer optimism at an all-time high, the American engine is still firing on all cylinders.

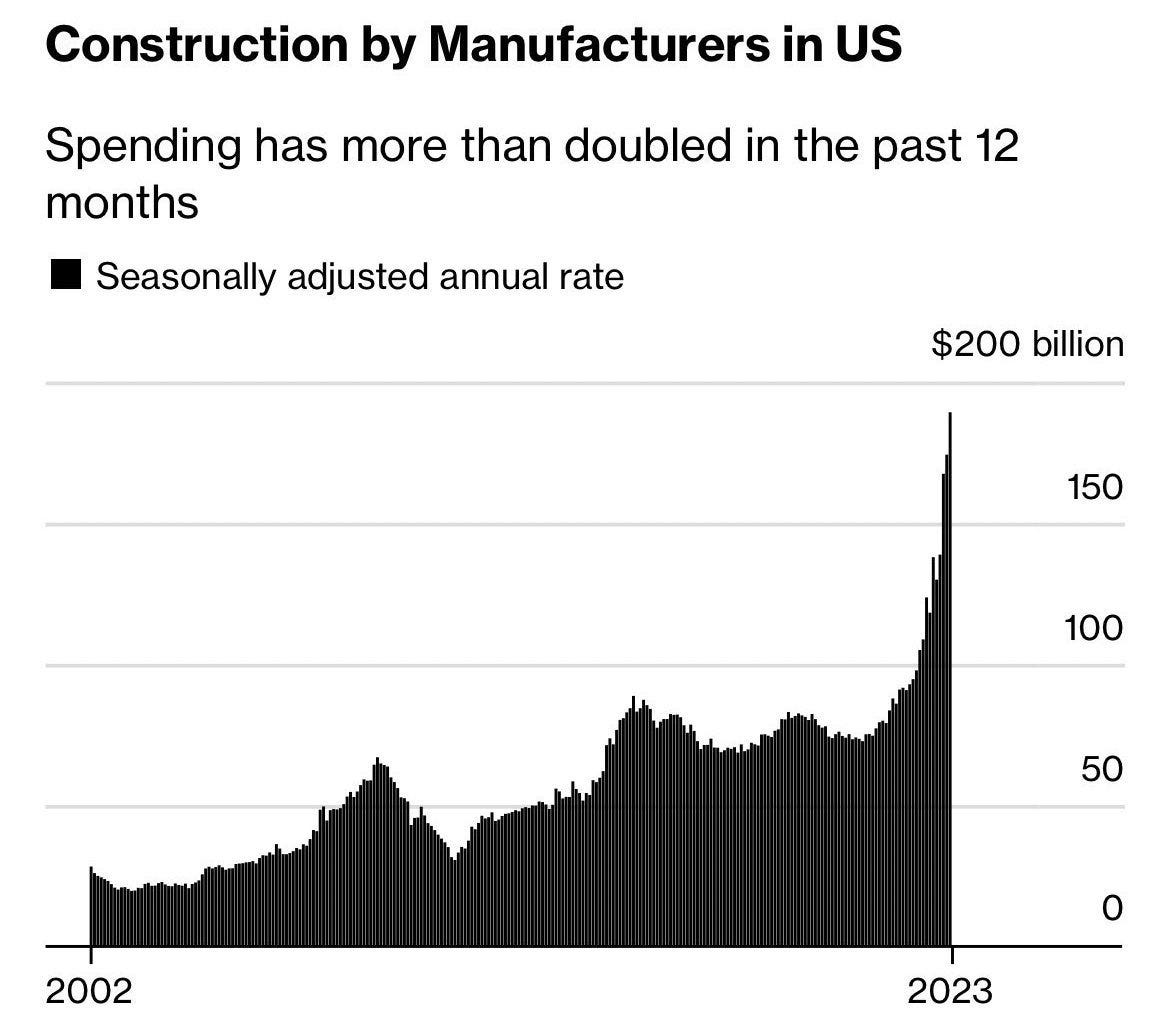

The return of international investors is also explained by an industrial boom in the USA, which contrasts with deindustrialization in Germany and stagnating industrial spending in many parts of the world:

Otavio Costa has identified a double bottom on the Chinese market, which would correspond with a double top on the American markets:

Against this backdrop, China's decision to reduce the banks' reserve ratio seems quite logical. The aim is to give fresh impetus to a Chinese market that has lost $6 trillion in just three years.

China plans to reduce the reserve requirement ratio for banks at the beginning of February in order to inject more money into the economy, announced the governor of the People's Bank of China, Pan Gongsheng. This 0.5 percentage point reduction will provide 1 billion yuan (around $139 billion) of long-term liquidity to the market on February 5. This unusual announcement at a press conference suggests an attempt to alleviate growing economic concerns. It is probably also linked to the yield differential between the two stock markets.

The Hang Seng Index rebounded spectacularly after the announcement:

It remains to be seen whether these efforts will be sufficient to reduce the differences in performance between the two stock markets.

Can the period of euphoria on US markets last?

Will the consumer, as the main economic driver, show signs of running out of steam in 2024?

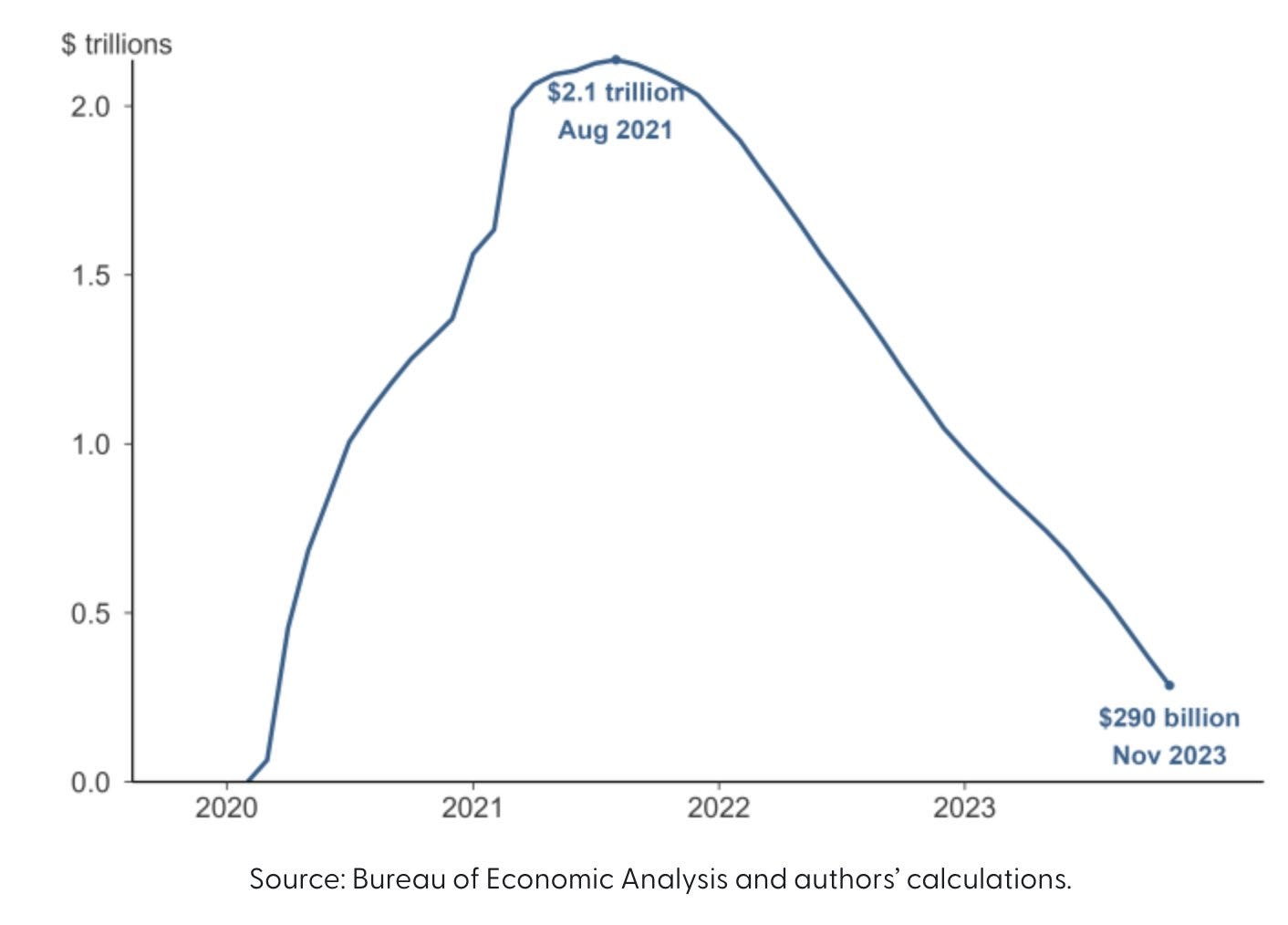

Americans' savings reserves, which had grown during the Covid pandemic, are rapidly running out:

In the absence of available savings, a new stimulus would be needed for the US consumer to maintain the same momentum as in 2023.

Although bank liquidity is widely available and borrowing capacities are not yet restrictive, will these favorable credit conditions be enough to maintain consumer optimism?

Market optimism is also underpinned by expectations of a rapid rate cut in 2024.

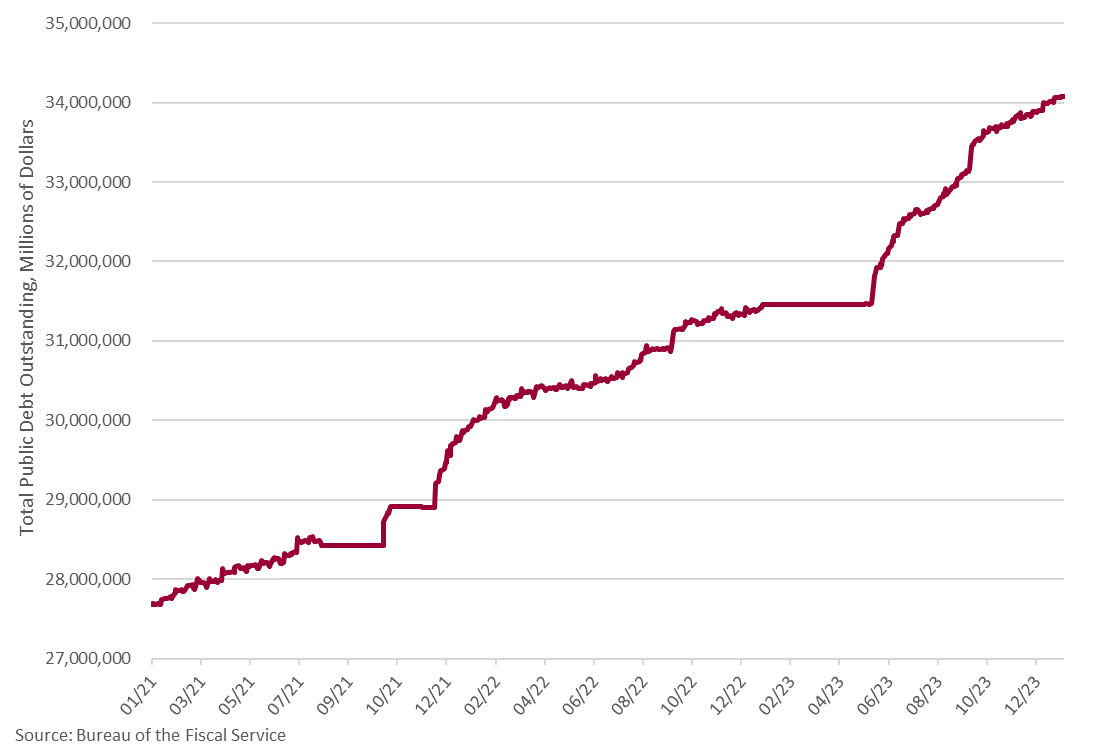

The U.S. Treasury may find it difficult to refinance its debt in the coming year at such high rates. US debt has just passed the $34 trillion mark:

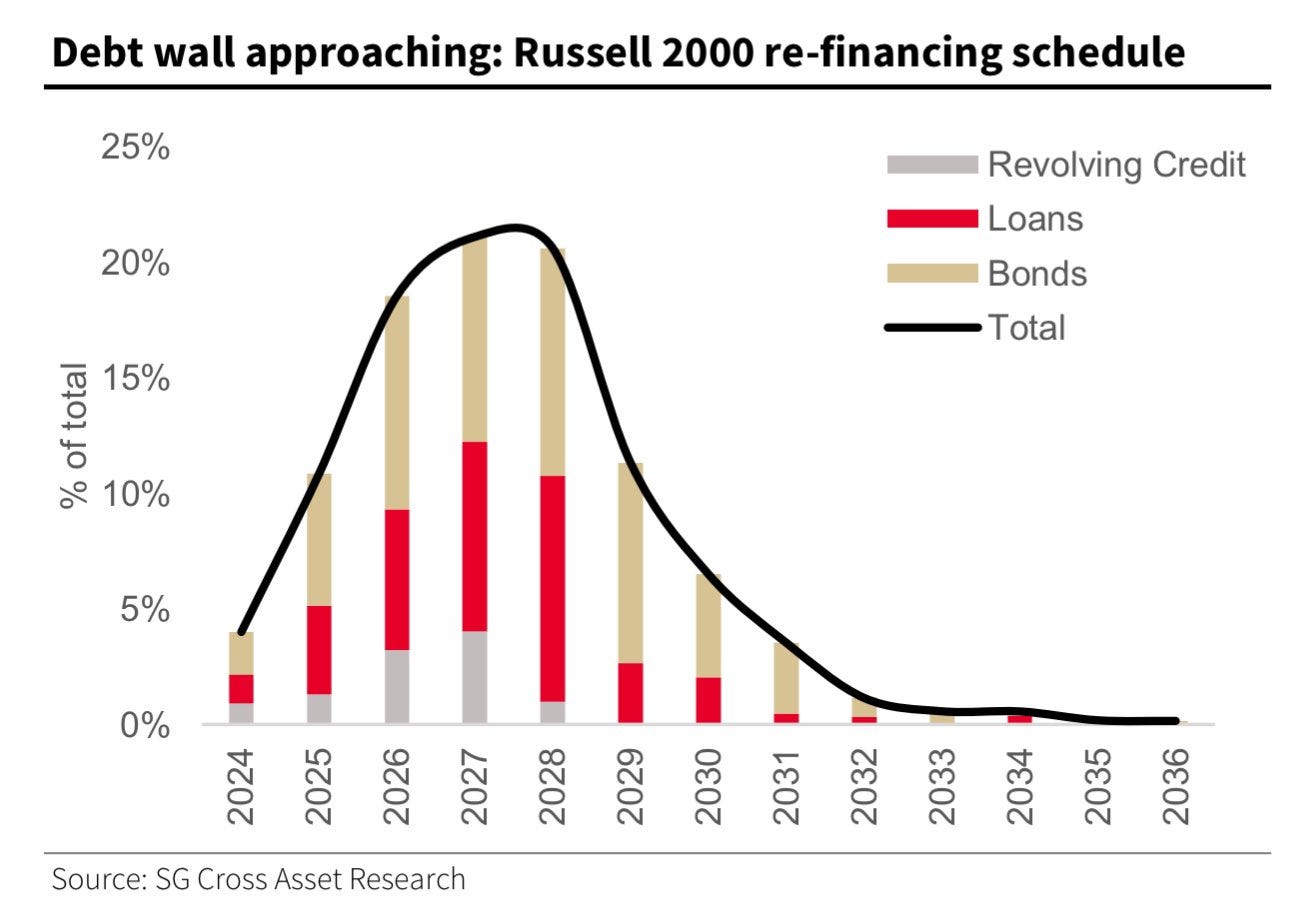

Over 80% of this debt will have to be refinanced over the next 12 months, at significantly higher rates. This is the famous "debt wall" we frequently discuss in these newsletters.

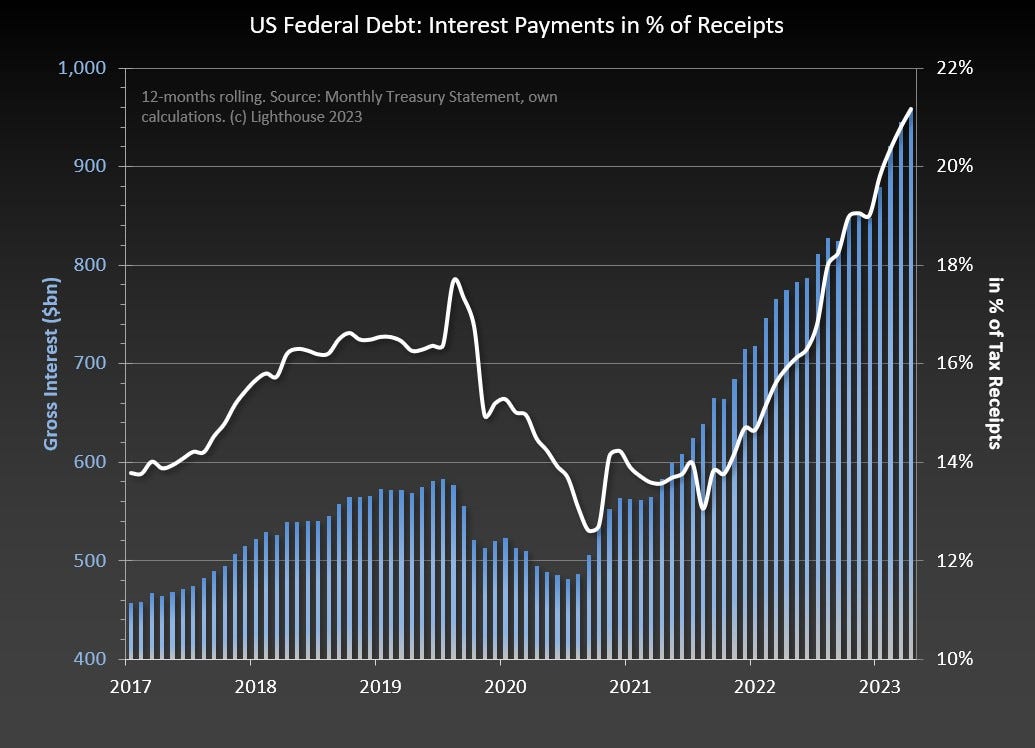

Interest on debt now accounts for 21.2% of total US government revenues, compared with 15.9% a year ago:

With refinancing becoming more and more frequent and rates failing to fall significantly, this curve is likely to become exponential in the weeks ahead, completely exhausting the US government's spending capacity.

Gold price holds above $2,000 precisely because of this debt wall. Either the Fed comes to the Treasury's rescue by drastically cutting rates to facilitate less painful short-term refinancing, or the Fed's change of course comes too late, which would be interpreted by the market as a mistake in monetary policy; the markets would correct sharply and the government would find itself in dire straits to balance its budget in the middle of an election year.

In this situation, gold could be sold in the short term in a deflationary wave, but it would also serve as the ultimate refuge for international investors disappointed by a stock market they believed to be invulnerable.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.