This week is one of the most intense of the year in terms of economic news.

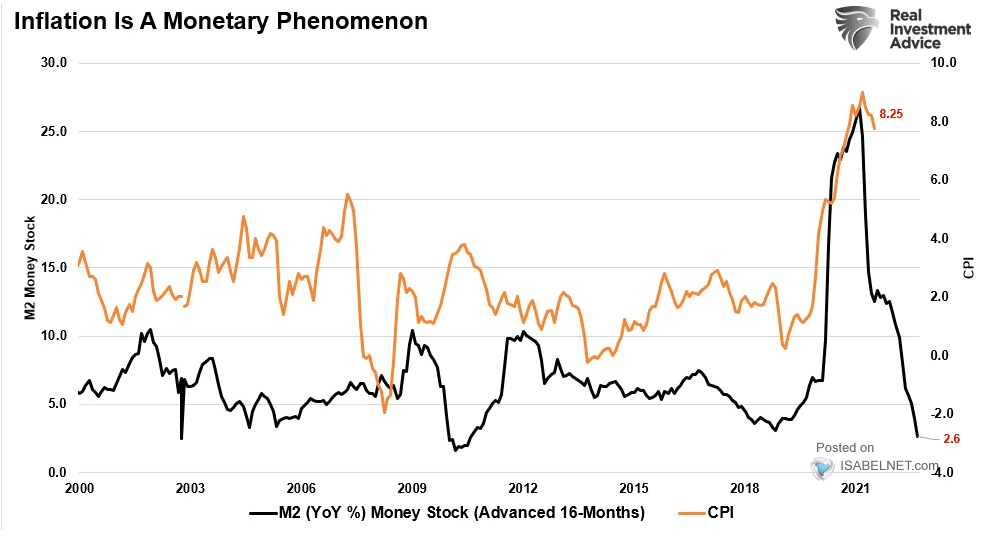

US inflation figures were released on Tuesday: the Consumer Price Index (CPI) came in at +7.1%. This is still a significant number, even if it is down significantly from last month. Inflation now seems to be more of an issue in Europe and Japan, with some observers even expecting a net decline in the US. To make this claim, they rely on a chart that has gone viral in recent weeks, which juxtaposes changes in CPI and M2 money supply 16 months apart:

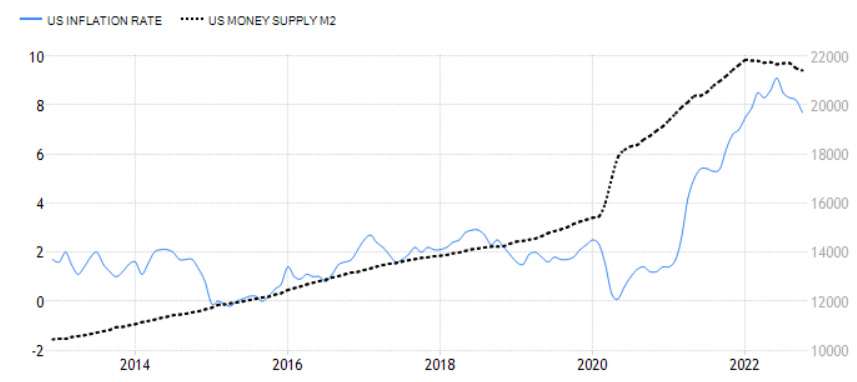

In their view, the expansion of the money supply was largely responsible for the rise in inflation:

The contraction of this money supply would allow a rapid decline in inflation, which would return in a few months to the values observed before the Covid-19 crisis. Is it that simple? Not for the Fed economists...

The latter have completely missed their forecasts on the rise in inflation in 2021. They are now much more measured about their predictions for the end of inflation (in the U.S.) in 2023.

On Wednesday, the Fed raised its benchmark interest rate once again by 50 basis points. A decision expected by the markets who are now anticipating a clean break in this ultra-fast series of rate hikes.

On Thursday, the US unemployment figures will be closely scrutinized to anticipate the Fed's next move.

Finally, on Friday, the PMI figures will give us a better idea of the economic slowdown underway in the United States.

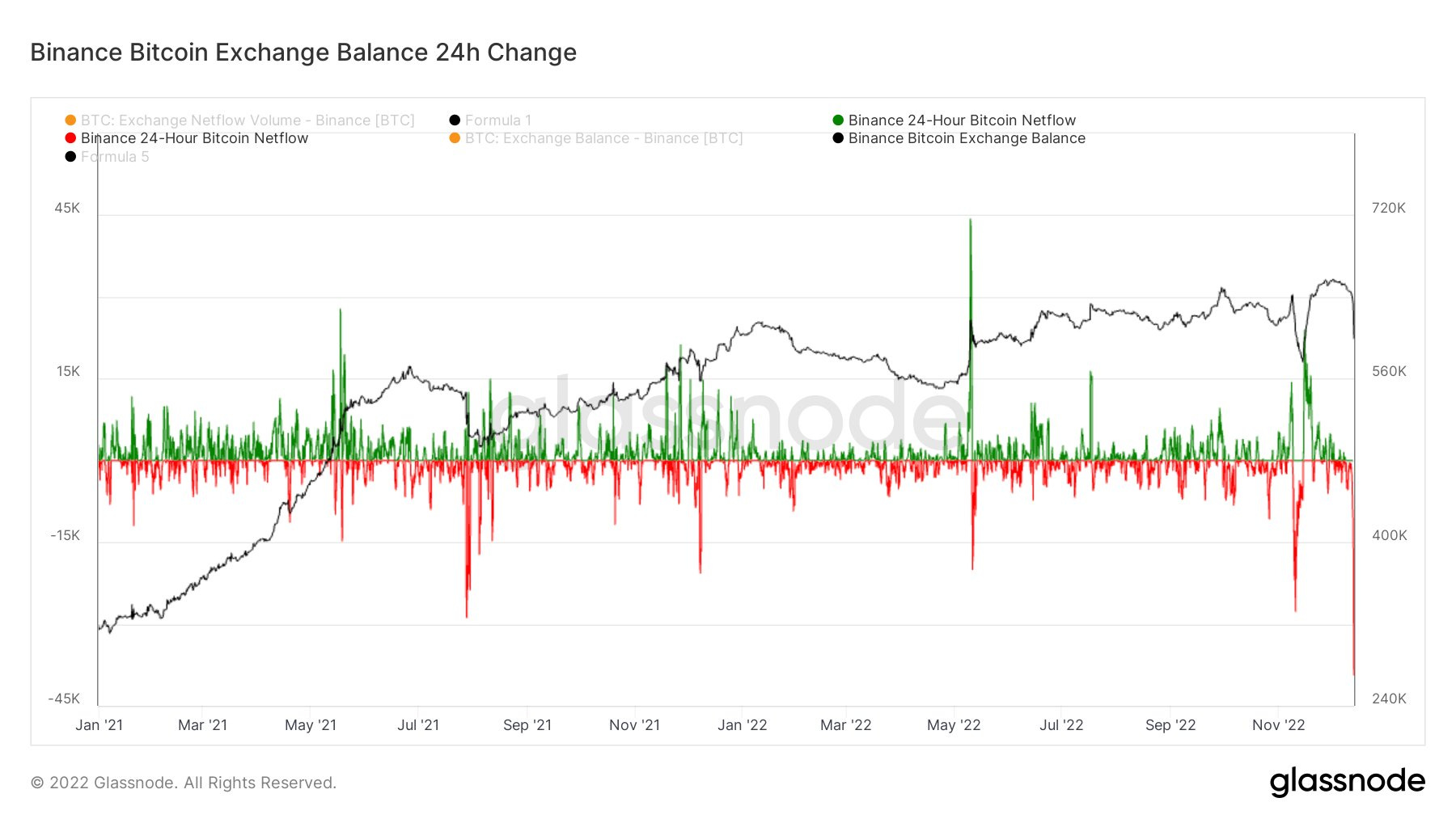

The news this week is also dominated by a new run on a cryptocurrency exchange platform. Binance recorded a record number of BTC withdrawals this Tuesday (nearly 40,000 bitcoins left the platform in 24 hours.)

In three days, the equivalent of nearly $3 billion was withdrawn from the Binance platform!

The other major event that went relatively unnoticed was the signing of a new cooperation agreement between China and Saudi Arabia, concluded during the official visit of Chinese President Xi Jinping. During this visit, a broader summit with Arab League countries was held and the Chinese president promised to continue importing large quantities of oil from the region and to increase its imports of liquefied natural gas.

This announcement comes on the heels of Qatar and China signing one of the largest Liquefied Natural Gas agreements in the industry's history. With this agreement, Qatar will supply four million tons per year of LNG to China starting in 2026 for twenty-seven years.

Qatar Energy has signed a long-term sale and purchase agreement with with China Petroleum & Chemical Corporation (Sinopec) to supply with 4 million tons of liquefied gas annually over 27 years.#QNA pic.twitter.com/tHi5Jd7ieq

— Qatar News Agency (@QNAEnglish) November 21, 2022

Europe, which has not managed to sign this type of agreement, is facing a corruption scandal at the highest level involving the Gulf country: arrests have been made in Brussels as part of an investigation into suspected corruption by Qatar in the European Parliament. Bags of money were found at the home of Eva Kaili, Vice-President of the Parliament.

In this context, it is logical to see China taking advantage of this to advance faster in this race to secure energy resources.

But the main event of this summit in Saudi Arabia was China's call to use the yuan to settle oil and gas trade transactions. This call for the abandonment of the dollar in trade between China and Middle East countries is a major geopolitical event, which has gone relatively unnoticed, but which could shake up the role of the dollar in international trade.

If it happens, such a move would weaken the U.S. dollar's hold on international trade, while simultaneously helping China establish its currency on a global scale.

Analyst Luke Gromen has a very interesting theory about this new form of trade between the Chinese and Arab countries :

Sell oil in CNY. Convert CNY into some Chinese goods, the balance into phys gold.

— Luke Gromen (@LukeGromen) December 9, 2022

Gold rises over time very consistently in CNY terms, protecting or increasing Saudi purchasing power from CNY inflation over time.

"Our currency, our problem" instead of "Our ccy, your problem." https://t.co/GTvYXH51Kz

Sales of oil and gas in yuan would allow these countries to buy directly in local currency the Chinese goods and services they need for their own economies. The yuan surplus would be used to buy gold, thus guaranteeing their purchases against a depreciation of the Chinese currency. This gold would be supplied to Arab countries via the Shanghai gold trading platform, which has been open for international trading since 2014.

China has been steadily accumulating gold in recent years, and purchases have even resumed in recent months.

China Reports First Gold Reserves Rise Since 2019

— GoldBroker (@Goldbroker_com) December 11, 2022

▶ https://t.co/iPUM9sux0Y#China #gold #PBoC #Dedollarization pic.twitter.com/dqVCNf1Qam

The accumulation of gold reserves now allows the country to reassure its trading partners about the guarantee offered in the context of transactions envisaged in yuan.

It remains to be seen how Middle East countries will react to this offer.

A de-dollarization of their trade with the second world power is a risk that threatens the fragile balance of relations between the United States and these Arab nations.

The dollar is approaching a major consolidation support:

Gold in yuan is clearly in breakup, the triangle of consolidation started in 2020 is solved by the top at the end of 2023:

Gold's strength in yuan terms is accompanied by a rebound in Chinese exports, following the authorities' decision to ease containment measures related to the new outbreak of Covid cases in the country.

Against this backdrop, bearish strategies on some metals are proving disastrous this year.

In my September 14 article, I wrote that late summer saw a record number of "shorts" on Sprott's PSLV ETF: investors were betting on a prolonged downturn in silver prices based on the risk of a sharp market correction. I added: "The advice to sell silver derivatives given by many analysts in August (TD securities had even given a price target of $17) has paid off: short positions are at their highest, both on futures and ETFs. These short positions on the paper market coincide with a tension on the physical resources of the metal. The raid on silver continues unabated. Earlier this week, the COMEX saw a record amount of metal removed from its vaults: over two million ounces in a single day!"

This week we learn that the recent rise in silver prices has led TD Securities to close its short positions on the metal. The management firm does not rule out another consolidation in 2023, but nevertheless had to urgently close its positions as its stops were exceeded in the recent strong rebound in futures prices.

Volatility in metal prices was very high in 2022, and there is no indication that it will decrease, in a context of tensions on the supply of these metals.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.