The German trade union GesamtMetall is sounding the alarm: the embargo on Russian gas and raw materials could bring the German metal and electrical industries to their knees.

The more tension mounts on the ground, as in Mariupol, the greater the possibility of a total embargo on Russian oil and gas. For the time being, Russia is still delivering gas to Europe, but the continuation of the war could change that in the very short term.

Germany is already facing an explosion in its energy bill. This week, it is the cost of steel that is soaring. The price per ton in Europe is over $1400, more than three times the price in 2020.

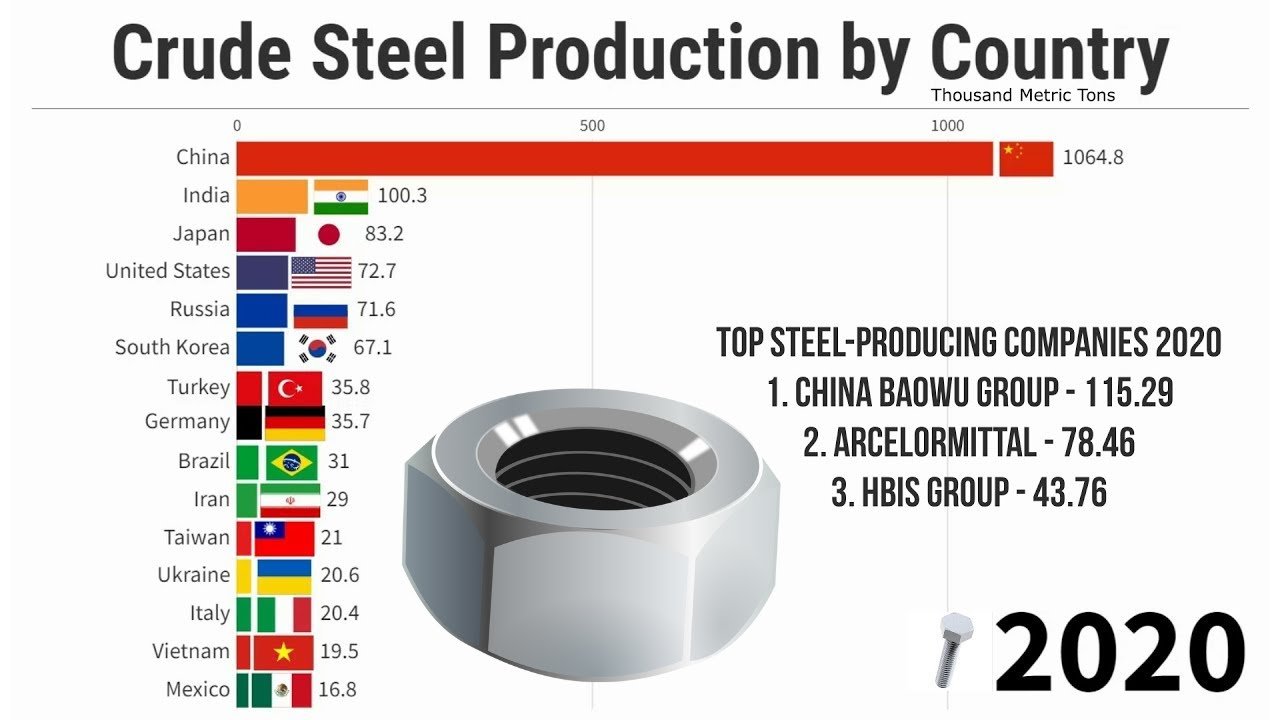

The Azovstal factory near Mariupol was completely destroyed. Ukrainian production is at a standstill, and Russian production is under embargo. Russia is the fifth largest steel producer in the world.

China is by far the world's largest steel producer. But its production is also affected by the consequences of the health crisis. Chinese demand is increasing very strongly despite the collapse of the Chinese real estate sector.

It is clear here that the war in Ukraine is increasing the pressure on steel prices. The conflict is acting as a trigger for the acceleration of the price increase. The strong Chinese demand for steel is also explained by military demand and the country's re-entry into a war economy.

This rise in steel prices also signals increasingly severe shortages, which are affecting the entire industrial world. These steel inventory pressures are in addition to shortages of electronic components. These supply problems are impacting the U.S. auto market in particular.

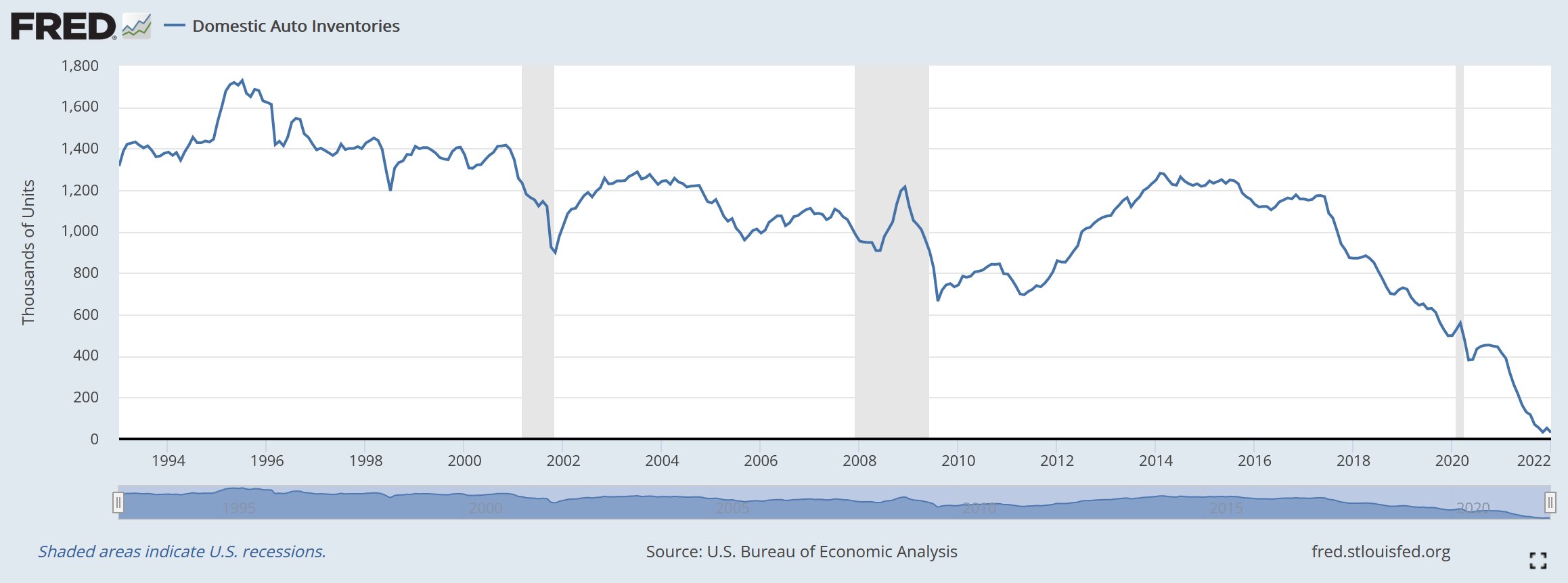

Auto inventories are at an all-time low. The purchase of new cars was always sustained during the health crisis, with fiscal stimulus measures that seem to have favored this sector (apparently, when Americans are given free money, they buy cars first!)

The artificial stimulation of demand, combined with supply problems related to inflation and the health crisis, have led to the current situation: the inventory of cars for sale is almost zero!

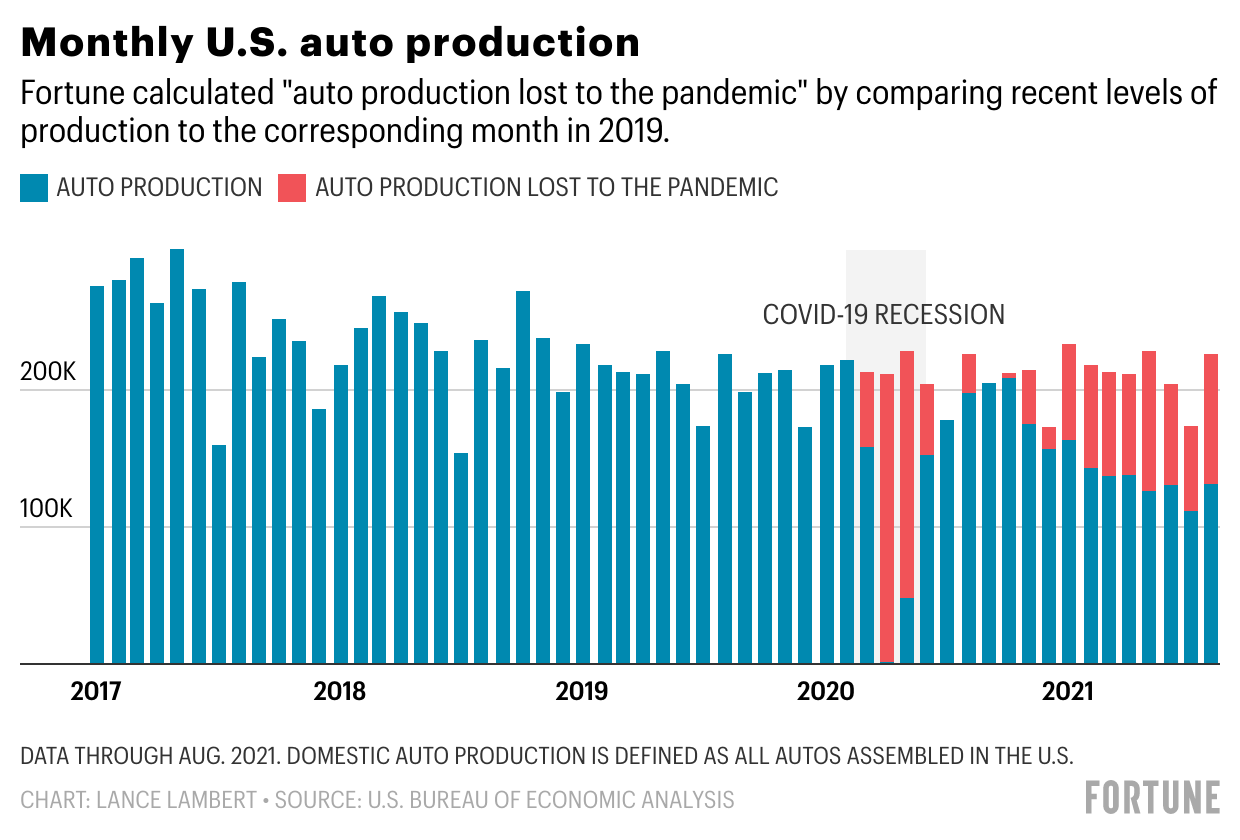

Car production is no longer sufficient to meet demand, and supply problems are still hampering American factories:

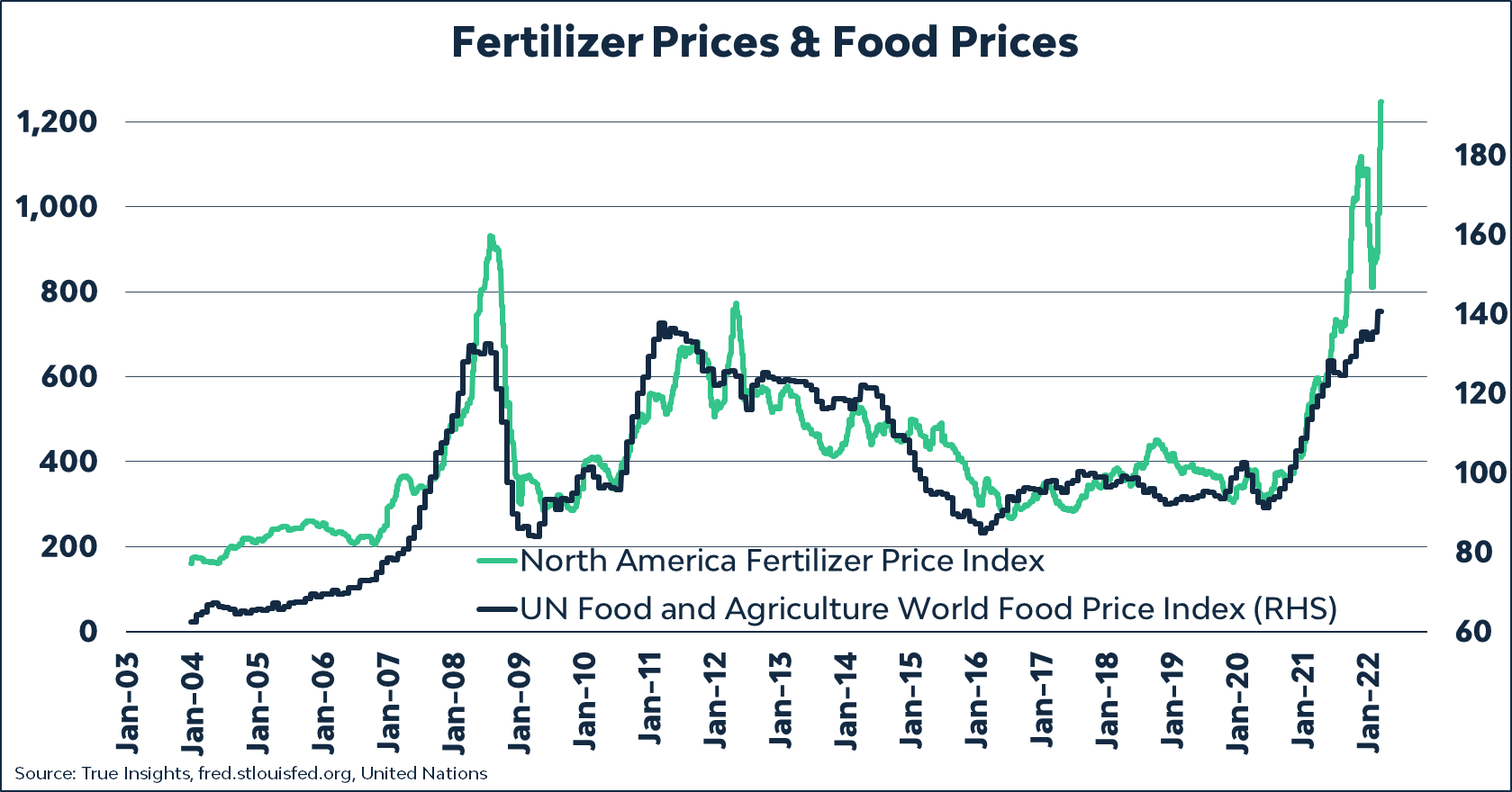

Even though Russia has very little control over steel prices, it is clear that the situation in Ukraine is causing tension on the entire market. The conflict is acting as a real lever on commodity prices, as China's alignment with Russia is now taken into account by the various participants. Russia and Ukraine account for 30% of world wheat exports, 17% of corn, 32% of barley and 75% of sunflower oil. Russia also exports about 15% of the world's fertilizers. In each of these markets, tensions on prices and trade volumes are palpable and are likely to lead to new geopolitical tensions regarding access to these vital resources.

The American embargo on Russian energy resources even threatens to affect the uranium market. A bill to this effect has been introduced by Senator John Barrasso. At the same time, Russia is threatening to get ahead of the United States in this area by cutting off American uranium supplies.

This new configuration in the uranium market prompted Caxton Associates to take a 10% stake in Sprott's SPUT trust, which is 100% invested in physical uranium. This $257 million investment is the most significant since the inception of Sprott's uranium product.

Trade tensions are also affecting the fertilizer market, with threats of supply cuts from Russia and Ukraine. Rising fertilizer prices pose an even greater food crisis than the last "Arab Spring".

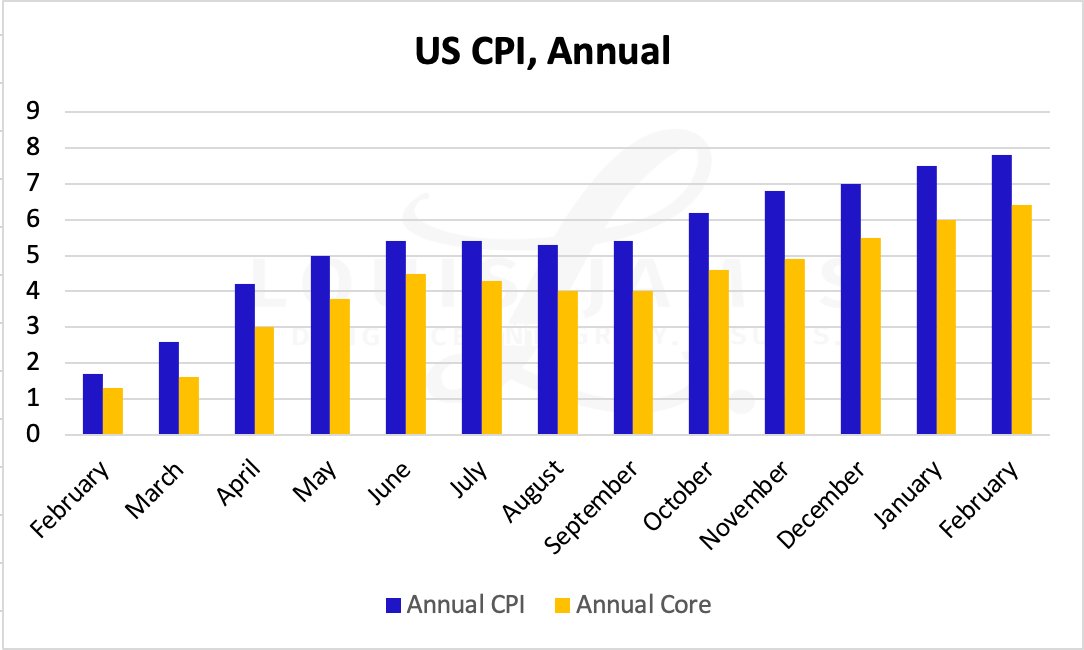

War accelerates inflation, and it is precisely in this geopolitical context that the Fed Chairman is changing his views on inflation. After more than a year of denial on the issue, Jerome Powell radically changes his approach to the phenomenon, which he admits is much more serious than expected.

Yes, inflation is a monetary phenomenon, and the Fed cannot sit back and wait for the magical return of a supposed disinflationary regime. In the words of the Fed Chairman himself, inflation is no longer a phenomenon solely linked to disruptions in the production chain. This admission, at this point in the crisis, is a shock to the bond market.

This week, the credit market is experiencing tensions reminiscent of the premises of the last financial crises.

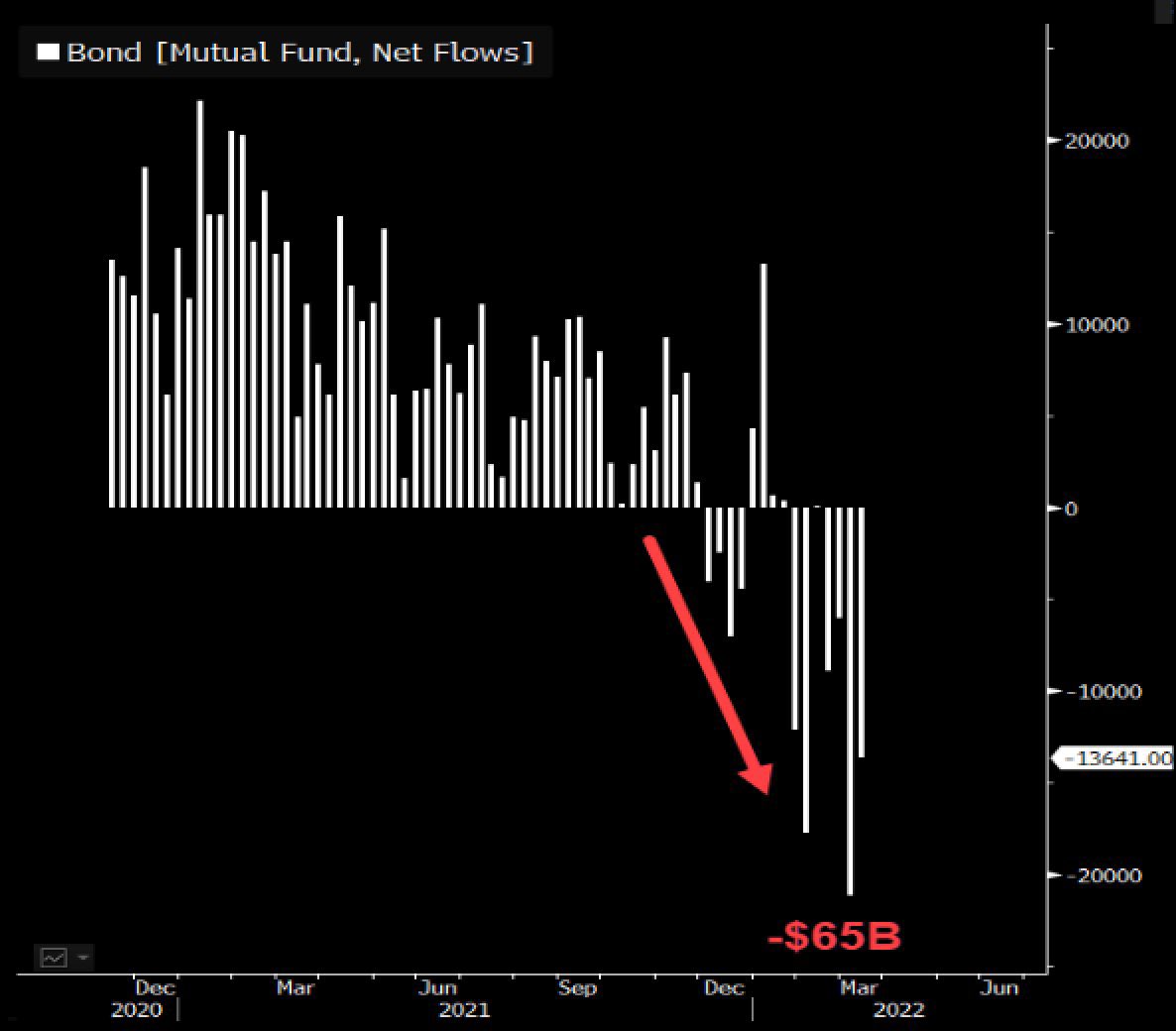

In just a few days, US long rates have soared and funds are massively withdrawing from the bond markets...

... and US mortgage rates have risen by almost 2% in a few weeks. U.S. home rates are on the verge of surpassing their 2018 highs.

The TLT index, which measures the yield on the U.S. 20-year, has fallen below its three-year lows and is approaching its bullish support. The $120 level will be closely scrutinized in the coming days.

The municipal bond market is in a more critical situation. Support has already been reached:

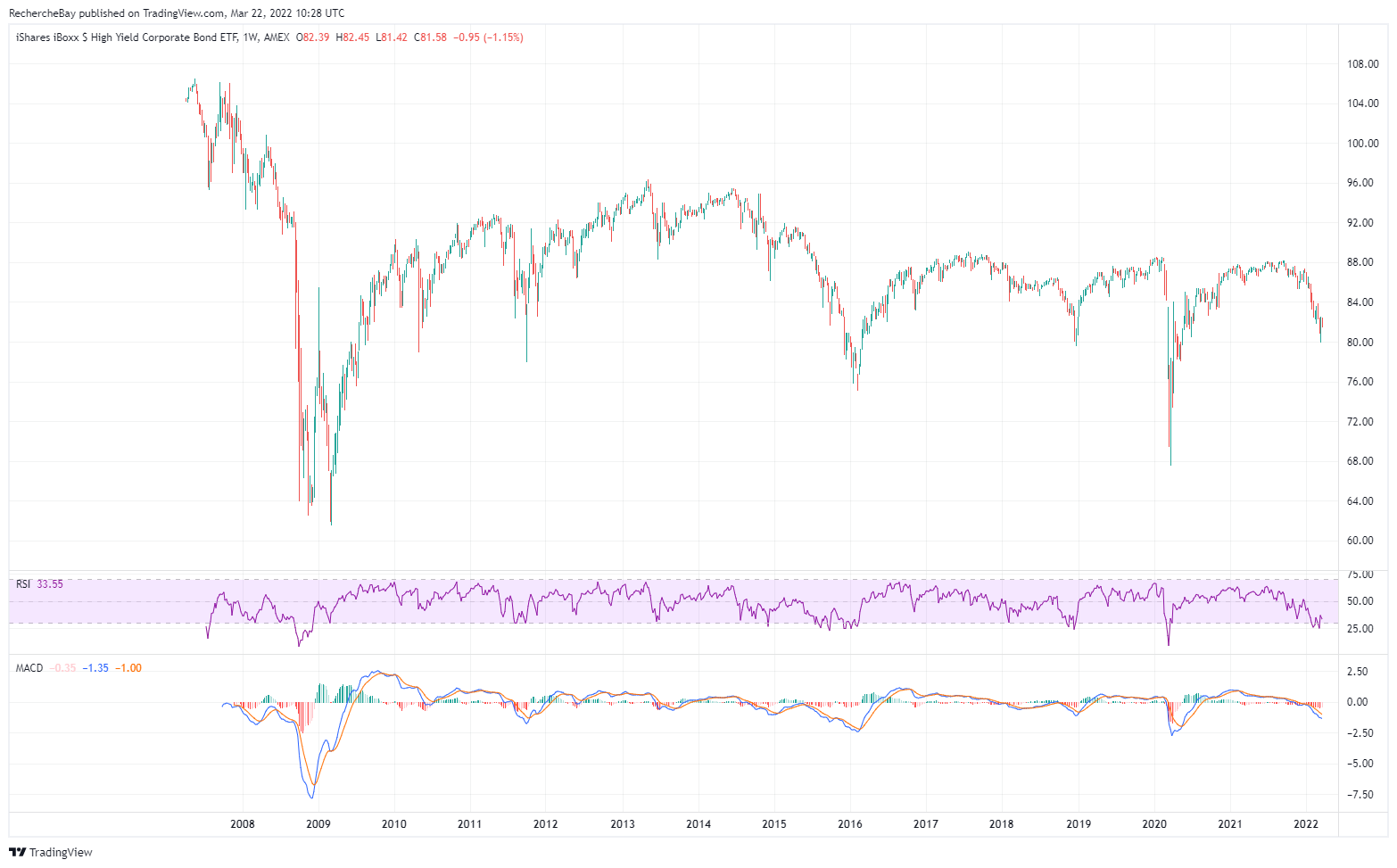

The stress is less significant, however, on HYG, which measures corporate bond yields. Stress levels are still far from having reached the levels of 2008 and 2020, which led the Fed to intervene massively on the markets:

The pace of rate hikes has been significant since the Fed's last speech. Even if we are very far from a capitulation phase, the bond market has been showing signs of cracking for a few days.

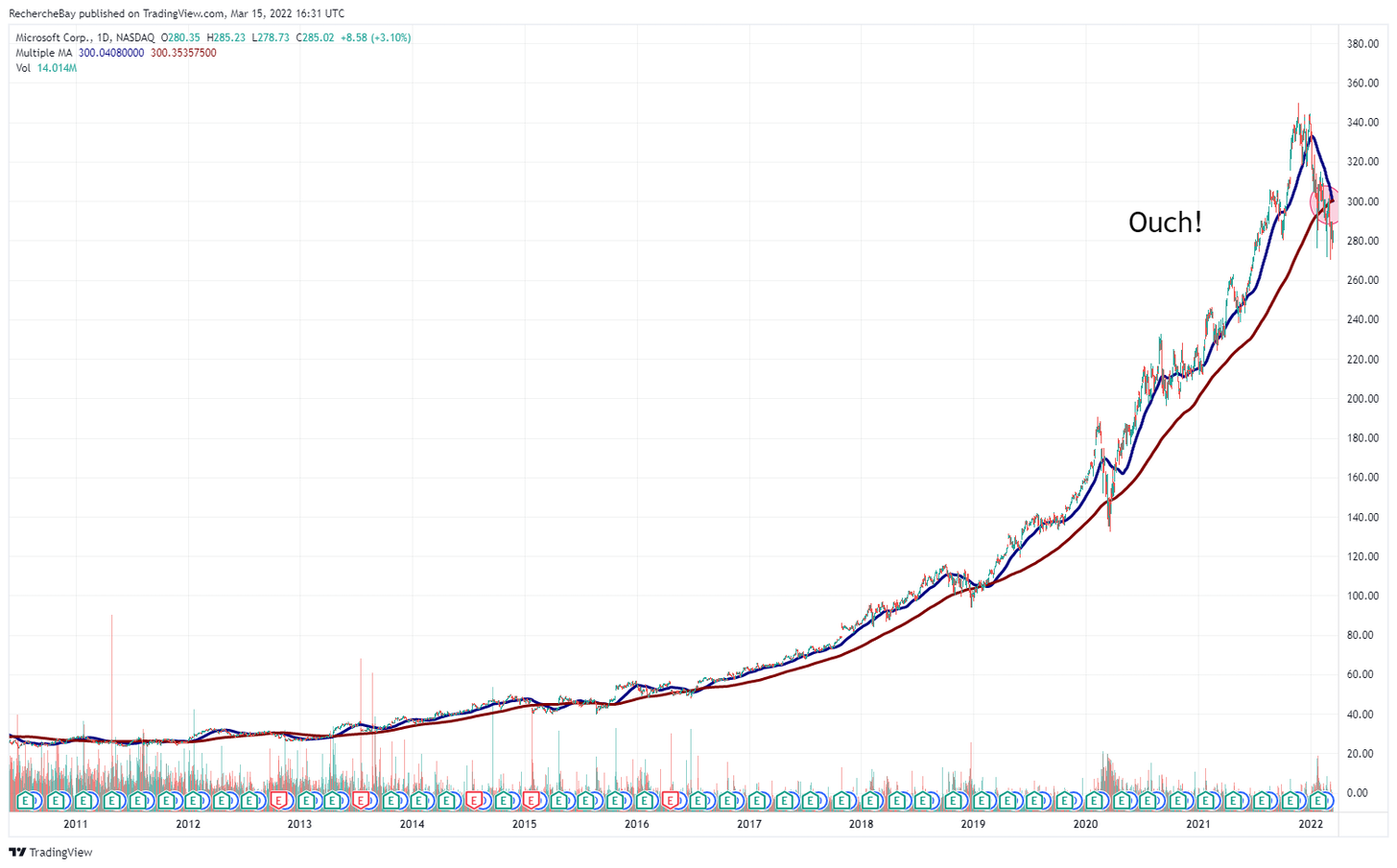

This weakness in the bond market is undoubtedly preventing a rebound in growth stocks, which are very sensitive to this surge in rates. However, the NASDAQ index has been recovering for a few days from a fairly pronounced oversold situation, led by the nearly 30% rebound in Chinese technology stocks.

But the momentum of this rebound seems to be running out of steam, given what is happening in the bond market.

The sharp rise in rates is traditionally unfavorable to gold and it is quite surprising to see gold prices hold this week at such high levels, especially after such a change in the Fed's rhetoric. Gold is not reacting to the rate hike because the pace of inflation is not slowing down, so real rates remain stable.

As long as this inflation continues to rise, rate hikes will not significantly correct gold.

Silver is also holding at high levels despite the situation in the bond market. There is a chart explanation for this.

Last week, the "Death Cross" pattern was drawn on the NASDAQ to explain that the rally in technology stocks would be countered by this technical pattern:

This week, we draw in daily the "Golden Cross" of silver metal which sends, unlike the NASDAQ, a bullish signal when testing the breakout of the bullish flag.

Graphically, the NASDAQ is limited on the upside, while silver is limited on the downside.

Weekly, the silver/NASDAQ ratio is testing a downtrend that started in 2011. After several failures to break through this trend, the double inverse "Death Cross" and "Golden Cross" configurations on both indices may change the game this time.

In any case, the physical silver market is anticipating this catch-up in silver prices. At many brokers, premiums exceed 60% on some silver coins, which exceeds the levels seen during the February 2021 short squeeze.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.