The European bond crisis is only very poorly covered by the European media. Sometimes you have to look for articles published on the other side of the globe to get a fair idea of what is happening in the government bond market.

However, the bond market is more important than the stock market and anticipates more accurately the occurrence of financial crises.

Last week, it was an article from the Asian Times that made headlines.

Hedges blow up after risk gauges in Germany’s government debt market exceeded those of the 2008 world crash https://t.co/vDQmde2qMm

— Asia Times (@asiatimesonline) October 7, 2022

The author explains that the margin calls that started in England are now spreading to the European continent. In particular, he quotes a fund manager who says that the current situation threatens the survival of his business "It's a global margin call. I hope we survive."

In this global sell-off, German debt is no longer serving as a safe haven this time. The 10-year rates on the other side of the Rhine are rising at the same speed as the 10-year rates in England:

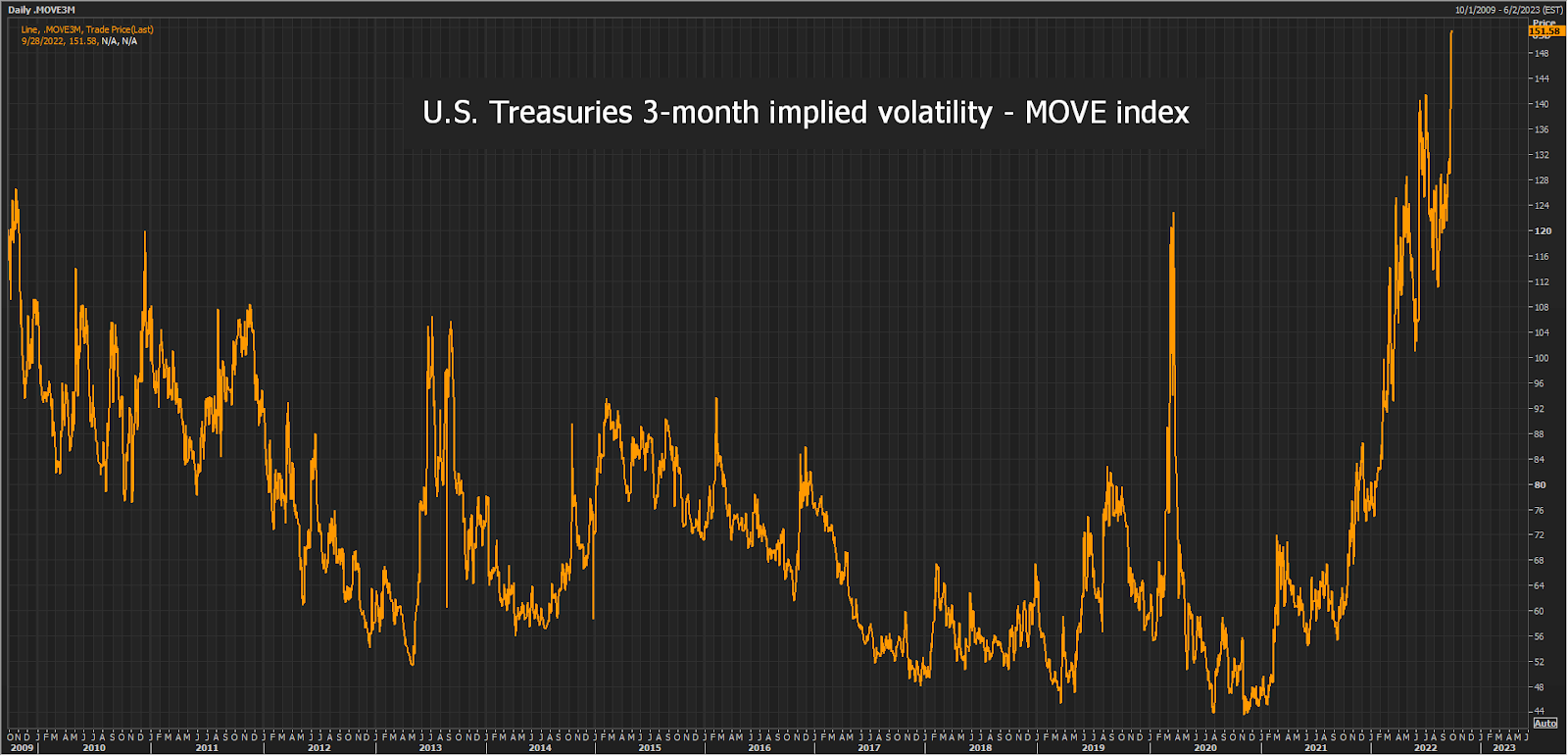

The plan to finance the energy bill has the same effect as the tax cuts decided by the new British government. The market now demands immediate remuneration whenever additional spending is even considered. Government debt is such that any additional attempt at a tax incentive is immediately reflected in the debt market. The sovereign debt market is in a state of tension never seen before. The illiquidity in this market is reaching levels that threaten the financial system as a whole. Last week, there were even three consecutive sessions without trading in Japanese bonds - a first in the country's history. This raises questions about the intrinsic value of these instruments. And these questions are something entirely new in modern finance. Until now, no one has dared to question the value or liquidity of an instrument backed by the debt of a country like Germany, England, Japan or even the United States. The volatility of bond products is usually reserved for instruments that are considered riskier. The U.S. 3-month has never experienced such volatility:

It is still difficult to measure the consequences of this unprecedented illiquidity and volatility on the rest of the financial system.

The real panic that has gripped the BoE since last week, with the institution having to intervene twice to relieve the British debt market, is maintaining this climate of uncertainty. How will the Bank of England manage this global margin call among pension funds? To what extent will the global margin call spread to other financial institutions?

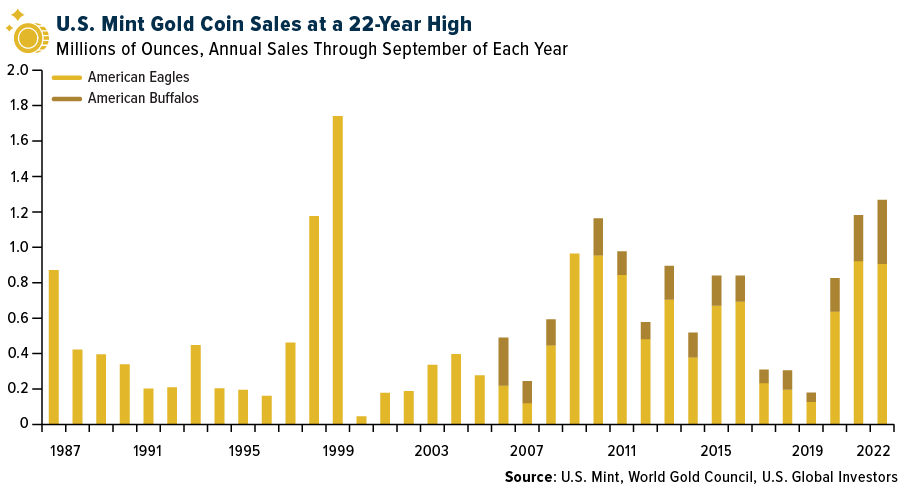

Against this backdrop, sales of physical gold at U.S. retailers are at their highest since 1999 and even exceed the gold rush levels of the great financial crisis of 2008:

The US Mint is forced to slow down its production of gold coins.

But the rush is even more impressive on physical silver.

Since the beginning of the Silver Short Squeeze, 332.8 million ounces of silver (nearly 10,000 tons!) have left the vaults of the COMEX and LBMA. Last month, the movement even accelerated. Indeed, the downturn in silver prices caused a veritable raid on physical metal stocks: nearly 60 million ounces (1,700 tons) were withdrawn from the world's two main physical silver stocks.

These numbers can be followed on a daily basis on the Twitter of "@Michael #silversqueeze", an account that has gone viral with the hundreds of thousands of retail investors behind this historic squeeze on silver. A community that the Financial Times described last week as "Reddit degens".

September saw a record for the largest combined monthly withdrawal from Comex and LBMA #silver vaults, coming in at almost 58.5 million ounces.

— Michael ?️? #silversqueeze (@mikesay98) October 10, 2022

Total combined withdrawals in 2022 now total almost 332.8 million ounces! #silversqueeze pic.twitter.com/83F6qLlt8I

Members of the r/Wallstreetsilver forum are trying to organize a "corner" on physical silver, like the Hunt brothers in the 1980s. The main purpose of this action is to make the futures market obsolete: without physical metal, the COMEX would no longer be able to honor deliveries, requests would be transformed into cash settlements and short speculators would have to cover their positions in a massive short squeeze. The volume of short positions in the futures markets held by institutional investors has reached a 4-year high. With leverage at very high levels, it is hard to imagine how these hedges could be achieved without causing significant margin calls by poorly positioned funds.

But beyond the short squeeze, it is, of course, the role of this market in determining spot prices that would be called into question. The real risk is that the determination of the price of silver will be based solely on the argument of physical supply and demand, without the futures market. Will the "degenerates" of the silver short squeeze manage to completely deplete silver stocks by threatening the very operation of the COMEX?

What seemed impossible in February 2021 in relation to the size of the market seems less unlikely today, especially when one measures the volume of physical silver that disappears from the exchanges every day. The tension on the physical is again palpable, as it was during the Covid crisis. But this time, in addition to the raid of the "retail" investment, the physical silver market is facing two new major problems:

- The amount of physical metal available is reduced as refining centers that produce silver as a by-product have decreased production due to the energy crisis. 73% of silver is a by-product of zinc, copper, lead and gold. Problems in refining these metals directly affect the amount of silver available. Half of the EU's zinc production has already been shut down. As the zinc smelting process separates the silver from the ore, it decreases the supply of silver produced by these refineries.

- The sources of supply now exclude Russia. And it is likely that these exclusions will soon include refined products using concentrates of Russian origin.

This rush into physical metal comes at a time when the global margin call is affecting funds that are liquidating their long positions in the futures market. Speculators are increasing their short positions in anticipation of a collapse in demand for metals due to the looming global recession. The decline in the price of silver, which is correlated to the futures market, is only accelerating the rush to buy the last ounces of metal available. In this context, the risks of physical shortages logically increase.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.