The year 2023 has started off with a bang for the precious metals sector. Gold, silver and platinum have recorded significant gains in the first two sessions. Silver in euros is even now in a breakout on its monthly chart, with a very bullish MACD reversal in progress:

Gold in euros has just breached its 200-day moving average on the daily chart and is also attempting to break a major resistance:

The price of platinum in euros is also attacking its last resistance:

In daily variation, platinum is the first metal to have broken a resistance in dollars, and this, from the beginning of this year 2023:

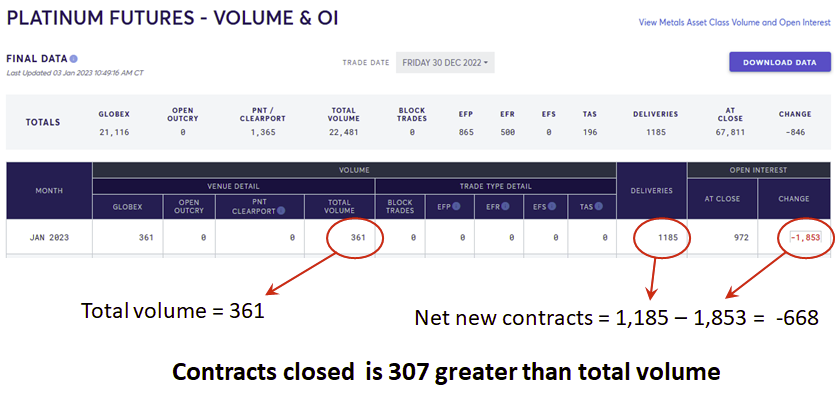

A prominent member of the Reddit r/Wallstreetsilver community has posted an alert about an exceptional event that took place a few days ago on the COMEX.

According to his calculations, the volume of platinum futures contracts now exceeds the amount of metal available on the COMEX:

This is not the first time this has happened, and according to the author, the situation is currently the same in the silver market.

How can delivery requests be fulfilled if they are larger than the available metal inventory?

It is likely that arrangements between short sellers and long contract holders will be made on a case-by-case basis: cash settlements with premiums, as has happened in the past.

The only problem here is that, given the very tense situation in the platinum and silver market, the temptation is great for speculators to open a future contract, wait for the stock depletion, and then negotiate a premium above the spot price with the seller of the contract. This speculation would pose a major problem for the functioning of the futures markets, forcing the determination of platinum and silver prices through other arbitrage mechanisms, thus increasing the volatility of these precious metals.

This very tense situation may explain the spectacular increases in silver and platinum prices.

Will January 2023 bring an end to the long period of consolidation in precious metals that began in August 2020, a period during which futures have helped to calm the feverish bouts in this market?

The current rise in precious metals has been anticipated by central banks, which have further increased their gold purchases in recent weeks:

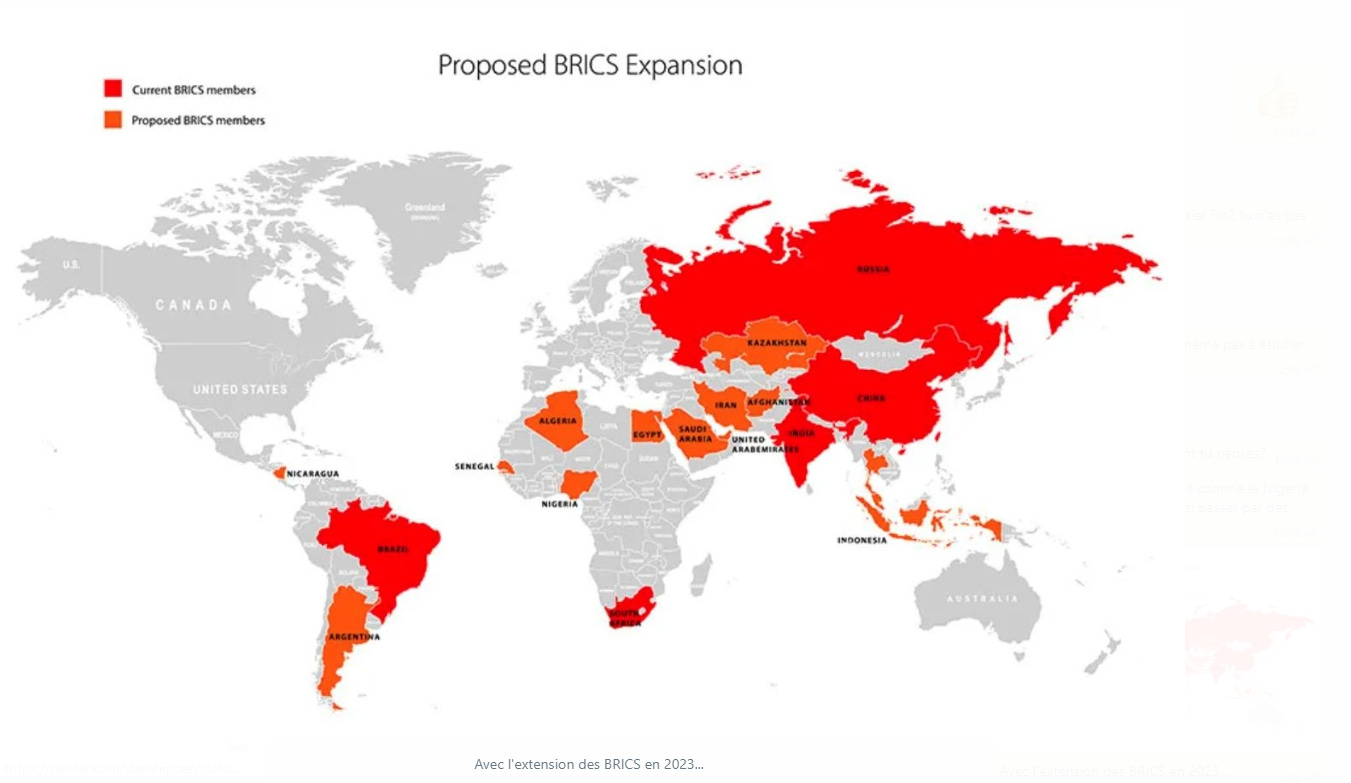

Most of these gold purchases have been made by the central banks of the BRICS countries, or by countries that are preparing to join this new conglomerate of nations whose objective is to build an exchange system that competes with the one set up by the West. These central banks are working to establish a system of transactions and settlements in which the dollar will be less used and gold will probably play a primary role.

With this in mind, investors will need to keep an even closer eye on the dollar in the future. The value of the greenback is very important for precious metals, but the prospect of the dollar losing its dominance in international trade is a key component of its future movements and the determination of the price of gold. As the dollar weakens, the BRICS transition to an alternative currency system will speed up. Recent central bank gold purchases suggest that gold will play a major monetary role for these countries.

How international investors anticipate the value of the greenback is now fundamental to gold's future.

There are powerful forces currently vying for the determination of the dollar's value. There are both bullish and bearish forces.

The dollar is being pushed up by the weakness of other currencies and deleveraging due to the bursting of the debt bubble.

The euro zone, mired in the energy crisis, has reopened the debate on the future of the euro amid fears of a new sovereign debt crisis.

Japan, meanwhile, is caught in the trap of an unprecedented bond crisis: at the beginning of this year, the country found absolutely no buyers at its new debt auctions, prompting the BoJ to urgently buy back a new batch of bonds to avoid a crash. The BoJ holds half of the Japanese bonds, the other half has no buyer! Under these conditions, how can we still consider Japanese bonds as a "market"? What is the future for the value of the yen?

The dollar draws its strength from the weakness of other currencies. But another factor could support the greenback in the short term.

A severe global recession would trigger large margin calls: the more the debt bubble bursts, the more it leads to asset liquidation which dries up liquidity and puts upward pressure on the dollar. This is one of the main strengths of the greenback at the moment: when the markets fall, the dollar rises. Paradoxically, the Fed needs a global recession to defend the intrinsic value and therefore the international safe haven role of the dollar!

However, other forces are likely to push the dollar lower: the US fiscal situation and the fragility of the Fed's balance sheet.

The U.S. deficit continues to grow: the growing debt burden and the Biden administration's new tax measures, combined with lower-than-expected tax receipts, make it impossible to expect a balanced budget in the near term. Since the U.S. government has been borrowing mostly at short maturities, rising rates are acting as if the government had borrowed at a floating rate. The impasse in which the country finds itself resembles the situation of a variable-rate mortgage borrower caught in the crosshairs of a sudden rise in rates. This untenable situation poses a risk to the value of the dollar, as it will eventually force the Fed to intervene again to buy up debt. The money printing press will have to be turned on again, further diluting the value of the money issued by the Fed.

The intrinsic value of the greenback is fundamentally linked to the quality of the Fed's balance sheet. The riskier the balance sheet, the more the fundamental value of the dollar decreases.

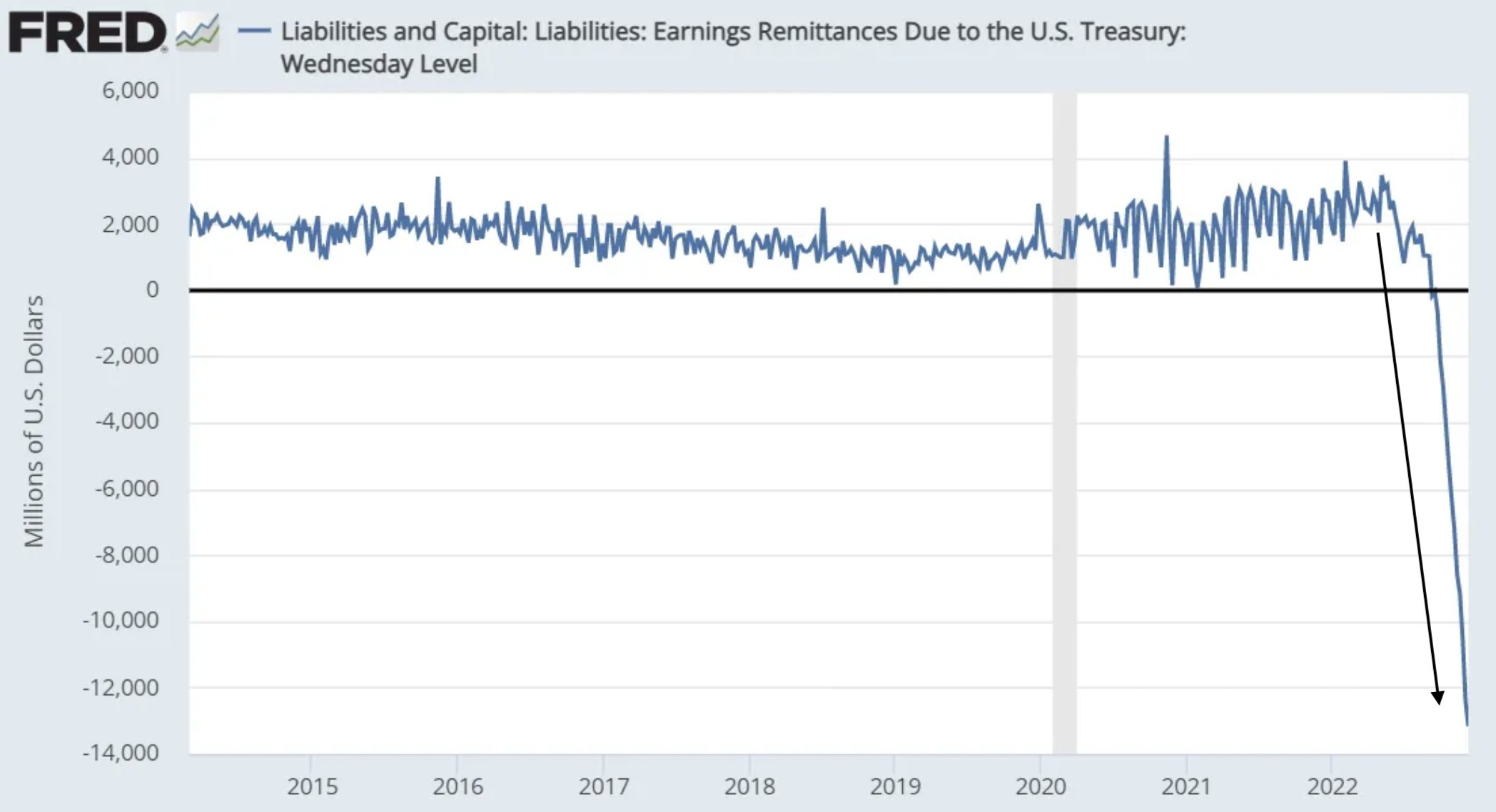

Regarding the Fed's balance sheet, a charth has been circulating on social medias for a few days:

The "Fed remittances" represented on this chart correspond to the remittances made by the Fed to the various banks and financial institutions that it supervises.

Since raising interest rates, the Fed has experienced a significant operating loss in its bond portfolio: it is losing about $12 billion per week, with interest expense far exceeding interest income. This is a dramatic change from previous years, when the Fed had a surplus on the coupons of the bond products it held (which it paid in part to the Treasury).

To make up for its losses, the U.S. central bank will simply issue IOUs, which it will collect as soon as the situation is reversed. Until then, the Fed printed dollars by buying debt. Technically, these successive quantitative easings have never been "empty" money printing, since a debt security was issued each time the money printing presses were turned on: the Fed's balance sheet grew as it piled up a set of promises to repay debts contracted mainly by the Treasury and real estate borrowers. This time, the Fed is issuing dollars to cover a loss in exchange for IOUs, which is not quite the same thing: printing money to buy debt is already very damaging for the dollar in an inflationary context, but printing money to cover losses is even more inflationary!

It remains to be seen which bullish or bearish forces will prevail in 2023.

As these bullish or bearish forces become more pronounced, it is logical to expect very high volatility in the Forex market and also in the gold market.

According to Jim Sinclair, the end of the dollar's monetary adventure will unfold with daily variations of + or - $100 in the price of gold. It could well be that this year 2023 will be the first of a new cycle of hyper-volatility in gold and precious metals.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.