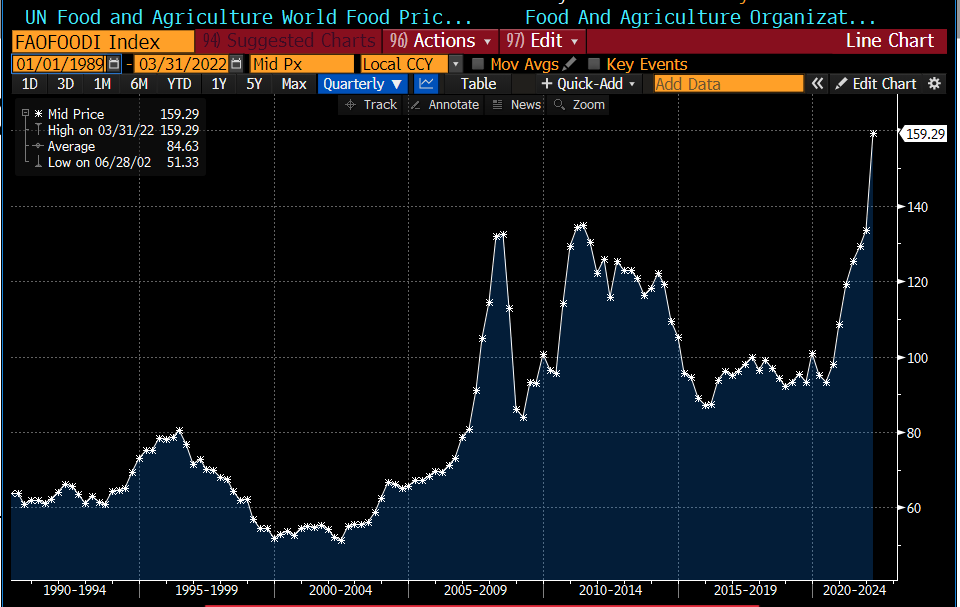

This week's chart depicts the upward explosion of the global food price index, which soared +33% over one year and +13% in a single month, far surpassing its all-time high in 2011.

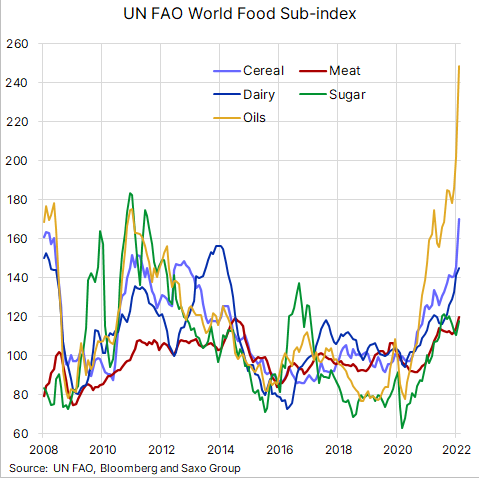

Cereal and oil are particularly affected by this increase, a logical consequence of the war in Ukraine:

The pace of inflation is accelerating in the U.S., as evidenced by the latest Consumer Price Index (CPI) figure, which rose +8.5% year-over-year. A 40-year record!

Gasoline is up +48.0%, used cars +35.3%, gas utilities +21.6%, meat/fish/eggs +13.7%, new cars +12.5%, electricity +11.1%... It is only thanks to the housing figures that this figure remains under 10%, but the questionable way in which the index is calculated leaves many observers very skeptical, especially when measuring the real increase in rents and real estate prices over one year. Real inflation is in the double digits in the U.S. and those who predicted a spike in inflation by the end of last year are suddenly very quiet.

In 2012, Jim Rogers made a bet that in the long term, inflation would reshuffle the deck, and that we would move from a society that pays its executives too much to a less globalized society that enriches farmers and pushes white-collar workers out of cities. This prediction has not yet come true, because the inflationary shock we are experiencing is too severe and is leading above all to phenomena of ruptures. Farmers do not have time to take advantage of this price increase; they are already struggling with the rising price of fertilizers. The reshuffling of the cards that Jim Rogers was talking about is taking place, but in sectors that are benefiting from this crisis and shortage situation. Logistics is the emergency.

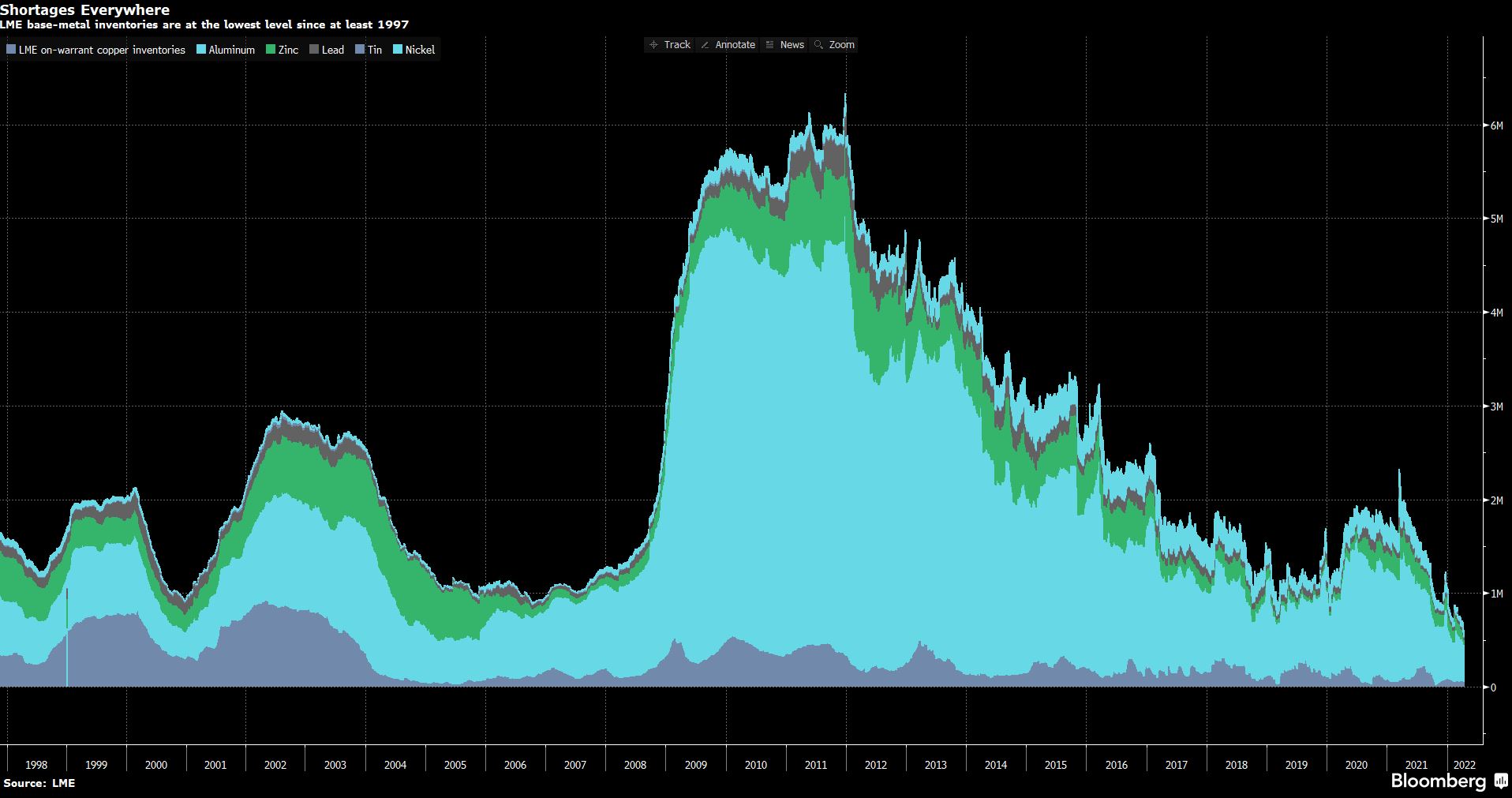

The immediate risk is not the rise in prices, but the risk of a supply disruption. This risk of disruption is particularly visible in metal inventories, which are at their lowest level since the beginning of the century:

The London Metals Exchange (LME) is now at risk of experiencing short-squeeze phenomena, similar to what we saw in nickel last month, in other markets such as zinc and aluminum.

This accelerated decline in inventories is also affecting silver metal: the LBMA and COMEX have seen their entire inventory shrink by almost 850 tons. In total, nearly 1,930 tons of silver metal were siphoned from these markets in the first quarter, with a notable acceleration since the beginning of March.

In parallel to this risk of shortages, the other consequence of inflation is the "Great Resignation" in the US, the first effects of which I already reported last November.

In times of uncontrollable inflation, job openings remain unfilled if they do not offer progressive salary bonuses that assure new hires of offsetting the rising cost of living. Employees do not hesitate to resign to compensate for the purchasing power they lose in their current position. The level of hiring is no longer a reliable economic indicator in the current high inflation episode. The level of remuneration has become the most important criterion for measuring the effects of this "Great Resignation". This is especially true at a time when American activity is not weakening: consumption is still driven by credit applications that are soaring to historic highs... Liquidity is sustaining the impressive recovery in activity. Costco's latest results attest to the frenetic consumerism in the US: sales jumped by +17.2% year-on-year, while the market was expecting +11.2%...

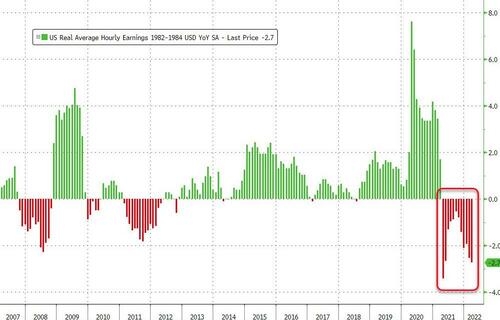

This resignation of American employees is the consequence of the collapse of real incomes, whose decline is accelerating this month:

In the U.S., a truck driver's salary is now over $100,000 a year for the first time. Bloomberg reports that Walmart will now pay its salaried drivers (not freelancers!) between $95,000 and $110,000 the first year. Financially speaking, it's better to start a career as a truck driver, without going into debt at university, than to go to school to become an engineer and earn less! The pressure on wages directly threatens the balance of economic and social benchmarks.

This risk to the real economy has completely changed the Fed's discourse and has caused US rates to soar in recent weeks. The risk is no longer on the unemployment rate, because inflation has changed the way the Fed's economists look at the new risks associated with this inflation.

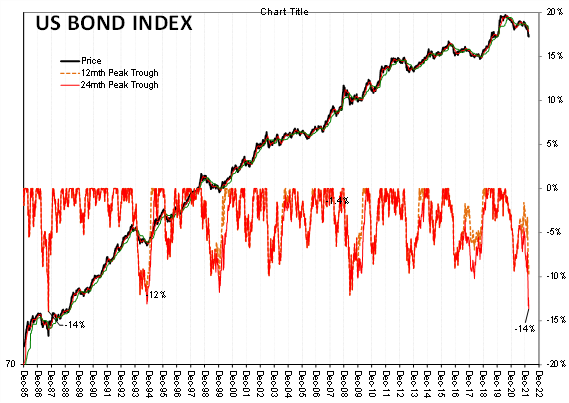

For the past few weeks, we have been witnessing a real bond crash in the United States, as the markets anticipate a radical change in monetary policy.

The U.S. ten-year index is down -14% from its March 2020 highs; this is the biggest drop in bond yields from a previous peak since 1987.

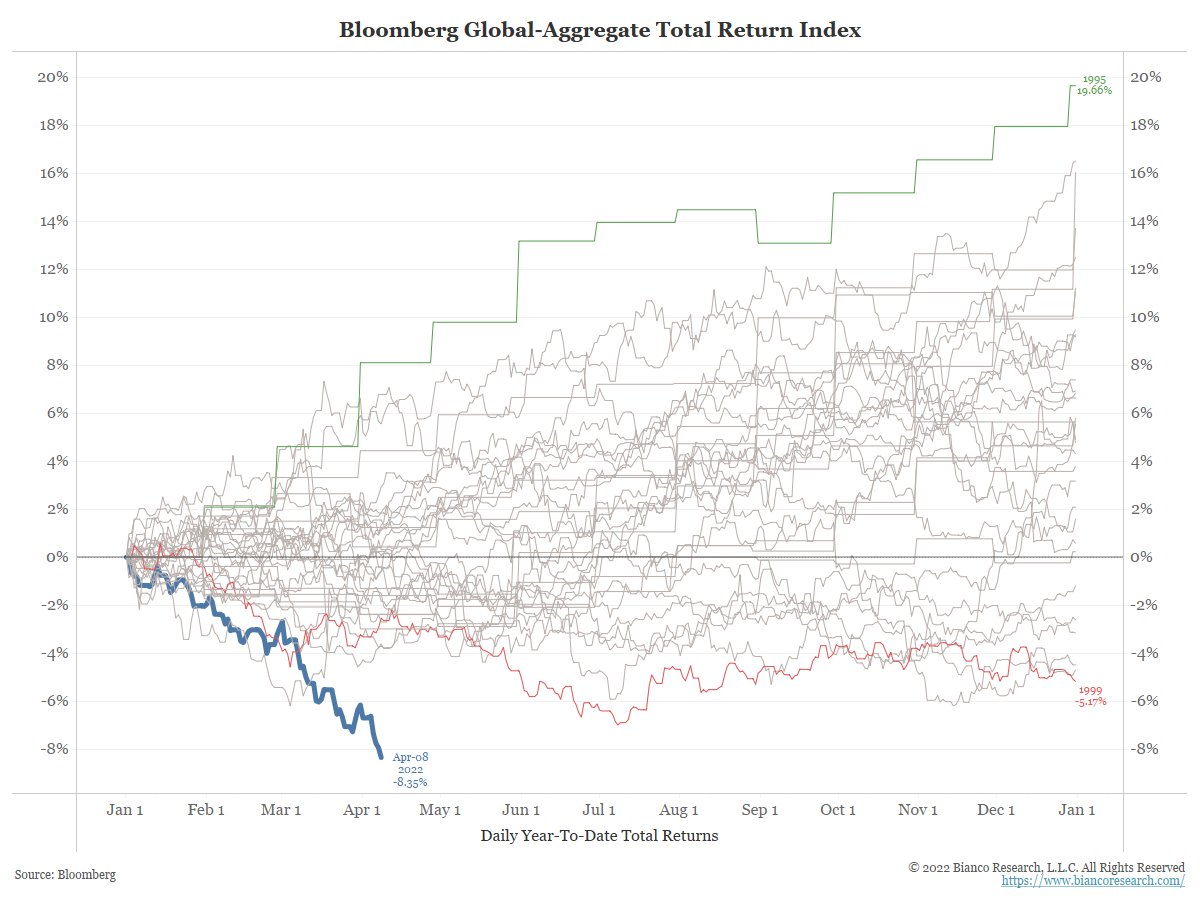

The beginning of 2022 marks the most severe correction in the bond market:

Looking in detail at the declines in bond products, it is the commercial real estate sector that is devaluing the most: the CMBS index (ETF) sank this week to its lowest level since March 2020. This ETF measures the performance of AAA-rated products and is likely to add to the losses of bond portfolios, which have already been hit hard since the beginning of the year:

The Fed, which is lagging far behind inflation and has not even begun to raise rates significantly, is already facing a historic bond crisis. The rapid rise in rates contrasts with the slowness of the monetary authorities to take into account the sudden awakening of inflation. Real inflation is probably over 10%, while the Fed's key rates are still close to 0%! But since the market has already anticipated a sharp rise in rates, the bond market and the funds massively invested in these products are not even benefiting from the Fed's accommodating policy. The Fed has completely missed the last cycle, which is now accelerating losses on the portfolios most exposed to these bond products.

Everyone loses! The fund managers ... and the players in the real economy.

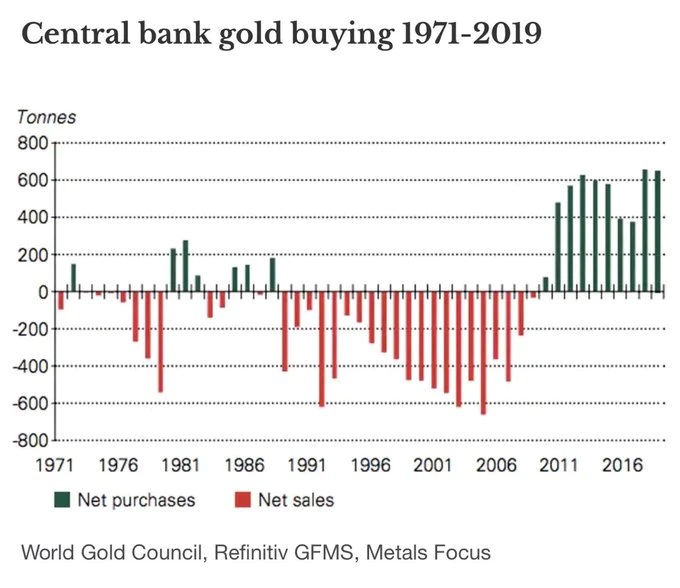

On the other hand, this inflation changes the perception of the value of fiat currencies. To prepare for the inflationary shock and the phenomena of commodity shortages, the central banks of developing countries are buying gold at the expense of foreign currency reserves.

Egypt, faced with a severe shortage of agricultural raw materials, increased its total gold reserves by 54% in February alone, bringing them to 125 tons.

Egypt is only continuing a resumption of gold purchases by central banks observed over the last ten years. A movement that is much better understood in the light of today's geopolitical and monetary events.

This increase in central bank purchases is now accompanied by a new flow of fund purchases into gold-linked ETFs. In March, the World Gold Council calculated that these trackers recorded an impressive +$11.3 billion in investment demand.

Global #goldETFs had net inflows of 187.3t (US$11.8bn, 5.3% of AUM) in March - the strongest month since February 2016. Get the details in our latest report on #gold ETFs here: https://t.co/jvmHEDNTLc pic.twitter.com/2xdgPgJ17F

— World Gold Council (@GOLDCOUNCIL) April 7, 2022

In this period of high demand for physical gold, the pressure on allocated accounts increases. This makes sense, as it is especially during these periods of high demand that owners of physical gold want to verify the accuracy and veracity of the inventories they hold.

The Australian central bank is launching an audit this month of its $6 billion physical gold reserves held in London. The audit is designed to identify the serial numbers of the bars the bank is supposed to hold in the vaults of the Bank of England.

In a turbulent monetary and geopolitical environment, physical evidence of gold holdings is now a pressing consideration for investors.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.