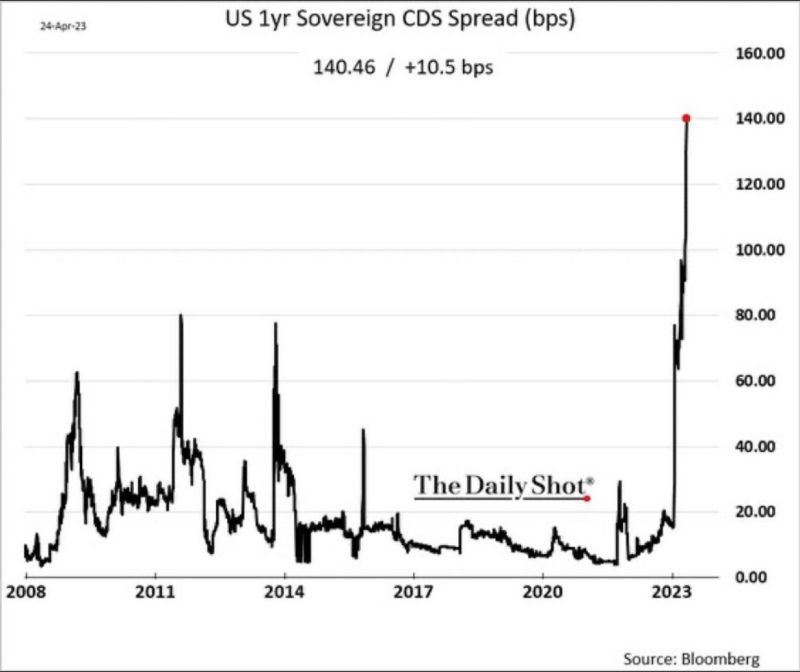

The chart of the week is the US Credit Default Swap (CDS): this index represents the cost of insurance against a US default. The 1 year CDS (US CDS 1 YR) has just exceeded 140 bps...

The 5-year CDS is also up, reaching 60 bps, an unprecedented amount for this maturity and this country.

In the midst of the debate on raising the debt ceiling, never before have so many investors sought to protect themselves against a US default, not even during the crises of 2008 and 2011.

With each debate on the debt ceiling, CDS prices rise:

But 2023 is not like the previous episodes. This time, the feverish attack on the index is real and far exceeds the last peaks.

The market is "predicting" a US debt crisis. This is not surprising, as we have been saying for several months in our newsletters:

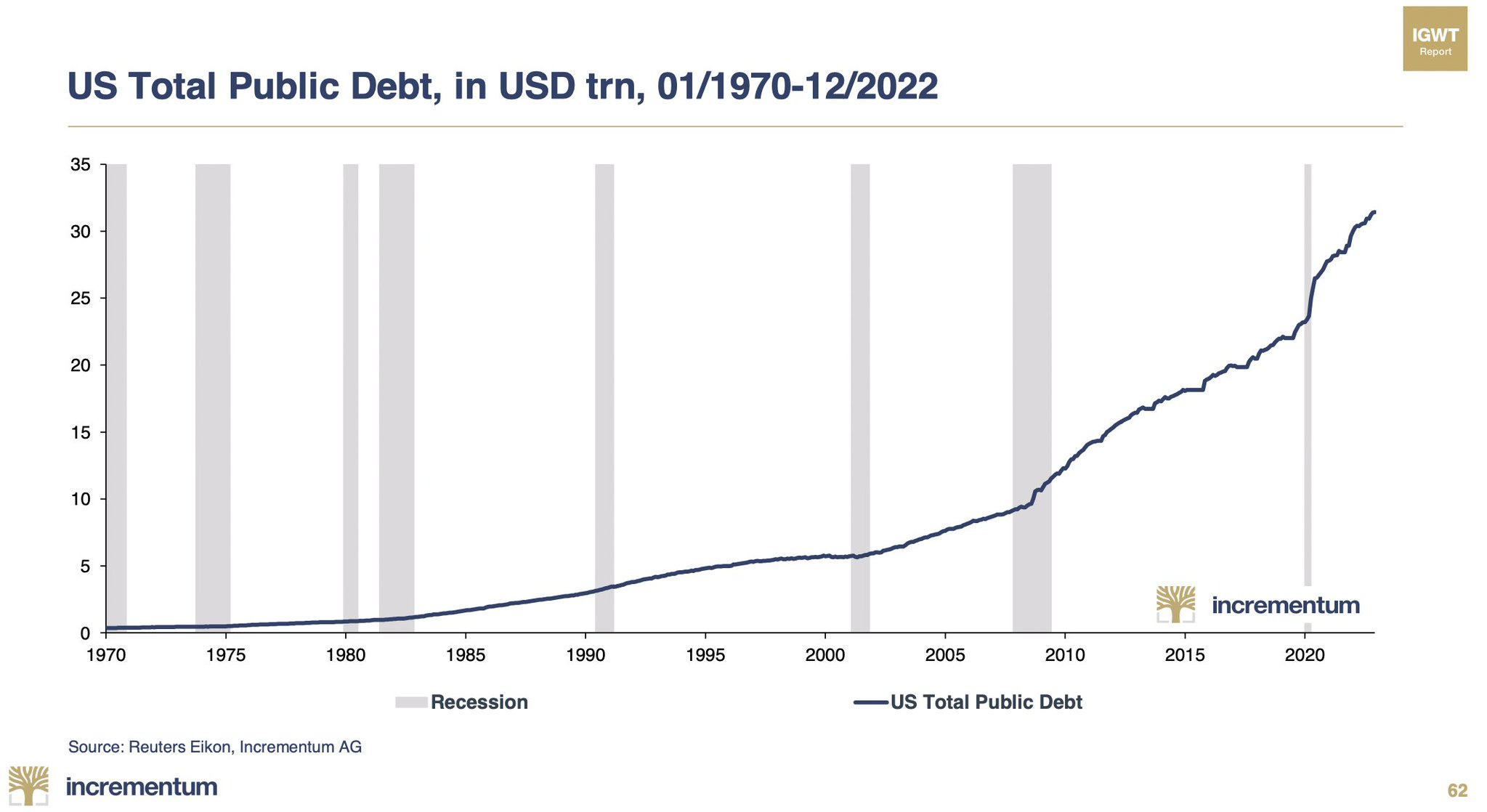

As I wrote last February, "The other victim of this stalemate is the U.S. federal government, which is no longer able to finance its deficits as the rates at which it borrows to pay off its past debts rise. The higher the rates go, the more money is needed to pay off old loans. The federal government is in a dramatic situation because the costs of its repayments have increased dramatically. The US public debt has tripled since 2008:

We are experiencing a 2008 crisis in reverse.

In 2008, the risk came from the banks and spread to households and businesses. The government intervened to restore the stability of the entire system.

Today, the risk comes from the State. It is the government that has to ensure the survival of businesses through its stimulus plan and that has to assume a longer than expected period of rising interest rates.

In 2023, the main risk is the default of the sovereign state, since all credit risk is now transferred to it."

CDS is measuring the impossible equation of financing U.S. debt with such high rates. The debt burden is about to exceed the huge defense budget. In other words, the United States finances its creditors more than its military. And these creditors are not necessarily all aligned on the same geostrategic line. How can we explain to Americans that the government's budget contributes more to financing a potential enemy than its own army? It is on this very point that the question of default has arisen before. But it is probably because the level of repayment of the US debt is becoming so uncomfortable that the option of default, even partial, is clearly being considered by so many investors.

The U.S. government's difficulties in financing its debt are likely to continue. The Fed has not yet succeeded in bringing inflation down substantially. Once this inflation has spread to wages, the inflationary regime has become self-perpetuating, the velocity of money has increased in response to this new trend, and the liquidity reserves accumulated in previous years are feeding this cycle. The Fed must now fight a phenomenon that has become "sticky" and self-perpetuating.

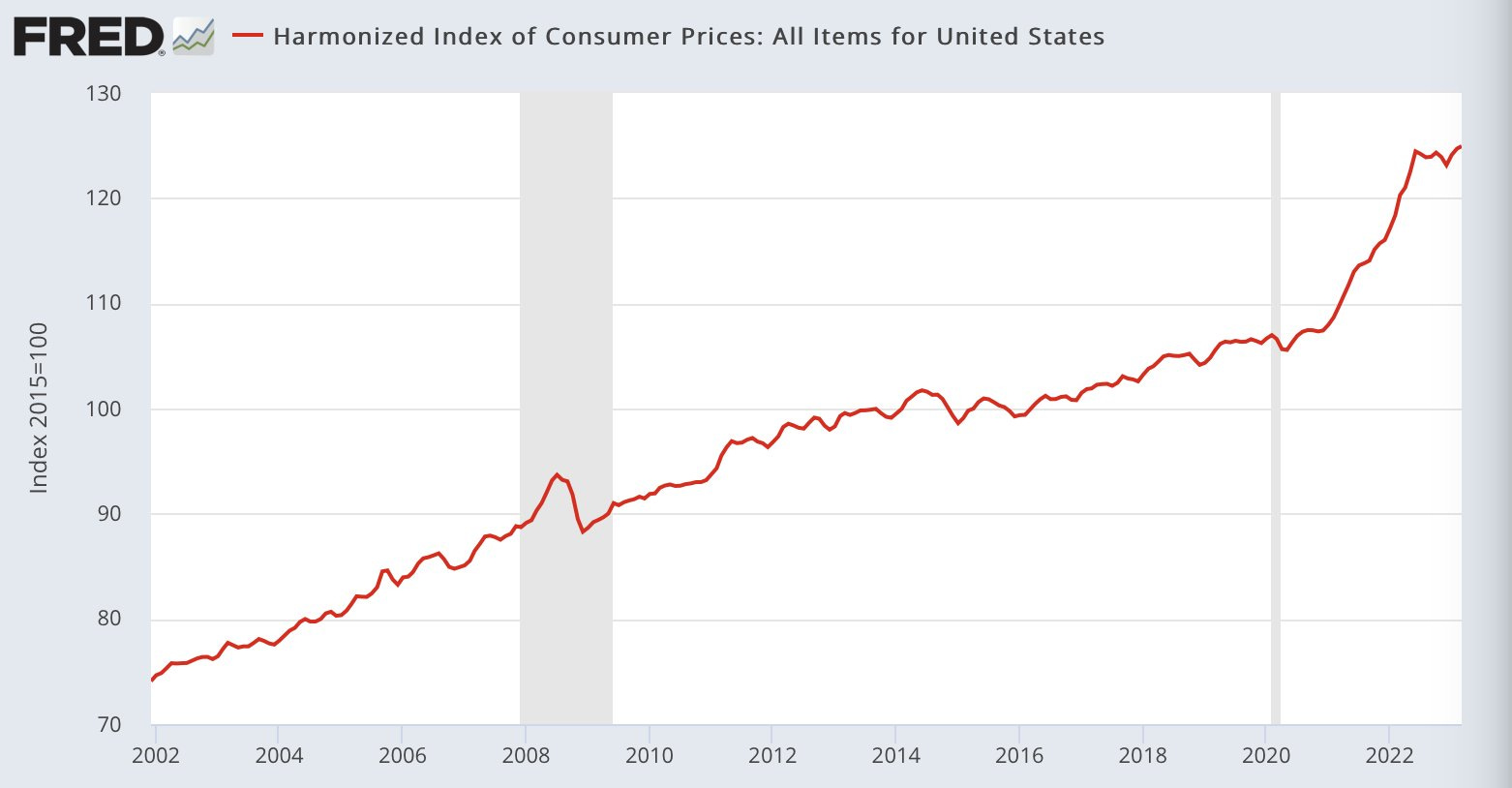

Consumer prices are the most affected by the very high level of inflation. The last plateau observed did not even allow for a small drop in prices. On the contrary, prices are on the rise again, despite the drop in oil prices:

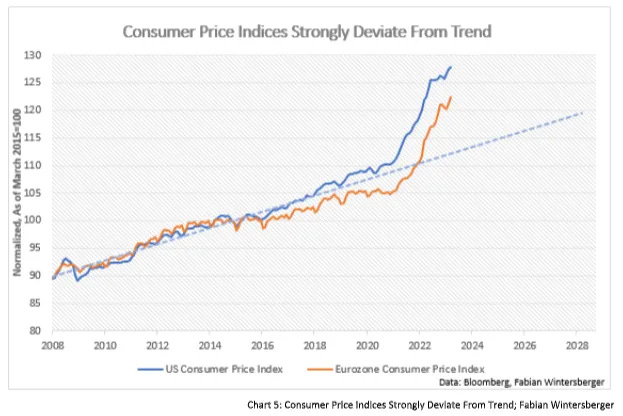

Consumer prices are moving away from their historical trend on a sustained basis:

The Fed must continue its fight against inflation and risks aggravating the already very critical situation of American public finances: by keeping rates so high, the debt burden increases and weakens the government's accounts. The risk of default also increases.

Even a partial default would have catastrophic consequences for the markets. It would completely redefine the value of U.S. Treasuries in the risk scale. A U.S. default would simply be cataclysmic for all financial assets. In such a scenario, one wonders who would be able to pay for these CDS contracts as the impact on the financial system would be so severe.

According to many observers, only a new intervention by the Fed to lower rates and buy U.S. debt would avoid the catastrophe. Recently, the Fed and the Treasury have been reactive in avoiding systemic contagion from the banking crisis. The establishment of an unlimited guarantee and a new funding window for distressed banks have stopped the bleeding.

But the banking crisis is not over. First Republic Bank fell 40% on the stock market after last month's plunge. The stock of the American regional bank has collapsed by -97% since the beginning of the year:

The conditions of the bank's rescue are still unclear. The tensions that appeared at the time of the banking crisis are returning to weigh on the markets. Most observers expect further interventions in the coming weeks. Whenever such stresses emerge, it gives savvy investors the opportunity to bet on the fact that central banks will intervene by opening the liquidity taps (which has a beneficial effect on the markets). These investors have made handsome gains by betting on the many interventions since 2008.

Every time the money supply is re-started, the markets stop their correction and go back up.

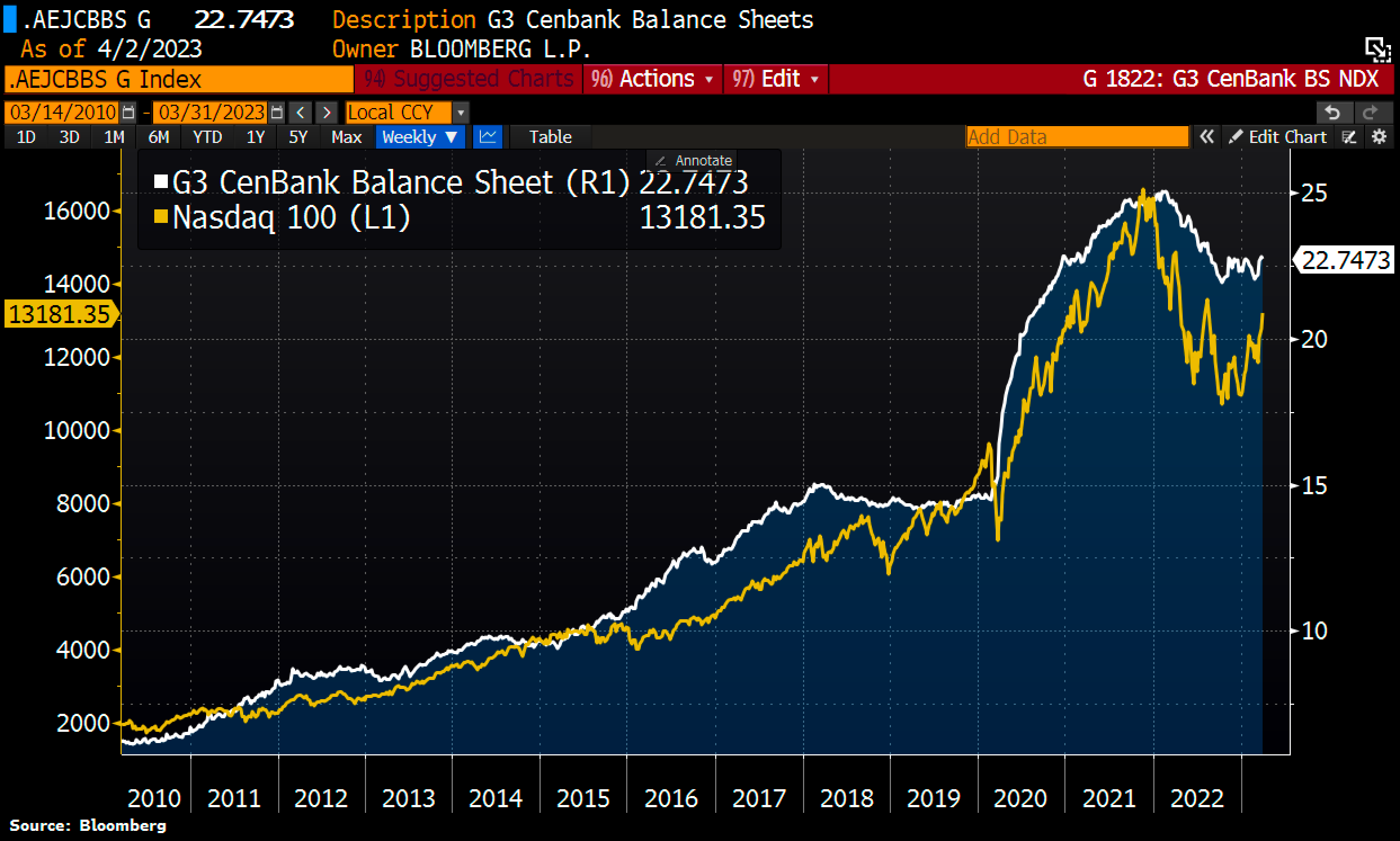

The Nasdaq curve closely follows the balance sheet of central banks:

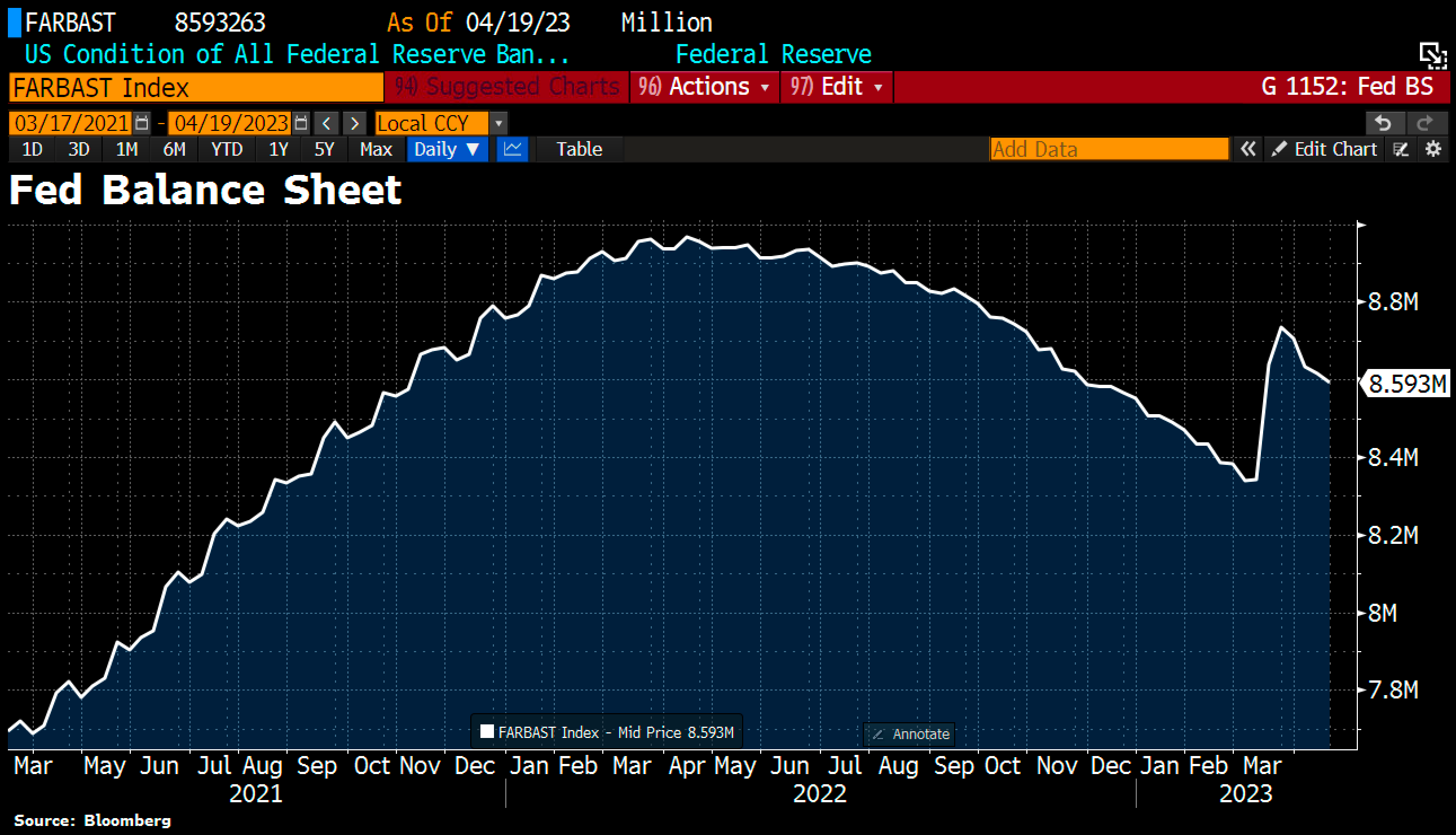

The Fed's recent intervention to avoid a contagion of the banking crisis put an abrupt end to the reduction of its balance sheet started last year:

Under these conditions, it is hard to imagine how the Fed could stand idly by in the face of the immediate threat of a debt default. Especially since such a default could reignite the banking crisis, which is directly linked to this emerging sovereign crisis. U.S. bond products are the foundation of the financial system.

Without a quick solution to the threat of a payment default, we risk entering a new systemic crisis, this time affecting one of the pillars of the financial system.

What are U.S. debt securities really worth if the risk of default increases so sharply?

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.