As we move into the last few days of 2021, the financial conditions in the United States have never been so favorable:

Money has never been so cheap, borrowing conditions have never been so easy to fulfil, and the banks have never paid such little heed to the solvency criteria. Interest rates have never been so low, repayments on student loans have been deferred to June 2022, and Quantitative Easing measures are continuing in all the bond segments, including mortgage-backed securities (MBS), even if the Fed has officially begun to reduce these asset purchases. Those who were expecting to see the Fed’s balance sheet collapse have not grasped the significance of the decision: the Fed is reducing the purchases but continuing to make its balance sheet explode, at a slightly less sustained pace...

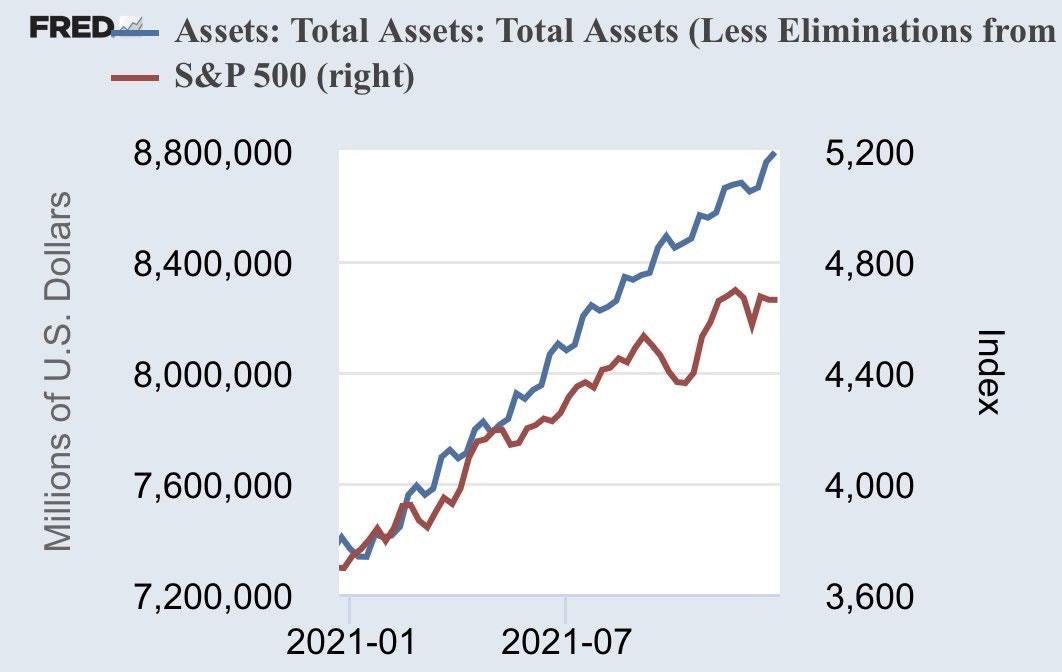

#Fed balance sheet on course to $9tn. Has gained another 0.4% to hit fresh ATH at $8.8tn. Fed's total assets now equal to 38% of US's GDP vs ECB's 82% and BoE's 133%. pic.twitter.com/t1ZPyWaymp

— Holger Zschaepitz (@Schuldensuehner) December 25, 2021

The reduction in the buying program by $30 billion, decided on at the Fed’s last meeting, has nonetheless translated into a swelling off the balance sheet by $126 billion in the last two weeks; the Fed’s balance sheet is at an historic high of virtually $9 trillion and this marked increase in December naturally had a knock-on effect on the performance of the markets, which benefited from this influx of new liquidities. The SP500 index is continuing to follow the curve of the increase in the central bank’s balance sheet...

It is difficult, nonetheless, at a time when this influx of liquidities is reducing, to maintain the bubble in the markets. And it is precisely at this moment when the buying program is slowing down that increasing numbers of observers are asking themselves whether or not there is a bubble in the stock market!

The Fed promised to stop its asset buying program in 2022, at a time when the U.S. deficit stood at $3 trillion. Who is going to buy these U.S. Treasury bonds if the Fed calls a halt to its purchases? Especially if the Fed leaves its rates at zero, when there is tearaway inflation.

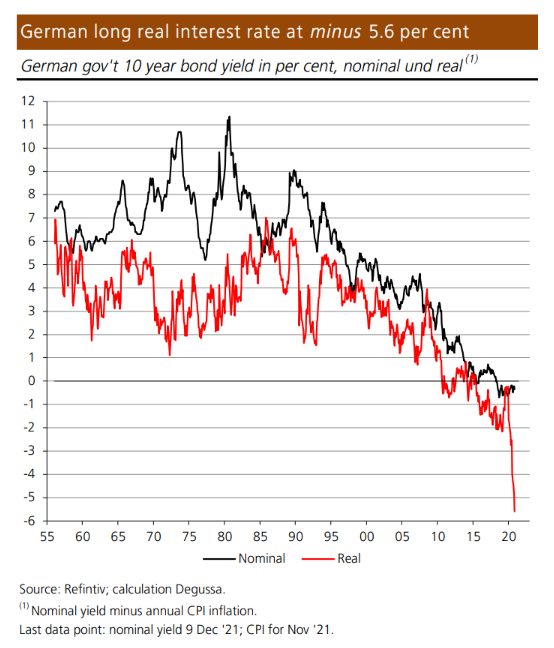

The answer to this question can perhaps be found in the Reverse Repos crisis which shows us, today, that the banks are looking for collateral. For at least a year now, the Fed has been exchanging the bonds it holds on its balance sheet for surplus liquidities coming from the financial institutions. The total size of these Reverse Repos transactions currently stands at almost $2 trillion. The banks need the Treasuries, because they lack collateral in their financial arrangements. The U.S. Treasury bond issuances in 2022 will make it possible to attenuate this absence. The banks will be delighted to find new U.S. Treasury bonds on the markets, to prop up their high-leverage commitments. On top of this, there will doubtless be a “flight to safety” at the slightest correction of the markets, and this will benefit the purchases of U.S. debt. Finally, given that the European bonds market is offering catastrophic real yields, one must also expect a shifting of these savings to the U.S. bonds market in 2022.

It will likely be a combination of these three factors that will support the demand for U.S. Treasury bond issuances and that will replace the Fed’s buying program in 2022.

The Fed is counting on these factors for a transition toward the “post-QE” period.

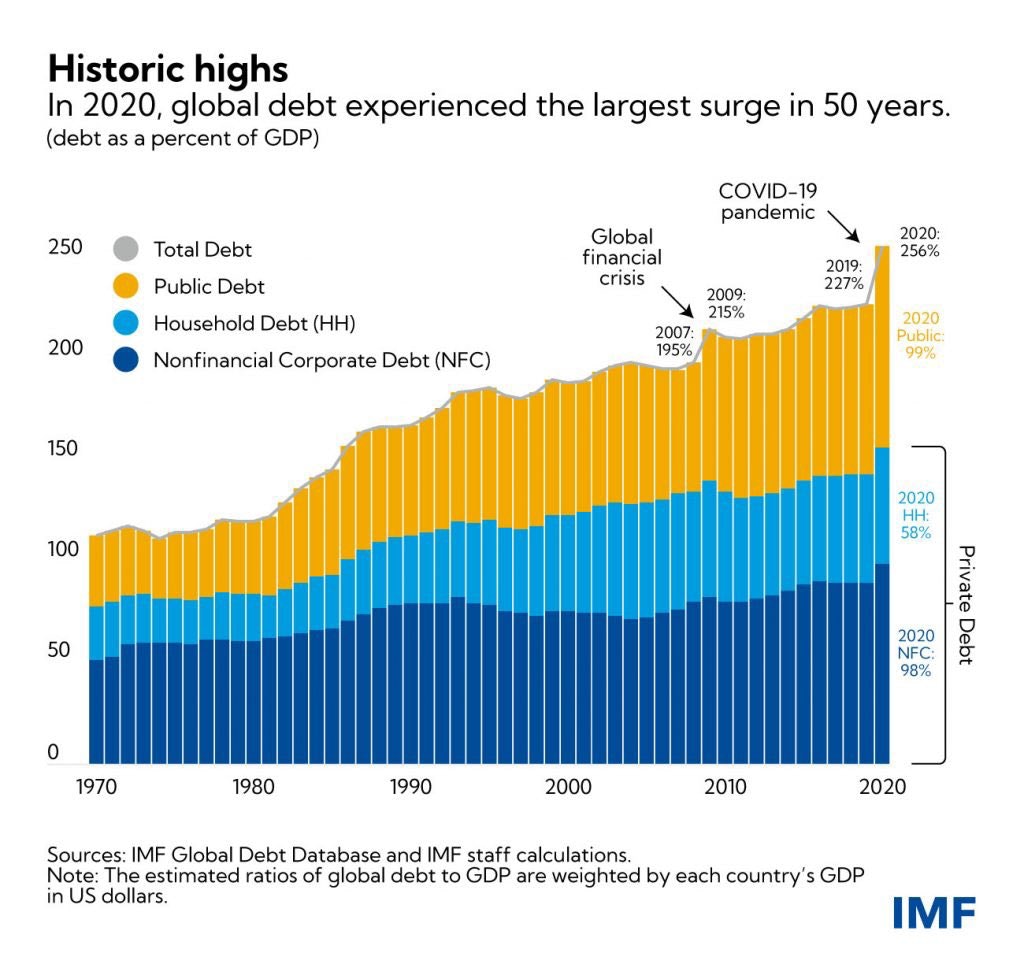

This situation nonetheless calls for a pursuit of the financial conditions that will be favorable in terms of supporting the recovery. This translates into an even bigger hike in the levels of public and private debt.

Support for U.S. consumption can therefore well and truly be said to be the key to U.S. monetary policy in 2022.

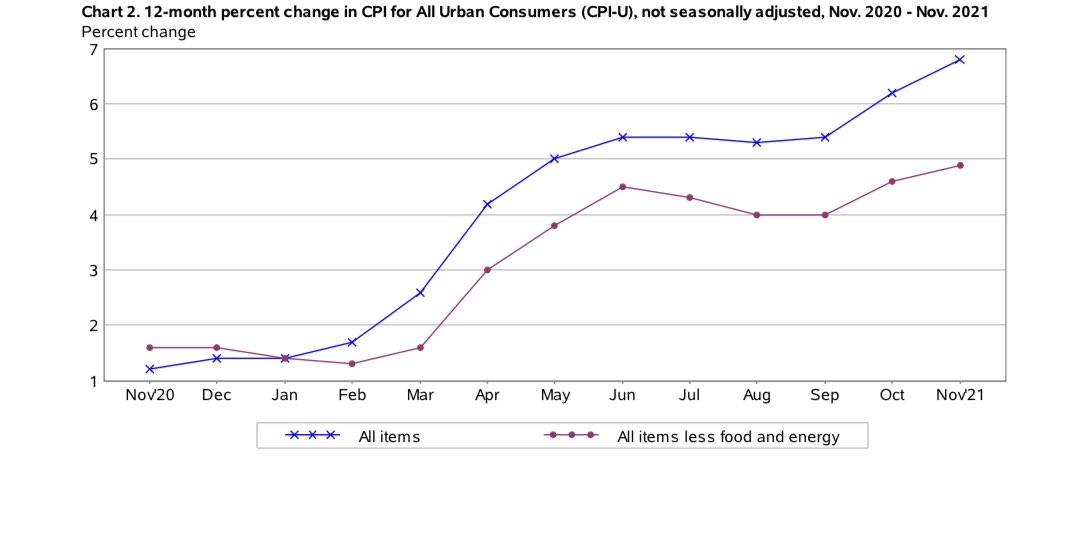

Since last summer, however, inflation has come along and altered the situation.

People have to spend more to get the same level of goods and services.

In other words, the growth figures are being scrambled by the inflation figures. Christmas sales are climbing by +8% in the United States...

But at the same time, inflation has surged on the equivalent figures:

The favorable financial conditions are making it possible to sustain the growth...but that is no longer enough. The American people are borrowing more to pay more, wages are going up, debt repayment conditions are becoming more lenient, but prices are skyrocketing. The growth is becoming more and more a measure of the inflation, and less and less a measure of actual activity.

It is almost as if U.S. economic activity was white hot, without there being any increase in actual wealth creation, with mounting debt and with inflation spiraling out of control. As one would logically expect, this cycle is exacerbating the inflation and making it self-sustaining.

And right now there is a factor that is exacerbating still further the risk of a continuation of this rise in prices across the board.

The problems of blockage in the supply chain could become even worse given the sanitary situation, particularly in China, where the spread of the Omicron variant constitutes a real threat, not least due to the ineffectiveness of the Sinovac vaccine (against this particular variant). A new round of lockdowns may be on the cards in China, and this would have a damaging effect on a supply chain that is already under great strain. This is an additional factor to monitor in relation to the acceleration of the rise in prices.

These fears regarding the inflation are not yet reflected in the gold prices. The majority of the institutional investors do not believe the inflation will continue and are refusing, for the time being, to hedge against this risk.

UBS is even expecting a bad year for gold in 2022, citing a bullish cycle for the dollar and a rate hike that will coincide with the end of the Quantitative Easing and the ebbing of inflation.

It is the same institutional investors who failed to anticipate the sudden arrival of inflation that are now predicting the end of the rise in prices, showing that they are completely out of touch with the situation on the ground and do not understand the technical mechanism behind this rise in prices.

If these forecasts turn out to be wrong again, we are at risk of having a very rapid reality check on the precious metals market.

For the time being, with such a negative sentiment weighing on the paper prices, it is in fact fairly easy for the banks to keep the prices below $1800 when selling futures contracts.

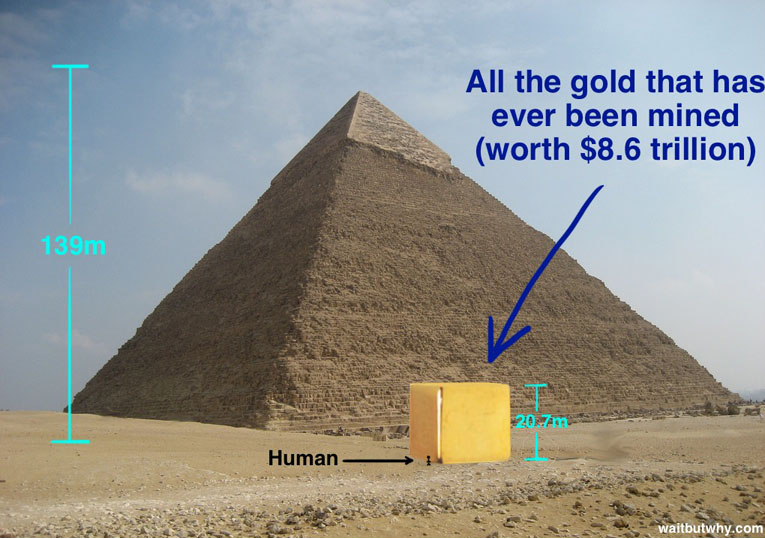

Price controls via the derivatives markets is still working, but let’s not forget that, in the final analysis, it is the physical demand that is the key element. The total amount of physical gold extracted since the dawn of man represents just $8.6 trillion, i.e. less than the Fed’s balance sheet!

The existence of the derivatives markets means that people are liable to forget this fundamental detail about the actual supply of gold.

The reality of the physical market triggered spectacular readjustments to the copper and nickel futures market in 2021.

The reality of the available inventories will soon catch up with the gold and silver markets, too. Indeed, the situation as regards these available inventories is even more strained, at a time when the inventories are being increasingly depleted.

If the awareness of the reality of the physical market kicks in at the same time as a change in sentiment among the institutional investors on inflation, 2022 risks being an explosive year in the precious metals sector.

Original source: Recherche Bay

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.