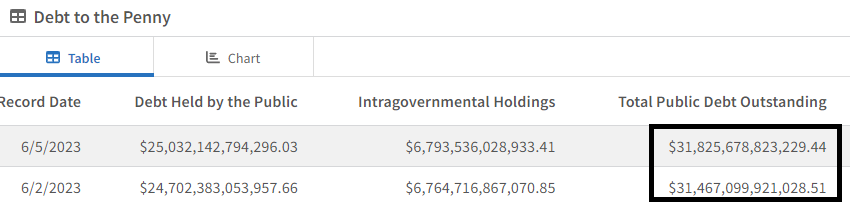

A double record for US public debt: new record amount and record increase in a single day.

According to Treasury data, the public debt stood at $31.825 trillion on June 6, a level never reached before. The increase of $358 billion in a single day is also a record.

The signing of the debt ceiling agreement has come and gone.

In a single day, America added to its debt the equivalent of Vietnam's annual GDP.

In 2022, American taxpayers paid $475 billion in interest on their debt. By 2023, with rising interest rates, this figure will approach $650 billion.

For the most optimistic, the United States will avoid a recession. In fact, it's likely that economic activity will limit the cost of the rising debt burden. The US economy is once again attracting foreign capital, as evidenced by the success of previous Treasury auctions.

For these analysts, debt is not a problem in a period of strong economic recovery. Negative activity indicators could call this model into question, but this prospect is receding. The current feeling is rather one of renewed confidence in the immediate future of activity on the other side of the Atlantic.

Only a collapse in US consumer spending could break this springtime optimism.

What could derail US consumption?

The last time America put an end to its buying frenzy was in 2008, when credit conditions deteriorated and the sense of impoverishment linked to the real estate crisis led to a sudden drop in the desire to buy. Logically, when you can no longer use your credit card, and the effect of wealth is diminishing, the desire and material possibility to consume decline.

Is there a credit crunch in the USA? The credit card floodgates remain open, so the answer is a priori negative.

But there are several indicators that could change this view.

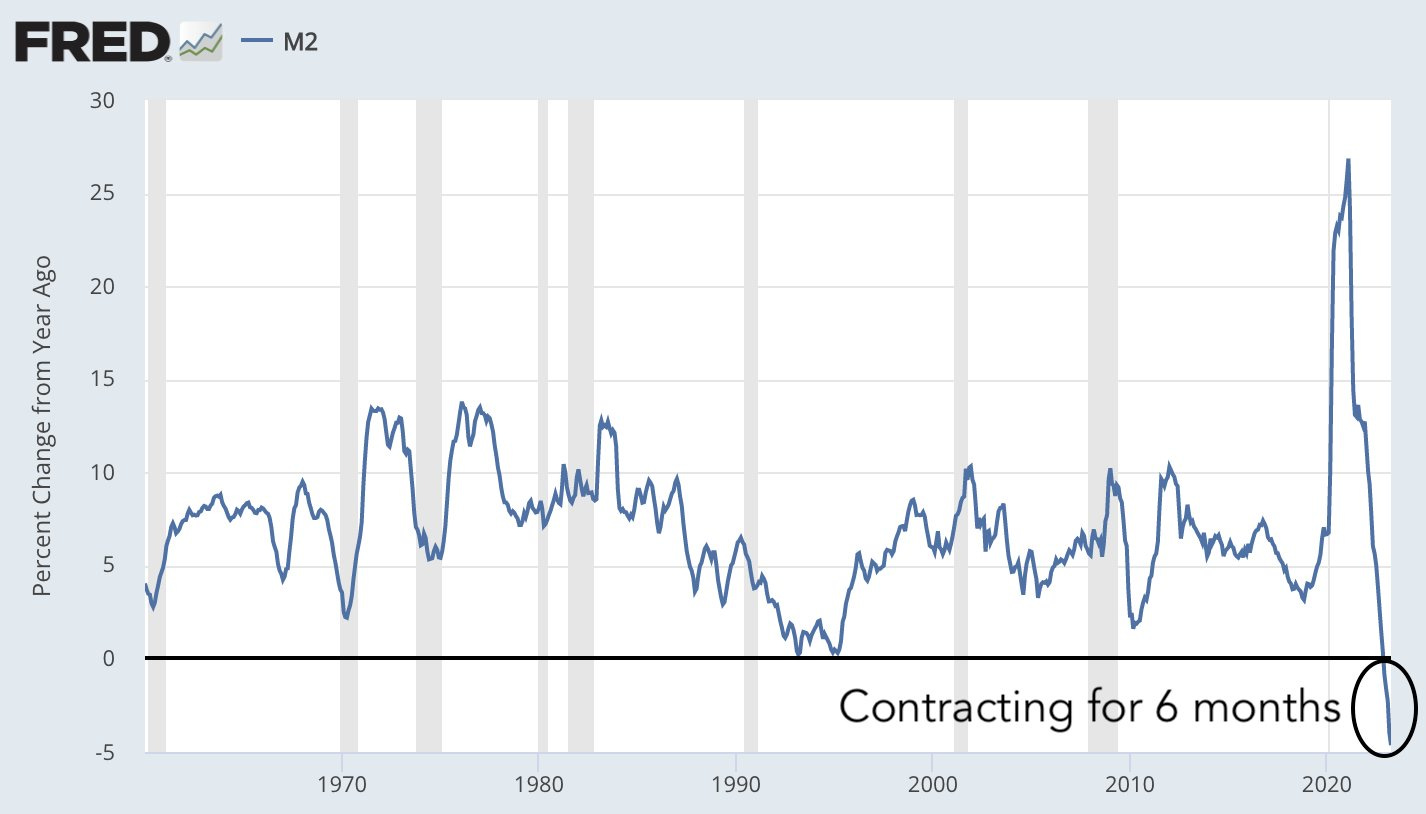

The significant contraction in M2 money supply heralds a sharp drop in available liquidity, as well as more difficult conditions on the credit market:

The fall in money supply is spectacular, but so was the previous rise. What's more, cash reserves in the banking sector remain exceptionally high. While banks are not in the same situation as in 2008, certain sectors of the economy are beginning to feel the adverse effects of higher rates, and could contribute in the very short term to triggering a credit crunch and a drop in consumption.

Real estate has been hard hit by higher mortgage rates. The impact is not limited to the commercial real estate sector.

Residential real estate has also been hard hit.

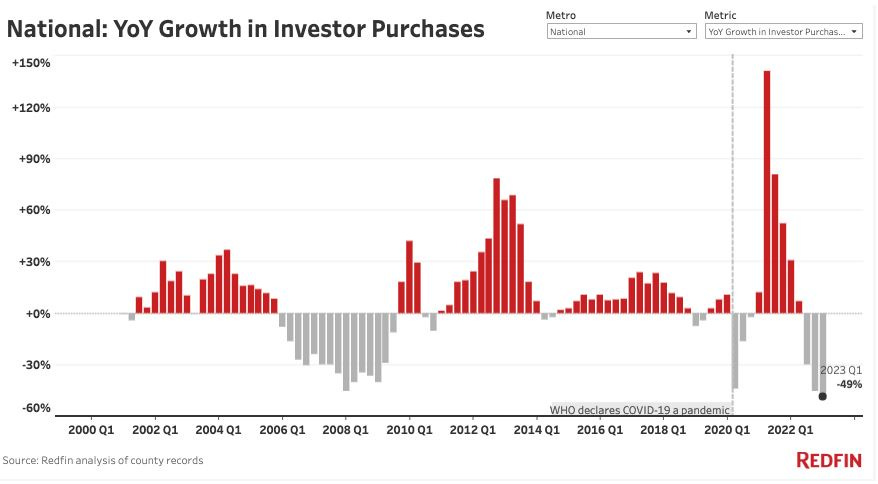

With mortgage rates now in excess of 7%, the number of first-time buyers has plummeted in recent weeks. Investors have literally deserted the US real estate market. The downturn is even more brutal than in 2008:

Housing sales are down 23% on last year.

Volumes are falling, but not prices. Most American borrowers have managed to renegotiate a fixed rate in time, and are not being strangled by rising rates as they were in 2008. The cost of rising rates is now borne by banks, not borrowers. The real estate crisis of 2023 is much less visible. It can be seen in the banks' balance sheets, via the depreciation in the level of return on securities in relation to the value of the assets held, but not in house prices.

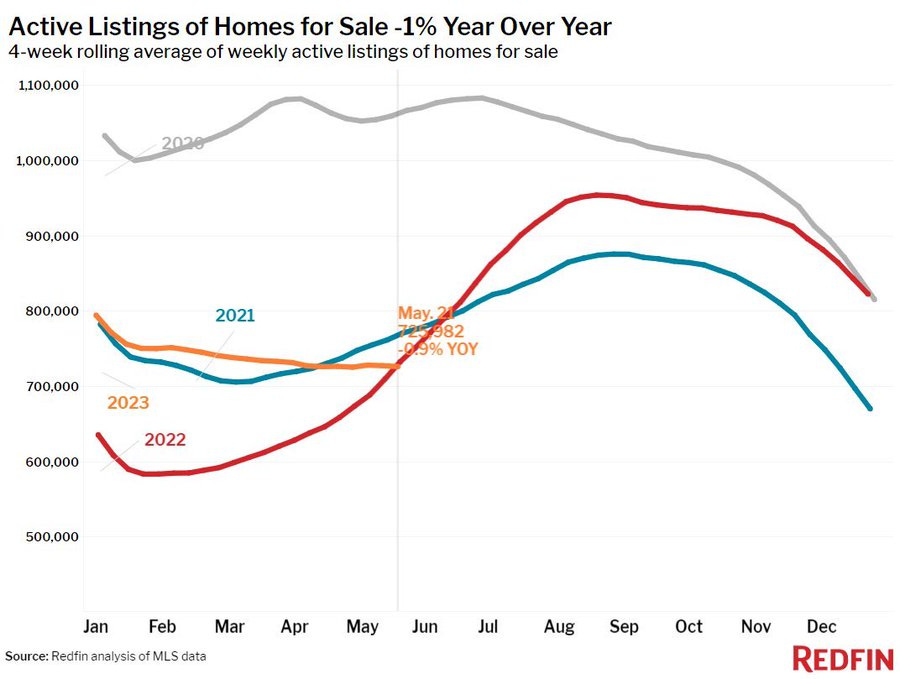

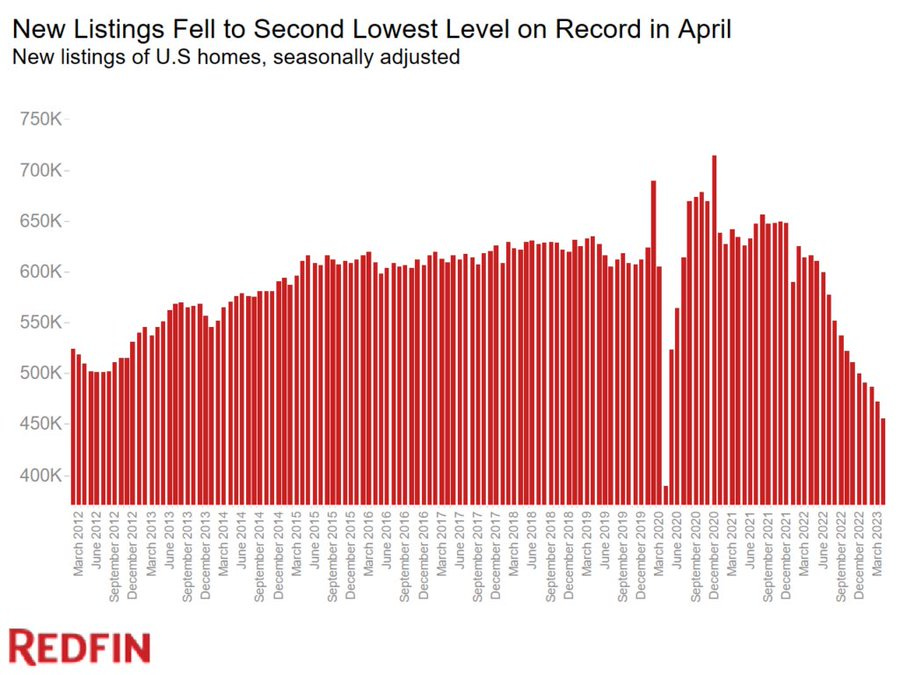

As prices remain unchanged, affordability rates are soaring, excluding younger people from buying property. Rents continue to rise, and housing stock is not increasing either:

Listings of homes for sale are down -26% since last year:

Activity in an entire sector of the economy is coming to a complete standstill.

Prices still correspond to a 3% borrowers' market. To regain the number of potential buyers that existed before interest rates were raised, there are only two possible options: either prices must fall significantly, or the average salary of future buyers must increase significantly!

The real estate market is totally frozen, and this crisis is likely to be even longer and more severe than in 2008 for the entire industry (agents, brokers, builders, construction trades, etc.). Even if the loss of wealth is not as immediate, as the conditions for a rapid fall in prices have not yet been met, the slow, irreversible destruction of a pillar of the American economy will have perhaps even more serious consequences for consumer spending and inflation in the long term.

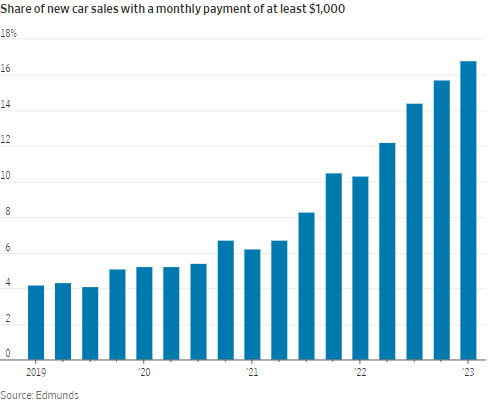

Another sector more directly affected by rising interest rates is the automotive sector. Along with commercial real estate, this is the sector with the greatest risk of triggering a credit crisis, but also the most likely to weigh on American consumption.

New car dealers are tightening their credit conditions in the face of the threat of an avalanche of defaults on car loans. In the first quarter of 2023, nearly 18% of new car sales resulted in repayments in excess of $1,000 per month:

This increase in repayment schedules is combined with a rise in the price of new cars. The downturn in inflation has not affected this sector of the economy. New car prices have soared and remain at stratospheric levels.

Rising prices and rising credit costs are a highly toxic combo!

Rising interest rates have a direct impact on the cost of buying a car. Households are now repaying the equivalent of a second mortgage on their new car! This is probably the area where the risk of default is highest. A risk likely to trigger a major credit crisis and thus affect the behavior of the American consumer.

A risk that still seems too far away from the markets, where the predominant sentiment is one of renewed optimism about US activity. The QQQ index, which measures investors' appetite for US growth stocks, has rebounded in recent weeks as strongly as it did after the low point of the health crisis:

Most investors are now positioned to accompany these tech stocks to new highs.

Gold, unlike in previous euphoric phases, is holding up at relatively high levels.

In 2013, the 50% surge in the QQQ index caused gold to fall by -16% in just a few months:

The difference is that in 2013, the Gold/Nasdaq ratio broke major support, whereas today it is testing major support in a long reversal chart pattern:

The fact that gold is holding its own against growth stocks is a sign that not everyone shares the gentle hope of avoiding a credit crunch and an associated marked slowdown in consumption. In such a far less optimistic scenario, US debt will prove to be the real bomb that many investors are trying to ignore.

An economic slowdown in the US, with such a high level of debt, would represent a real danger for the dollar: a default through money printing or a default on debt would then become inevitable, wiping out confidence in dollar-denominated securities.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.