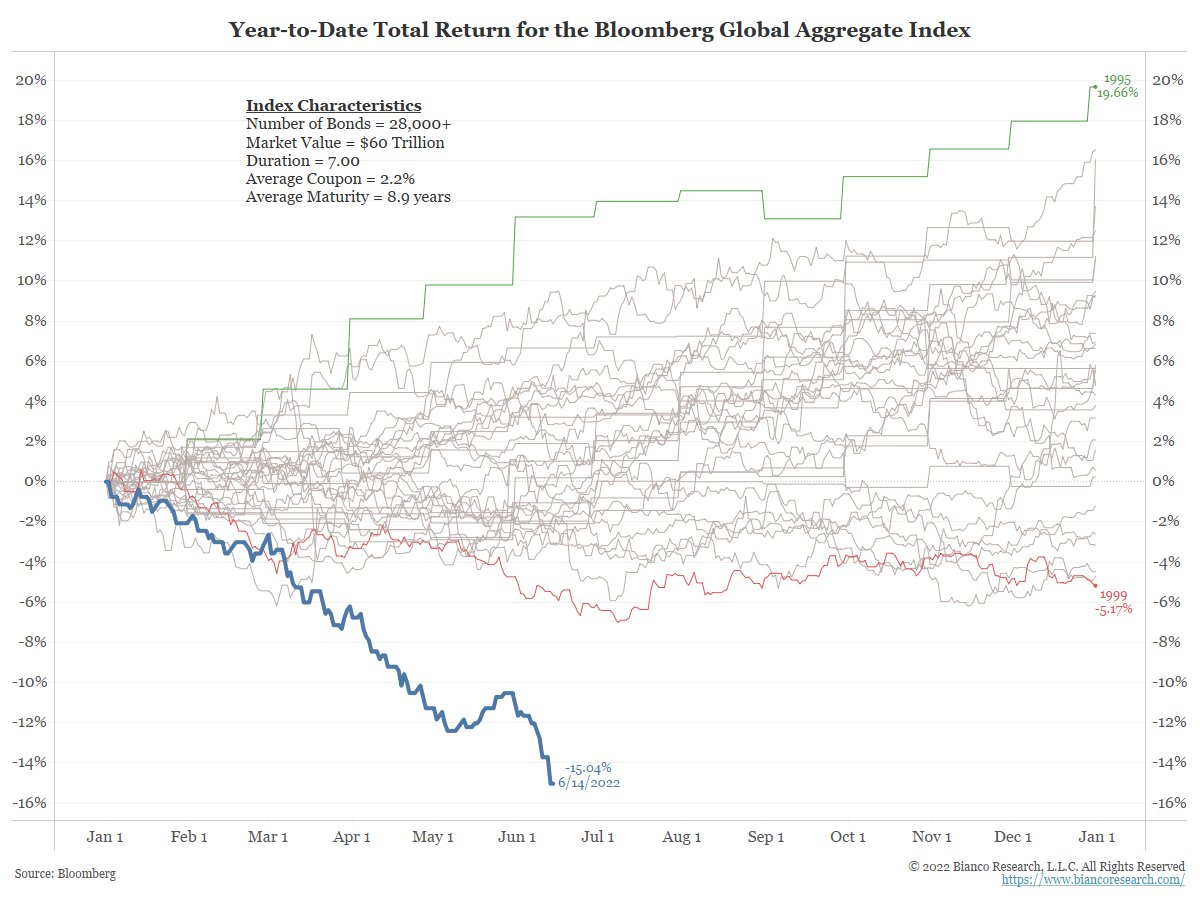

The intensity of the bond market's decline is unprecedented.

Bloomberg's Aggregate Index, which measures a basket of more than 28,000 bonds, has lost more than 15% since the beginning of the year, a drop not seen since the 1970s.

A bond product used to offer security, a probability of getting an almost guaranteed return every year. This is why bonds are the basis of most life insurance funds: their regular performance puts them in the less risky category than other assets. But what has happened since the beginning of the year changes the game:

The radio silence that accompanies the spectacular plunge of these assets, which are, however, in almost all savings products, is really surprising. It's even surprising that there hasn't been a major detonation yet in an institution exposed to this highly leveraged asset class. Given the rate at which these asset classes are collapsing, it should not be long before that happens.

Speculative corporate bonds rated "subprime", as measured by the HYG ETF, are among the bond products that have fallen sharply. The acceleration of their decline is reminiscent of the plunge in 2020, which forced the Fed to intervene by buying up "corporate debt" securities, regardless of their rating.

The fall is even more spectacular for bond products linked to the US real estate market. The MBB index, a tracker associated with US real estate bonds (MBS), has exceeded the correction level of 2020 and has even fallen further than during the 2008 crisis:

The situation in commercial real estate bond products is even worse: the drop in CMBS exceeds in magnitude all previous bond crashes in the sector.

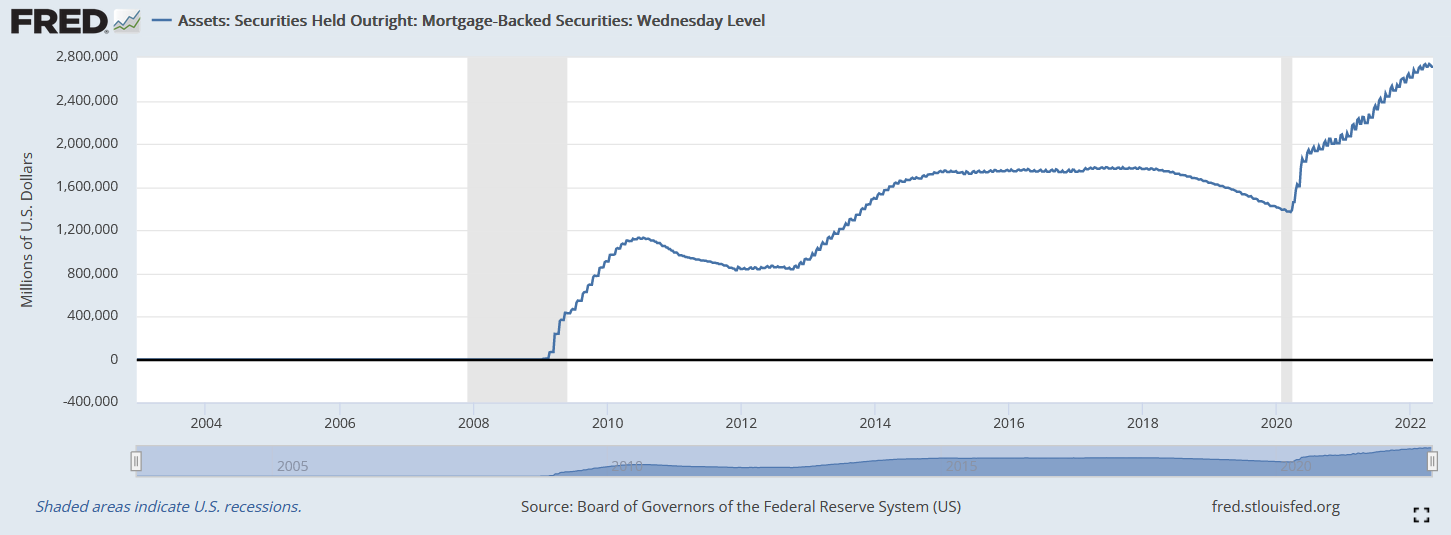

These collapses are taking place while the Fed has not yet started to reduce its balance sheet!

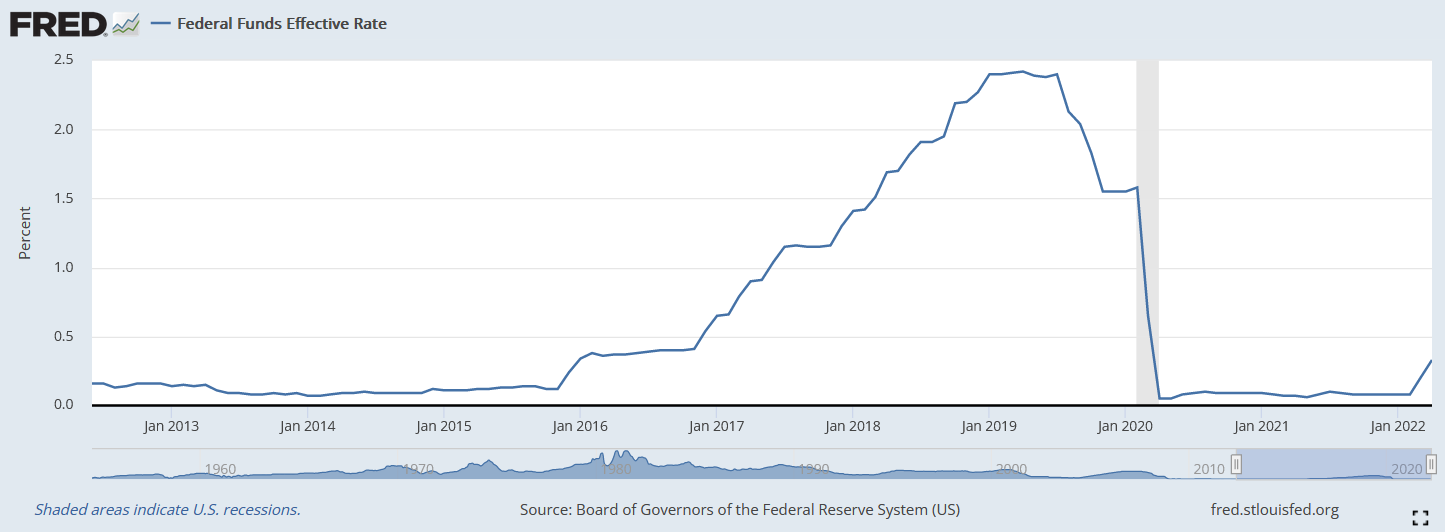

The bond market is no longer waiting for the Fed and is acting in anticipation of rate hike decisions: the US 10-year has broken its 40-year downtrend and is soaring to over 3.4%.

Despite the Fed's 0.75% rate hike on Wednesday, June 15, we can see that on the same time scale, the Fed is way behind the market. In previous rate hike phases, the market wisely waited for the Fed's action. The situation is quite different today:

This time, the market did not wait for quantitative easing to end and quantitative tightening to begin.

Even before the Fed started to reduce its balance sheet, the market blew the whistle on the bond market.

The market began a severe revaluation of these assets. We can now see that these debt securities were kept artificially high by a monetary easing program that ultimately masked the risk of these assets and induced pricing errors for so many years. The annual returns on these products were illusory and the sharp correction we are seeing brings these securities back to their true price.

When the Fed intervenes by buying debt securities for years, asset prices are kept artificially high. As soon as the Fed announces the end of its bond-buying program, the music stops and the products in question return to their true market value.

The Fed has stopped the music because inflation is causing it to lose control of the bond market.

By the way, the decision to withdraw the liquidity it has poured into the markets is an admission of the inflationary nature of its quantitative easing program. This is what we have been saying in these articles for more than two years: the origin of inflation is linked to the quantity of money created in the system by central banks. We are currently experiencing the consequences of monetary inflation that first materialized in the inflation of asset prices and then spread to essential goods due to a commodity supply problem, including those related to fossil fuels.

To fight this inflation, the Fed decided to reduce its balance sheet and to stop buying bonds, which pushed the market to re-price these products at their real cost, without the intervention of the Fed.

Who is paying for the consequences of this bond collapse? Where is this huge loss hidden? Deafening silence. A bad sign...

The next few weeks are likely to reveal the disaster predicted by this historic fall in bond stocks. For the moment, it is radio silence! "When the tide goes out, you see who is swimming naked" is definitely the most appropriate saying for a financial market that is still very opaque.

But let's look in detail at the bond products linked to the real estate market, the famous MBS. Today, the Fed has nearly $2.8 trillion of these securities on its balance sheet, purchased in each QE program since 2008:

Losses in real estate debt securities are eroding the Fed's balance sheet. It is this type of impairment that caused banking institutions to fail in 2008. The loss is now concentrated on the central bank's balance sheet. The balance sheets of U.S. banks may have been cleaned of most of the toxic real estate products, but the Fed's balance sheet has been deteriorated!

And what happens when a central bank's balance sheet deteriorates? The value of the money it issues declines. The process is not immediate, but what is happening now in the credit market is a mathematical guarantee of the future depreciation of the fiduciary intrinsic value of the dollar in relation to tangible assets or other currencies that will have succeeded in tying themselves to commodities, and not to debt derivatives whose intrinsic value keeps falling.

The purchase of physical gold by central banks is part of this loss of confidence in the dollar's ability to maintain its value-preserving role. For this reason, the dollar could lose its function as a reserve currency on the balance sheet of many central banks.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.