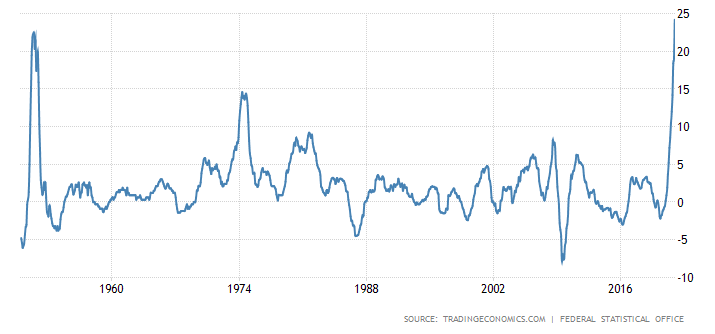

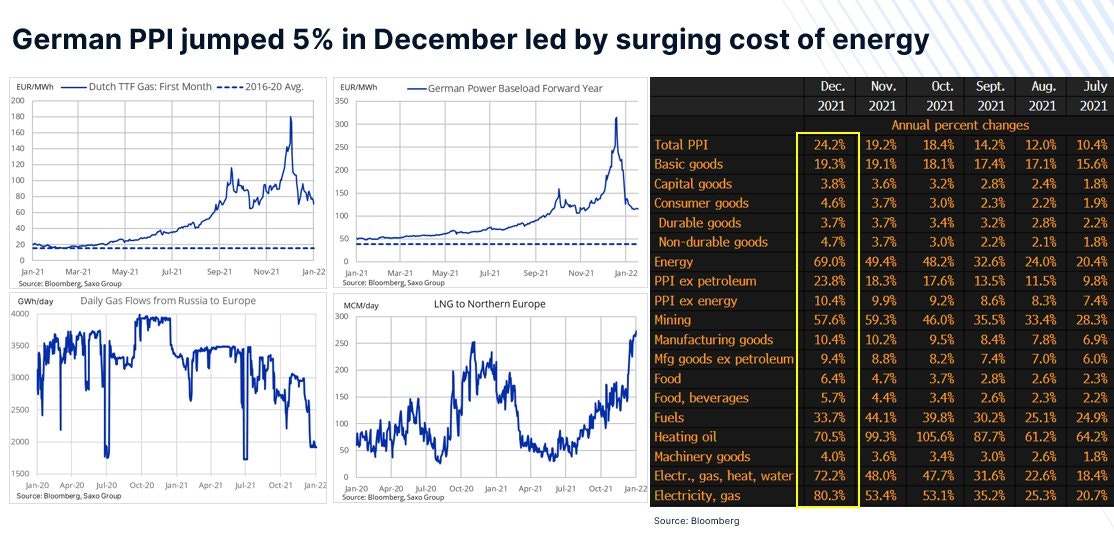

The figure of the week is the German PPI index, which soared to 24.2% in annual variation, a record since the Second World War:

It should be remembered that, despite these figures, the European Central Bank continues its monetary expansion while maintaining its rates at 0%.

The increase in this figure is mainly a consequence of the rise in energy costs. But if we look in detail, we see that this price increase is gradually spreading to all sectors of the economy.

Monetary authorities are clinging to their bet that this inflationary surge will be transitory. And they are relying on the figures for natural gas futures, which fell back sharply at the end of December...

In the meantime, the French government is trying to hide the rise in energy prices.

The Commission de régulation de l'énergie (CRE) reports that, without the intervention of the government, which has promised to limit the next increase to 4%, the regulated electricity tariff would have risen by 44.5% for individuals on February 1st.

Camouflaging the price increase in the hope that inflation will be transitory... This is a very risky bet! The PPI index will certainly be lower in the next few months, but we will very logically see this increase carried over to the CPI index. The fiscal and monetary authorities are likely to welcome a decline in the PPI index at a time when inflation will be felt even more in real life. Good luck explaining to consumers who are sinking in the face of a veritable tsunami that the next wave is slightly smaller!

Precisely, on the front of this price increase, nothing is settled on the substance. Tensions between Ukraine and Russia and European inventory levels are pushing gas prices up again. Tensions on the production chain are still not dissipating. And most commodities are resuming their meteoric rise. Oil is trading this week at its highest since October 2014 at nearly $90 a barrel...

It would take much stronger action by central banks to turn things around.

The Fed's recent decision, which amounts to a promise of future rate hikes, is far from sufficient.

Even if Mr. Powell's speech seems more hawkish and suggests a change in its accommodative monetary policy, in concrete terms, the Fed is way behind on inflation, and the task ahead to firmly fight inflation is huge!

Another new fact: at the beginning of 2022, volatility is back on the markets. This volatility reflects doubts about the future of monetary policy.

On Monday, the U.S. stock market experienced a session that caused the Dow Jones index to swing more than 1,000 points, which is simply the third most volatile session in the history of this index!

The stock indexes are correcting (loss of more than 10% since their highs). Volatility on the stock markets is likely to continue after the Fed's announcement, at a time when companies are allowed to restart their stock buyback programs.

U.S. rates have been rising since the beginning of the year, anticipating the end of the Fed's buyback program in the United States.

The US 10-year yield has risen from 1.4% to 1.8% in a few weeks. And this rise is taking place in a context where the Fed continues its bond buybacks. It is simply the prospect of seeing these buybacks come to an end that is creating tension on rates.

Since March 2020, the Fed has purchased more than half of all Treasury bond issues... The Fed has also purchased more than one-third of outstanding U.S. real estate loans! It is this money printing and monetization of debt that is precisely the main cause of the inflation that is spreading around the world.

This is what Lijan Zhao, the spokesman of the Chinese Ministry of Foreign Affairs, said in a very undiplomatic tweet:

“Inflation Exporter”

— Lijian Zhao 赵立坚 (@zlj517) January 20, 2022

$5.8 trillion printed since 2020—Same old tricks to get the world to pay for #US debts.#AmericaIsBack pic.twitter.com/8vJOUeok5u

If I am not mistaken, this is the first time that a Chinese politician has directly (and bluntly) questioned US monetary policy.

The US exports inflation by monetizing its debt.

Without monetizing this debt, US rates would be much higher and would yield much more to its holders, and the first in line, China. Instead, the holders of this debt are paid in a currency that is depreciating precisely because of inflation.

The Fed's commitment to stop this monetization is also a response to the concerns of holders of US debt. Paradoxically, it is the promise to stop this policy that is driving up rates and further depreciating the oldest bonds held by these same creditors. Inflation is the trigger for bond risk awareness!

Stopping the quantitative easing program poses other risks: a surge in interest rates threatens the very sectors of the economy that depend on keeping interest rates low.

The first victim of this prospect of higher rates is the growth stock sector, whose business model is tied to an environment of rates close to zero.

Investors have withdrawn massively from this sector in recent weeks.

As an illustration of this challenge to a sector that was still very recently popular, AMC's share price has been divided by three since the summer:

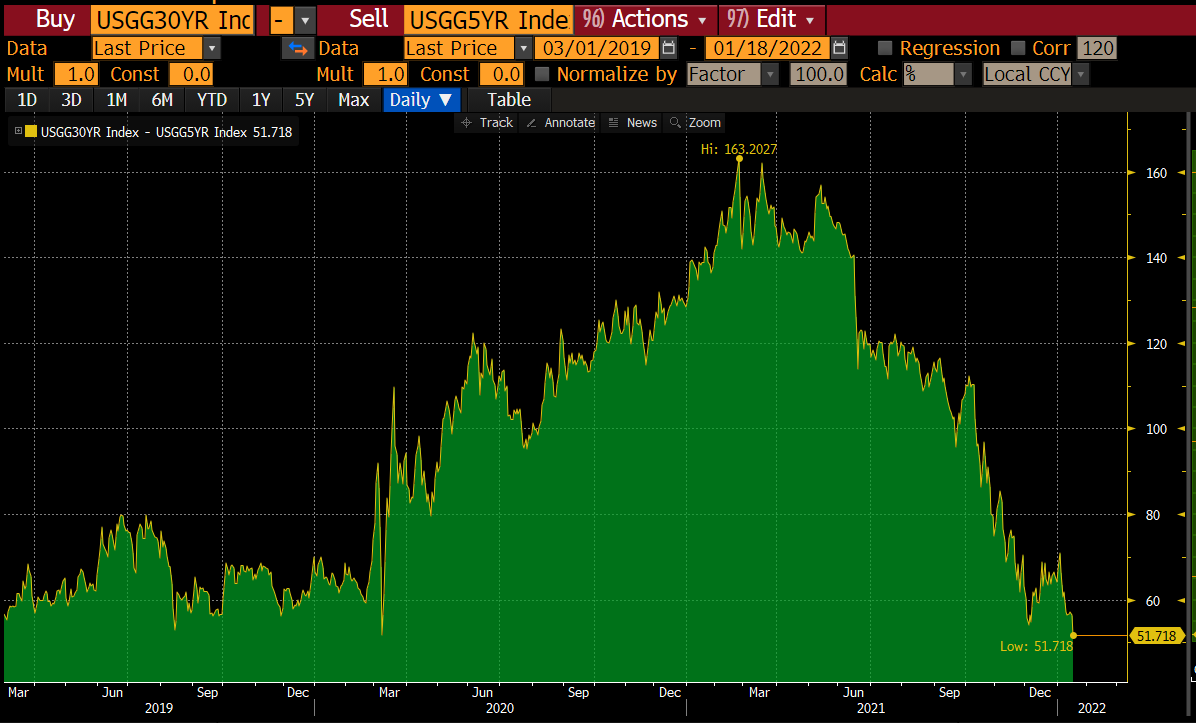

The perception of a change in monetary policy is narrowing the long/short spread. Some observers deduce that a recession is imminent. Personally, I tend to look less at the yield curve in a market that is now heavily impacted by central bank interventions. The current situation is not comparable to that of 2008. There is much more liquidity in the system and the banking sector, especially in the US, is far from being in a stressful situation comparable to that period... we will come back to this in next week's article. The yield curve used to be a good indicator to anticipate a slowdown in demand, but now that market is blurred by direct action by central banks and this indicator has become much less readable.

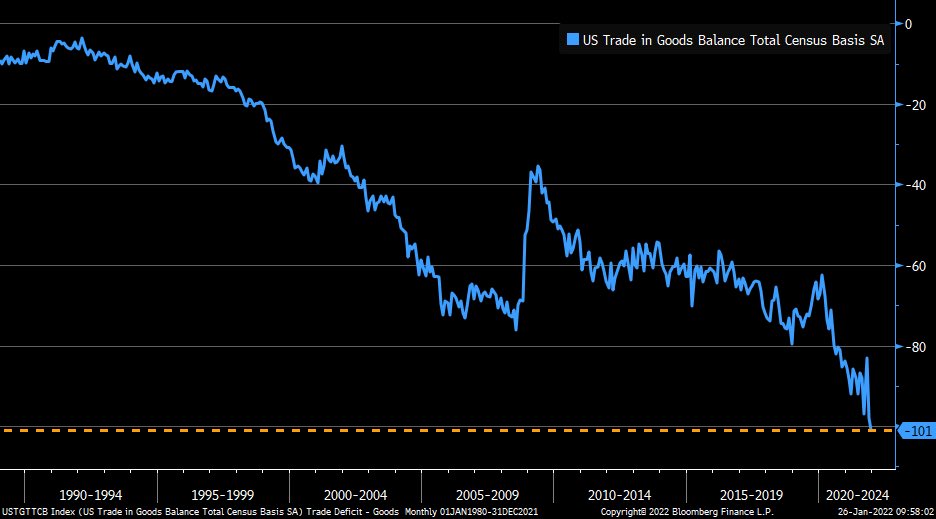

U.S. consumption continues to be strong, pushing the U.S. deficit to record levels. This is particularly evident in the trade in goods numbers:

The United States consumes and imports, driven by an artificial stimulation of demand. The production chain is jammed at the ports, especially because of this crucial problem: what to do with the containers that pile up at American ports and cannot leave empty? The United States imports too much because demand is stimulated, and in exchange they export inflation precisely because of this fiscal and monetary policy that favors demand!

The market volatility caused by these doubts about the future of interest rates is now reaching the real estate sector, which in turn is suddenly considered at risk.

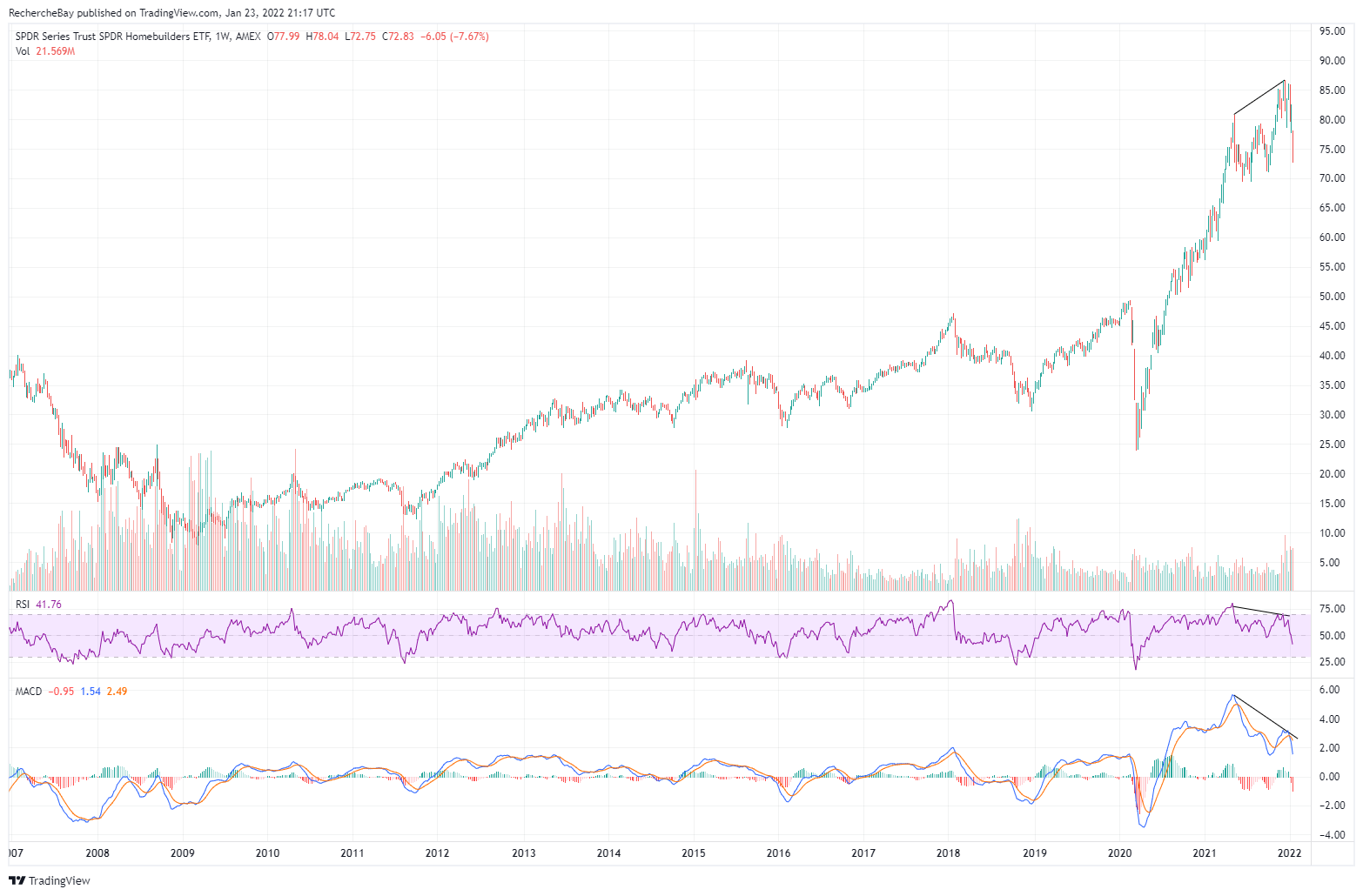

The "stone", once considered a tangible refuge, has become a derivative of the bond market and is therefore strongly linked to the volatility of this market. And any threat of rising interest rates has a direct impact on demand. December sales figures in the U.S. are in free fall, and the SPDR index of U.S. homebuilders is correcting sharply with a marked downward divergence in weekly:

Stopping the quantitative easing program today will only accelerate the housing correction.

And if the Fed speeds up the rate hike, market volatility could spill over into a slowdown in economic activity.

But conversely, as we have just seen, if the rate hike that has been decided on turns into a bluff, inflation is likely to get out of control and that will have even more damaging consequences. Continued inflation leads to a demand for higher wages (which has already started) and forces governments to increase their spending to avoid impoverishing public servants, which increases the use of the printing press and makes price increases even worse. It is urgent to break this inflationary spiral to avoid much more serious societal problems! Central bankers know this mathematical sequence perfectly well.

This stalemate in which the Fed has settled benefits gold.

Gold is an indicator of the powerlessness of the monetary authorities.

This is evidenced by the latest investor buying this week. Purchases of GLD and SLV ETFs are rising again at a steady pace at the beginning of the year, but it is especially on the futures market that the situation is becoming very tense. February is traditionally a very active month in terms of contract deliveries. The level of open interest on the February contract is exceptionally high even though the options contracts have expired. It remains to be seen how many long contracts will result in actual delivery requests. The capping of futures contracts that occurred on the day of expiration only increased the leverage between the number of "paper" positions in futures contracts and the physical inventory actually available on the COMEX.

However, this explosive situation is not exceptional, it has happened many times before.

There are several solutions for futures sellers who need to find physicals: trigger additional massive sales. This would bring the spot to respectable levels to trade a cash settlement on delivery requests. One solution would be to take reserves of physicals used by rehypothecation mechanisms to meet delivery demands (e.g. using stocks leased by ETF holders). In the past, it is this type of resolution that has allowed contracts to be honored and the futures market to continue to function.

We simply notice that these tensions on the futures markets are getting closer and closer. This is quite logical, as the amount of physical gold available is decreasing globally, requiring more and more financial engineering to keep a fractional system running on an increasingly fragile foundation.

Under these conditions, the price of gold is likely to be very volatile over the next few weeks. But if history repeats itself, physical prices may remain relatively stable in the event of a sharp correction in futures prices. Premiums rise in such corrections, because even if the spot price declines, the amount of physical gold available remains the same, and these declines usually cause a surge in demand but not supply! Physical gold is disappearing because demand from central banks and investors is constantly increasing. This is even more true in relation to physical silver where the rise in industrial demand is now accompanied by a recovery in investment demand. India's latest silver import figures speak for themselves: the country imported 2,600 tons of silver in the last four months of 2021, or 10% of annual production! When we know that most of the imports in India are done "under the table" for tax reasons, the demand for physical silver in the country is having a very clear impact on the stocks of available metal. Again, this makes the COMEX fractional system more and more fragile.

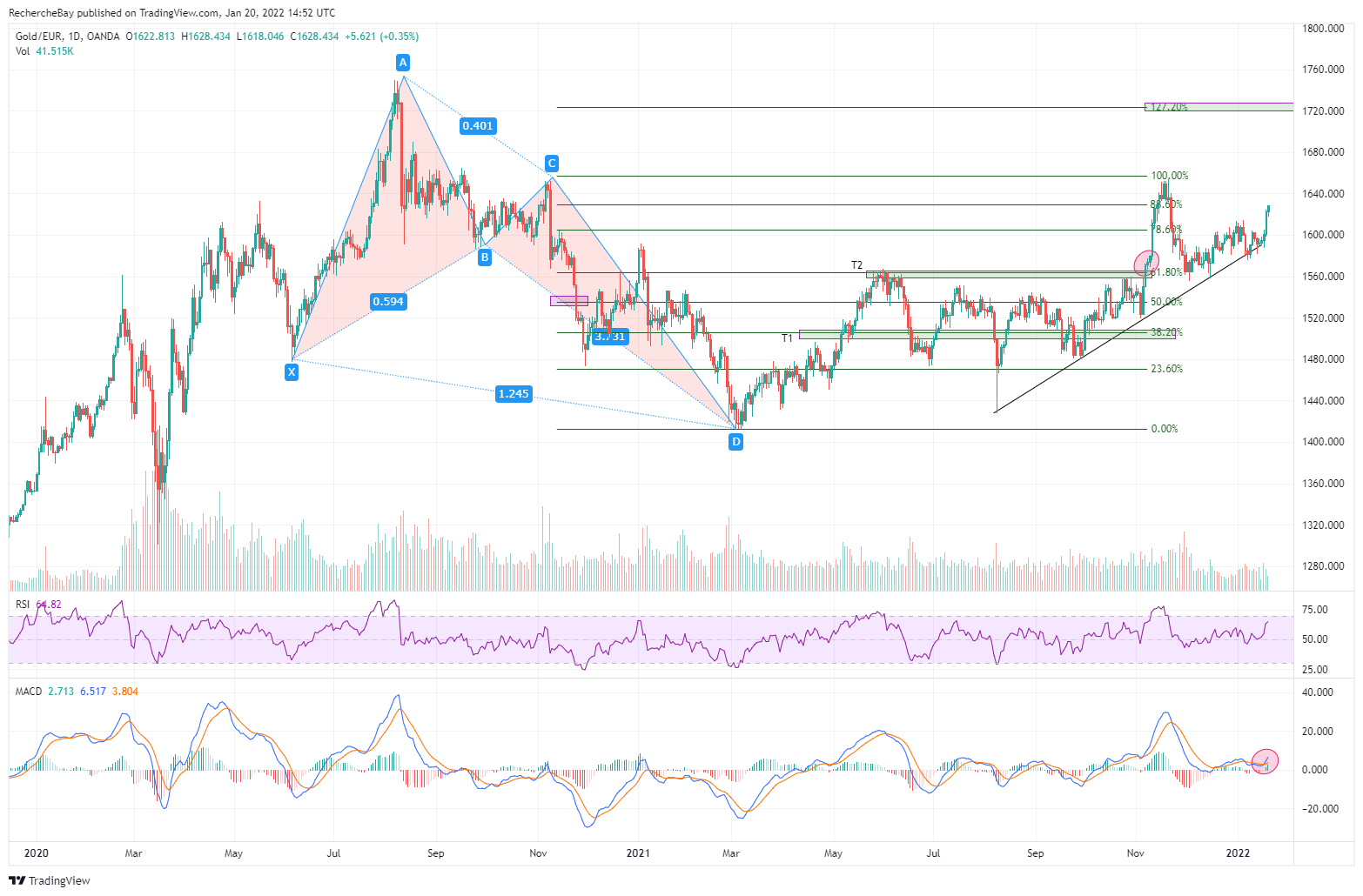

Gold prices in euros have risen above €1,600 again and are supported by the uptrend started last summer, driven by the 2021 harmonic bullish pattern:

On the long-term chart of gold in euros, the bullish "flag" is in the process of ending. The cup handle may be a bit longer than expected if gold corrects in the short term, but the long-term pattern is largely bullish graphically with upside targets much higher than current levels.

Many investors are expecting a short-term correction in gold in reaction to the Fed's decision. This probably explains the wait-and-see attitude of these investors on the miners. If this majority of investors is right, we will still have a lot of opportunities and a new period of sales on the stocks we are watching. However, the risk is to have a breakout on gold and silver now, and in that case, these investors would be forced to run behind a train that started too fast! This situation leads to very fine-tuned investment strategies adapted to the increasing volatility.

Original source: Recherche Bay

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.