The US real estate market is experiencing an unprecedented freeze. Mortgage demand in the US has fallen to its lowest level since 1995. In less than four years, mortgage applications have fallen by a spectacular 63%, reflecting growing buyer disaffection:

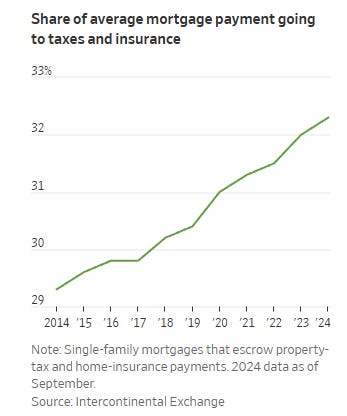

Taxes and insurance: a growing burden

In September, a record 32% of US household mortgage payments were absorbed by taxes and insurance, reducing the margin available for principal repayment:

This phenomenon is particularly pronounced in areas such as Miami and Rochester, where these expenses now account for more than half of monthly payments. A case in point is a family in New Orleans, whose tax and insurance expenses have risen from $725 to $2,448 per month, exceeding even their monthly mortgage payment. In this context, some homeowners are foregoing insurance, as is the case for 21% of homeowners in Miami, while others are considering moving to states where life is less expensive.

This situation highlights a structural crisis in real estate financing, amplified by rising costs linked to climate change and regulatory requirements.

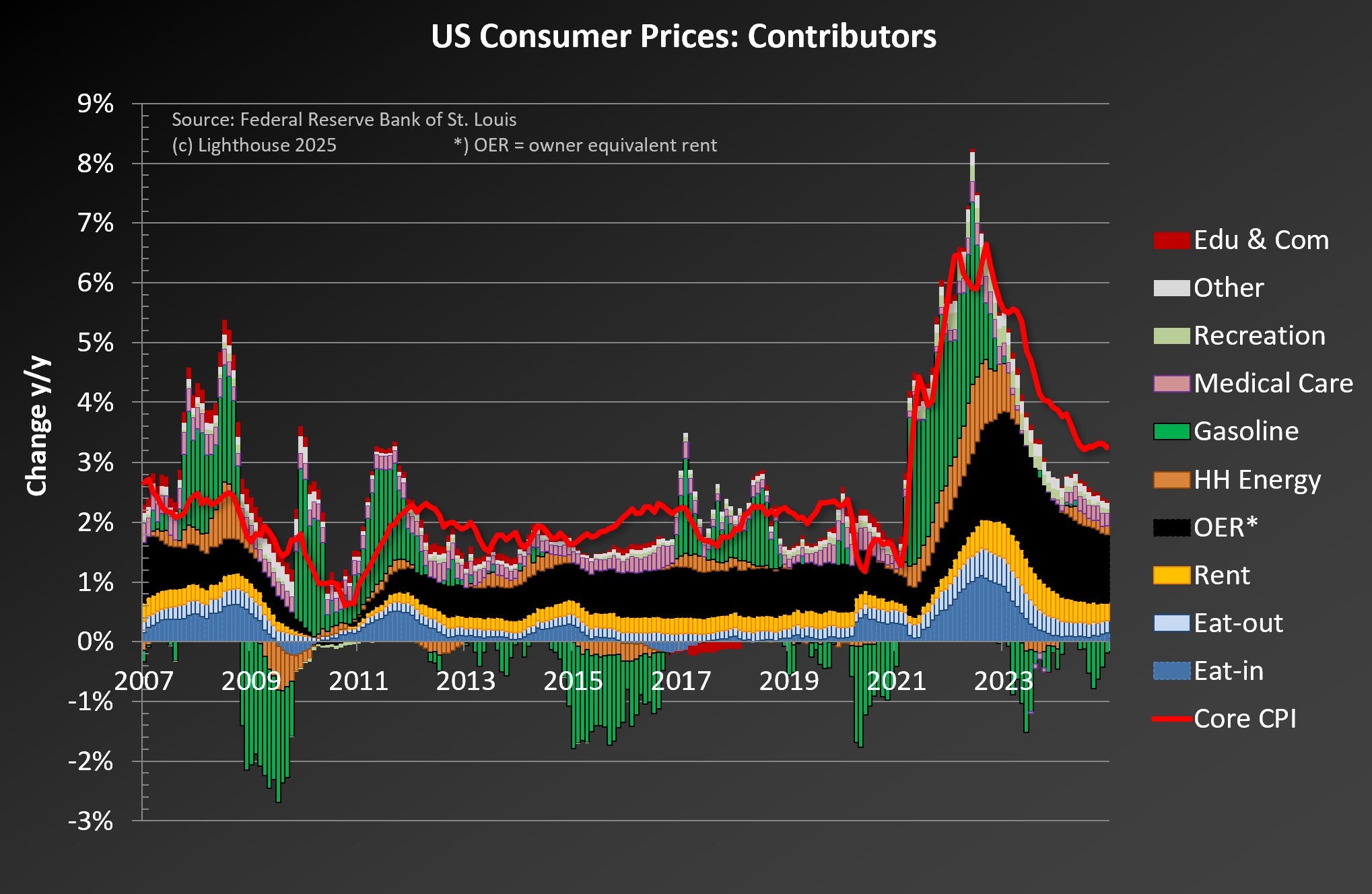

Housing - both rents and property expenses - has become the main driver of US inflation, overtaking items such as energy and gasoline. With mortgage payments accounting for a higher proportion of median income than in 2006, the situation is unlikely to improve:

Inflation is now focusing on the costs associated with property maintenance, while public institutions, heavily in debt, are raising taxes to alleviate their debts. As a result, housing is not only becoming more and more expensive to acquire, but also more and more expensive to own!

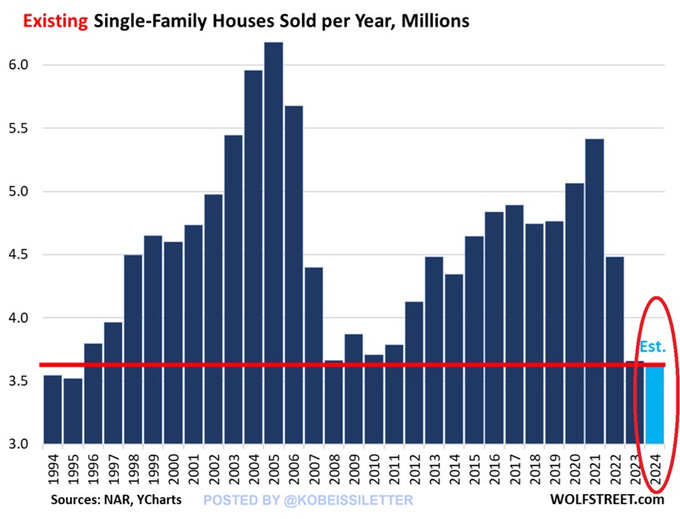

A stalled market, sales at an all-time low

In 2024, sales of existing homes fell to their lowest level since 1995, with around 4.04 million transactions, a figure even lower than that seen during the 2008 crisis:

A no-win situation for many homeowners

In 2024, an alarming phenomenon emerged: buying a new home has become less expensive than buying an existing one! On average, a new home costs $417,400, compared with $419,300 for an existing home. An anomaly that illustrates the market's critical situation.

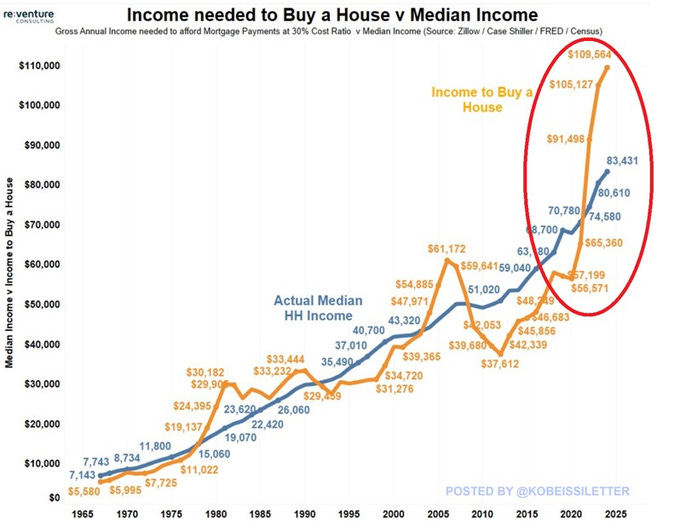

Unaffordable housing for most households

The ability to own a home is reaching critical levels. The annual income required to buy a median-value home has reached a record $109,564, a figure that has doubled in just four years. By comparison, the median household income in the U.S. currently stands at $83,431, a gap of $26,133:

The ability of American households to access home ownership has never been so low.

The market is completely frozen, and this paralysis is the result of a formidable combination: high interest rates and record prices. The average age of home buyers is now 49, compared with 31 in 1981, illustrating the growing gap between younger generations and home ownership.

Young people's disaffection with property purchases is reflected in a marked shift towards other types of investment.

In my December bulletin, I wrote that the rush into crypto-currencies mainly concerns younger investors, notably Generation Z, for whom traditional investment, such as active management and hedge funds, is a thing of the past. Today, they favor high-potential strategies with asymmetrical risk (limited losses, exponential gains). This craze is also the logical consequence of the younger generation's inability to access property ownership. The American dream seems hard to attain, completely changing the way people think about investing.

Faced with prohibitive costs, plummeting sales and crushing encumbrances, the U.S. real estate market has reached an impasse.

Without significant intervention, home ownership could become an even more distant dream for millions of Americans.

The danger lies in the potential detour of an entire generation from this type of investment. What's more, some US institutions could be hard hit by a collapse in the real estate market.

In February 2024, I wrote in a special bulletin that the real estate sector accounted for a quarter of China's GDP, and high levels of leverage led to fears that the deleveraging of the sector could send many banks into a deflationary spiral.

The rise in the price of gold in 2024 is mainly due to the real estate crisis in China. Many investors, previously focused on real estate, have redirected their capital into gold. Moreover, the fear that the collapse of the Chinese real estate market could affect the banking sector has prompted many savers to turn to this safe haven par excellence. Gold is thus positioned as the last bastion against a possible systemic banking shock or currency devaluation resulting from a Chinese rescue plan to prop up its banks.

China's real estate crisis has propelled demand for physical gold to record levels. It is precisely this strong physical demand that explains the recent spectacular rise in the price of gold.

The price of gold in renminbi has almost doubled in the space of two years:

Today, the situation in the US presents similar risks, with the real estate sector at a complete standstill. Faced with this paralysis and the uncertainties it engenders, physical gold now plays the same role in the United States as it did in China last year: a safe alternative in the face of economic and financial instability.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.