In my monthly bulletin reserved for Or.fr clients, I came back to the IMF report entitled “Gold as International Reserves: A Barbarous Relic No More?”

In this report, the IMF changes its tone: gold is no longer considered a "useless" asset. On the contrary, it represents an important part of central banks' reserves.

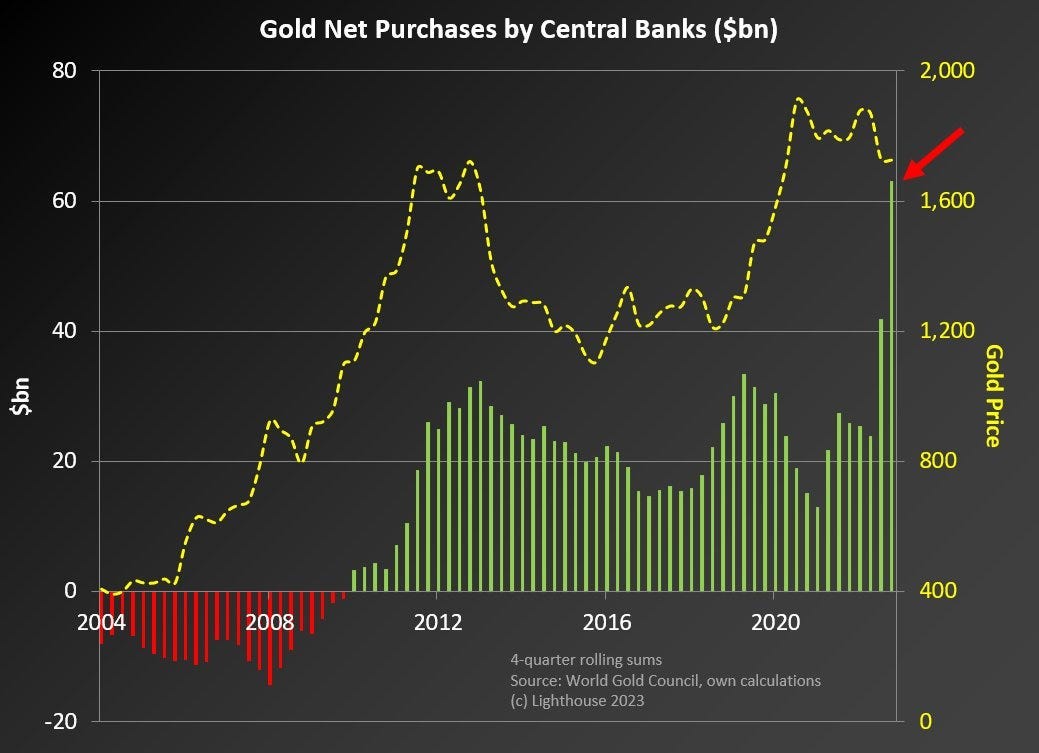

The latest figures from the World Gold Council show that central bank gold purchases reached a record high in the last quarter of 2022:

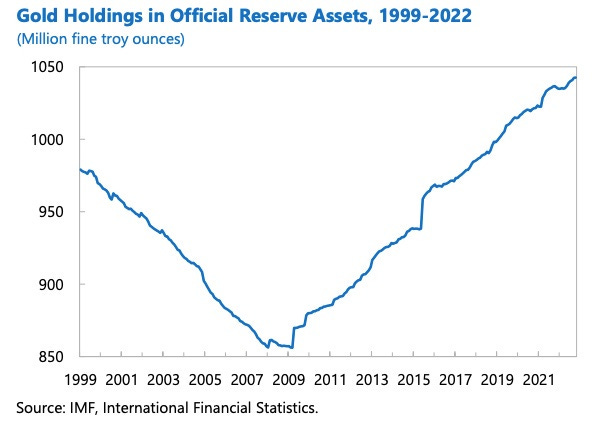

The gold reserves of central banks have exploded upwards since the 2008 crisis:

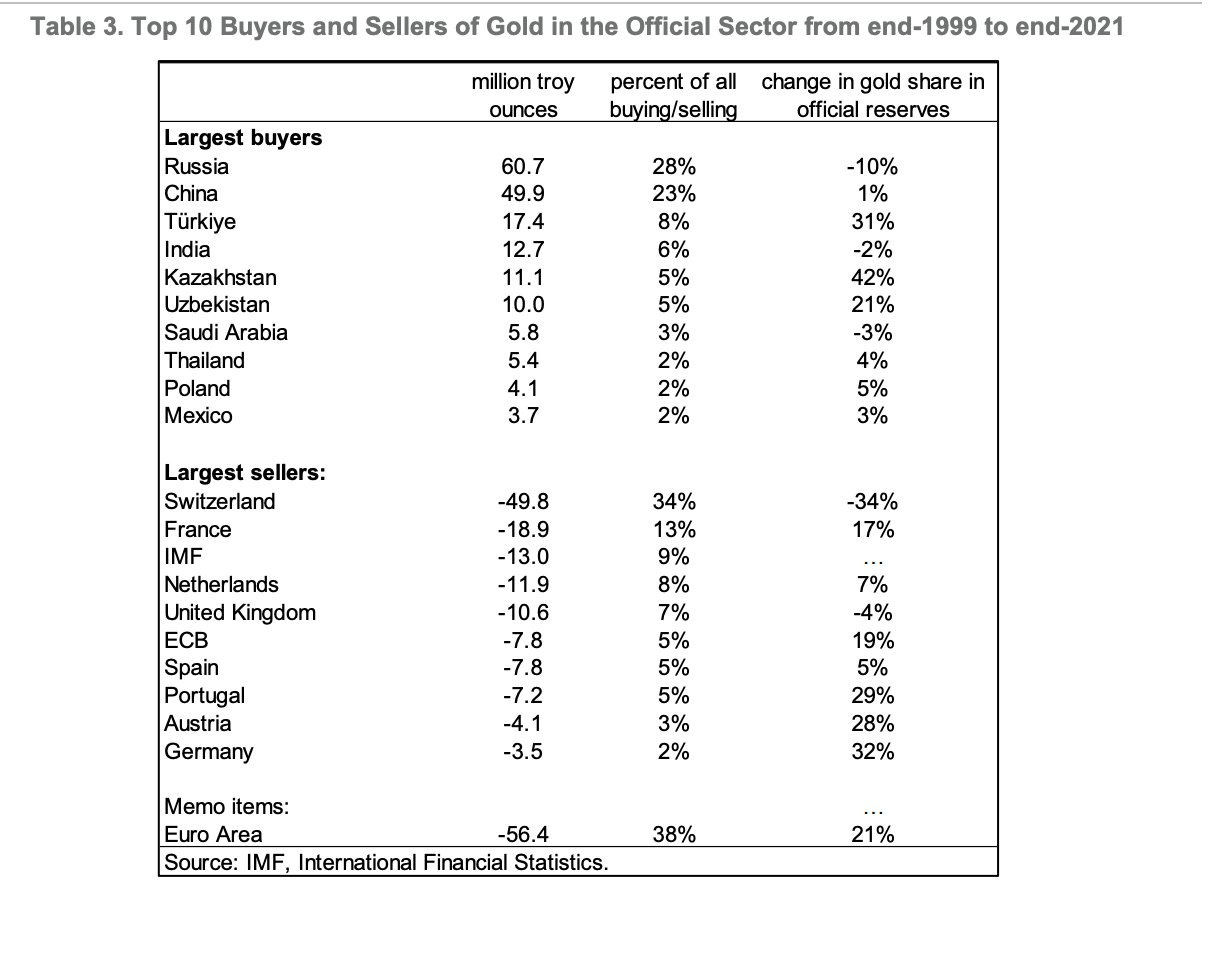

But if we look in detail at the IMF data, we notice that these massive purchases are attributable to only a few central banks, the other institutions having even sold the metal.

The big winners in the rise of gold over the last twenty years are the developing countries and the BRICS, led by Russia and China:

The big losers are the European countries, in particular Switzerland and France.

Switzerland sold 1,548 tonnes, which at the current price of an ounce of gold represents a loss of 87 billion Swiss francs. This figure is in line with the colossal loss recorded by the Swiss National Bank: according to provisional figures, the SNB closed the year 2022 with a loss of around 132 billion Swiss francs. Switzerland has lost billions by selling its gold and squandered even more by playing the financial markets!

France is not to be outdone. By selling 587 tons of gold, the loss for the Bank of France amounts to 33 billion euros.

France has not fully benefited from the tripling of the price of gold in euros over the last twenty years and is now considerably impoverished. France, like most European countries, has missed out on the spectacular rise of gold:

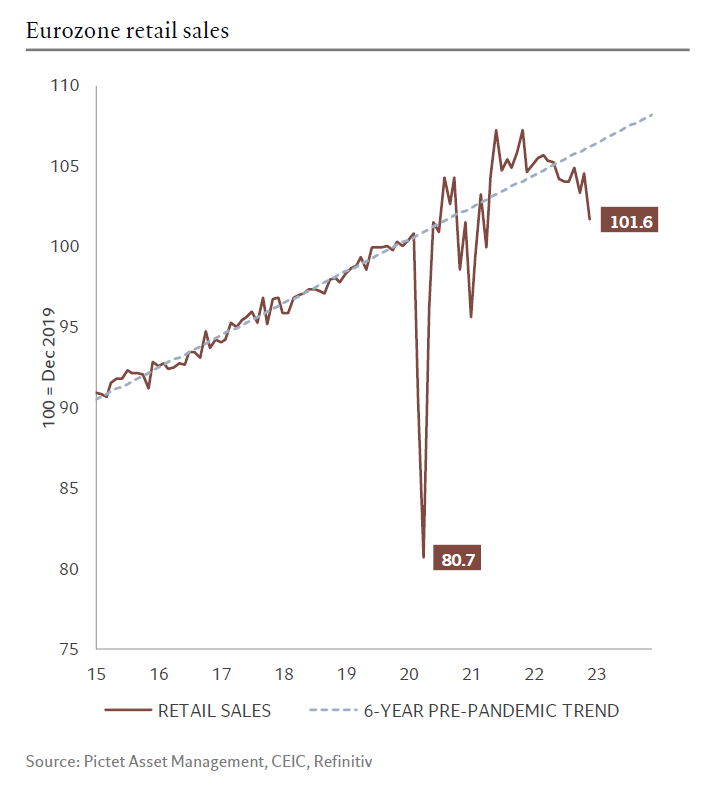

The "barbarous relic", now considered by the IMF as a reserve currency, could have helped these European countries to absorb the consequences of the war in Ukraine and the associated energy crisis. The economic situation in Europe is deteriorating faster than in the United States. The American consumer is holding up better than the European.

Retail sales are falling sharply in Europe, a downward acceleration not yet visible in the United States:

German exports fell by -6.3%, while analysts were expecting -3% after a decline of -0.3% last month.

This slowdown parallels consumer spending figures released by MasterCard, which show an impressive 8.8% annual increase in consumer purchases in January 2023.

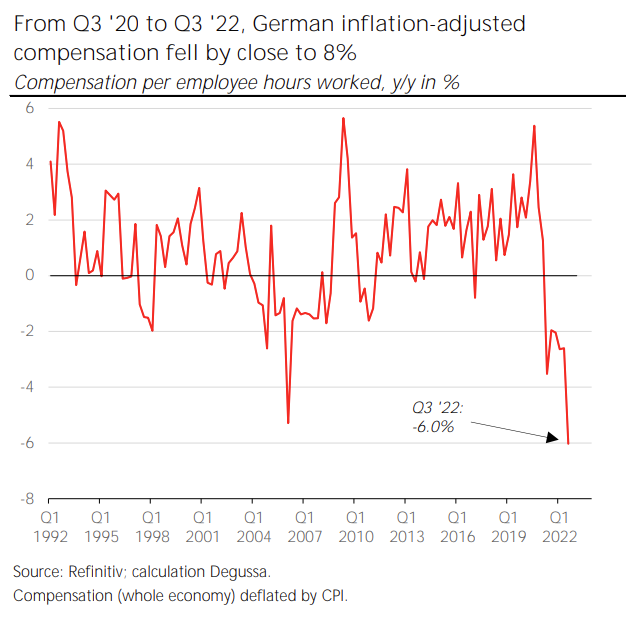

Americans continue to consume as wages rise with inflation, which is not the case in Europe where the loss of purchasing power is accelerating. For example, the decline in real wages in Germany reaches a record low in the third quarter of 2022:

Wages are falling and European savings have also been reduced in relation to gold over the last twenty years. 10,000 deutsche marks bought 14 gold coins at the launch of the euro. Since the returns on savings have been very low, these 10,000 DM represent more than €9,000 on a savings account with an average annual return of 3%. Today, these savings only buy 5 gold coins...

But savers are not the only ones who have become poorer in the last two decades.

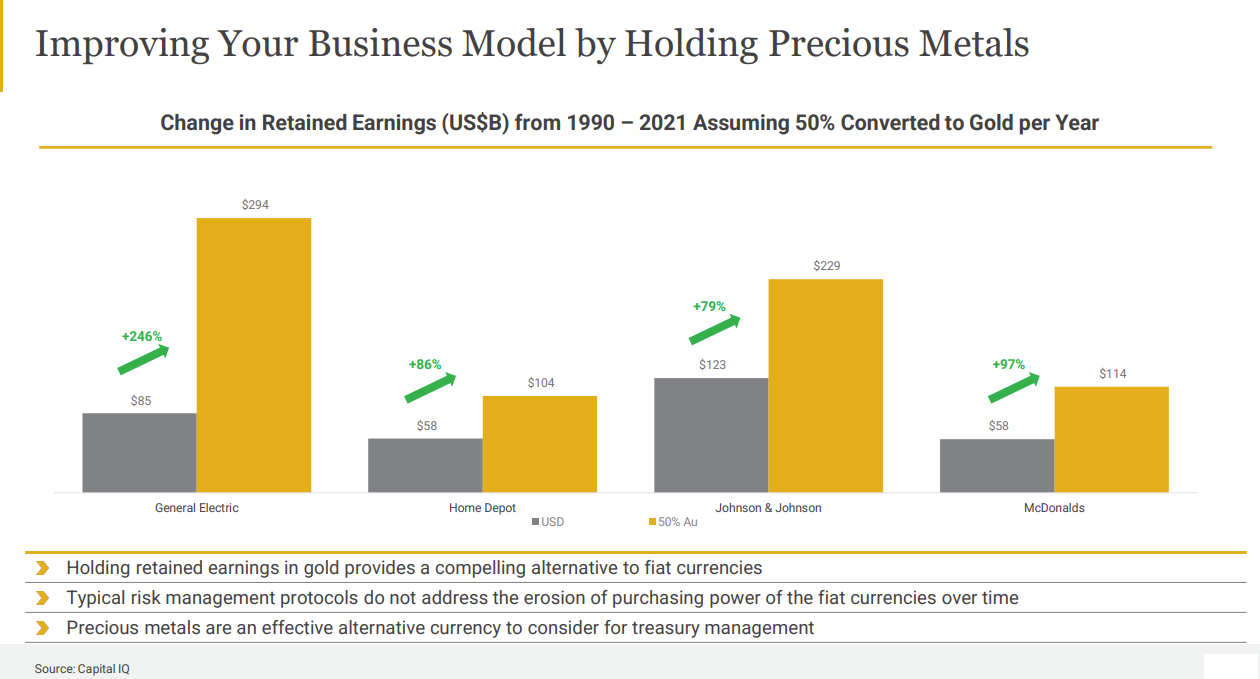

Companies have also experienced a shortfall compared to the gold prices rise. If these companies had invested even a small part of their cash in gold, it would have greatly improved their financial situation...

Capital IQ has done some calculations for large American companies. If General Electric, Home Depot, Johnson & Johnson and McDonald's had converted half of their revenues into gold, every year between 1990 and 2021, their cash flow would have jumped dramatically in a few years:

These calculations confirm the IMF report and demonstrate the intrinsic value of gold as a reserve currency, including for companies. Gold protects against the erosion of reserves exclusively linked to fiat currencies.

Cash managers never look at the loss of purchasing power of their reserves, yet this is an essential element to take into account when facing periods of rising investment costs.

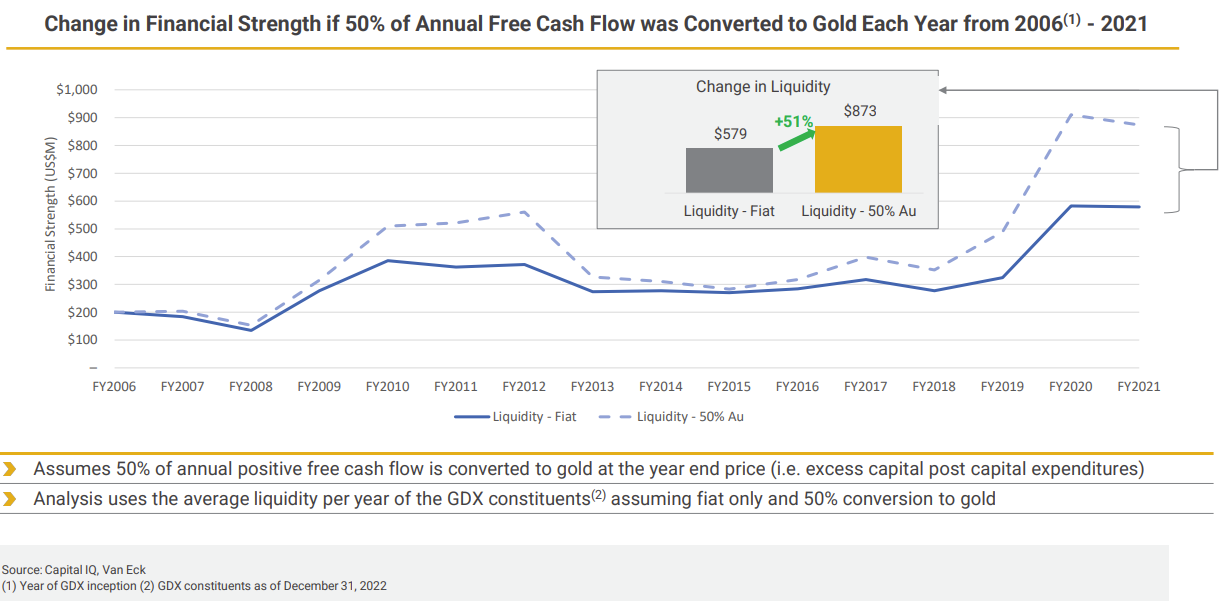

Gold as a reserve currency should also be considered by mining companies. After all, they are the first to be affected. It is quite incredible that so few companies in the sector have integrated gold into their cash management.

A similar calculation applied to gold miners shows that they could have generated 50% more cash by converting half of their net revenues into gold instead of keeping them in cash:

This data proves that in the long run, it is better to keep your profits in gold than in dollars or euros.

Cash represents a challenge for corporate treasuries, particularly because of the speed of erosion of its intrinsic value.

It should be noted that mining companies have an advantage over other companies in that they can support the price of precious metals by reducing the supply in the market.

Although the IMF emphasizes the importance of holding gold as a reserve currency, the share of savings allocated to gold remains low among individuals. We are far from the 10% allocation to gold that wealth managers advised our grandparents when they were young workers.

It is even more incomprehensible that gold miners do not hold this minimum percentage of gold in their treasury, while they encourage individuals to invest part of their savings in physical gold.

As part of a sound risk management strategy, gold and silver allow for long-term investment without fear of loss of purchasing power.

Gold can also serve as a hedge against operating and investment costs. If prices rise, the price of the metals held are also likely to rise, allowing companies to pay their rising costs.

Replacement cost is also a consideration. Considering inflation and risk, the average price of an ounce of gold or silver today is higher than its current price reflects. By selling metals, companies take the risk of buying them back later at a higher price.

By holding gold, mining companies would retain the flexibility to sell at the right time based on market opportunities.

Holding gold rather than cash also helps to withstand periods of high volatility in metals, during which futures pricing does not always allow for "price discovery”. The very functioning of the derivatives markets leads to periods of strong disruption, due in particular to leverage effects and the depletion of COMEX stocks.

Cyberattacks, a New Risk for the COMEX

For the past two weeks, a new element has been added to this pricing problem: ION Cleared Derivatives, one of the CFTC's data providers, has suffered a cyberattack that affects the availability of market data. It is not known if this data has been altered, what sensitive data has been hacked, or if this act of hacking is likely to cause disruptions to futures trading. Worse, futures trading is now in a complete fog, with participants not knowing who is holding short or long positions, and who has added such positions in the past two weeks.

Rob Kientz, a COMEX data analyst and former computer security expert, made a very informative video about this increasingly opaque market.

In his video, the analyst goes back to the CFTC's statement that the incident "impacting some clearing members’ ability to provide the CFTC with timely and accurate data." In particular, the release of the weekly Commitments of Traders (COT) report has been delayed. The data on the Cftc.gov site has not been updated for fifteen days

According to Kientz, without this COT report, the markets could simply stop working. Dublin-based ION Cleared Derivatives was hacked about a week ago by Russian hacker group Lockbit. Despite promises of a resolution within two to three days, nothing has changed since then and it is possible that the data has been compromised.

The analyst recalls that numerous alerts have been published on sites specializing in this type of threat. The VMware vulnerability, probably associated with this cyberattack, was even listed as a potential target for ransomware. To support this statement, several of my friends in charge of IT security have confirmed an attack on VMware precisely on this date. I even know a system manager who, as a precaution, shut down all of his company's servers on Friday night. He preferred to suffer the wrath of his employers rather than having to explain to them that they would have to pay a ransom the following Monday to unlock their data.

Apparently, the same precautions were not taken by ION, which is responsible for determining the prices of all commodities!

In this attack, the data (such as cloud servers, hard drives, databases, etc.) was encrypted by a malicious person who holds the decryption key. To recover the data, the hackers demand a ransom. However, no information has been released about any payment from ION. And even if the data were unlocked, there is no certainty about its integrity. As a result, it is impossible to know if the trading data, derivative positions and prices of gold and silver are accurate, which poses a risk to the commodity markets used to price products around the world!

The FBI has opened an investigation into the incident. Cybersecurity firm Malwarebytes has confirmed that ION data was indeed hacked by Lockbit.

Back in November 2022, however, the CFTC said it was aware of the risks of cyberattacks. However, the agency did not require third-party companies to follow best practices to patch their existing vulnerabilities. The FBI warned: either you've been hacked or you will be. The CFTC mentioned this in their report to prove that they expected an attack sooner or later. Disruptions to the trading platform could cause some short-term chaos in the financial markets. According to Rob Kientz, the CFTC did not take the problem seriously enough and did not hire the necessary teams and then did not put sufficient constraints in place with its data operator. By the way, where is this data stored? Many questions arise from this incident...

Rob Kientz wonders to what extent the possession of market data could be used to manipulate prices, for example by speculating on the intervention of a sovereign state that would have had access to this information. He makes particular reference to gold in the current tense geopolitical environment.

In my analyses of the precious metals market, I have downplayed the risk of a cyberattack on the COMEX. We are discovering how fragile the price discovery mechanism is, which logically reinforces the role and relevance of physical gold. The more fragile the paper market becomes, the more the need to hold physical metal is felt.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.