Like every year, the news seems to come to a standstill during the vacation season.

The fact is, the media hardly reports anything any more, apart from the weather or certain news items. The disconnect is total. And yet, in the meantime, everything seems to be accelerating, both geo-politically and economically.

The return from vacation is likely to be difficult, with August shaping up to be a hectic month on all fronts.

In the United States, public finances continue to deteriorate.

Fitch has just downgraded the long-term credit rating of the United States from AAA to AA+. The rating agency explains that "the repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management". "In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process", adds Fitch.

To finance its deficit and keep spending, the U.S. Treasury issued $1.8 trillion in short-term debt in just two short months, as much as the country had issued in its entire 209-year history.

The US Treasury has also just raised its estimate of the amount to be borrowed in the second quarter to $1.85 trillion. This is unprecedented. This is the logical consequence of last June's lifting of the debt ceiling. The Treasury is in freewheel mode, borrowing without limit.

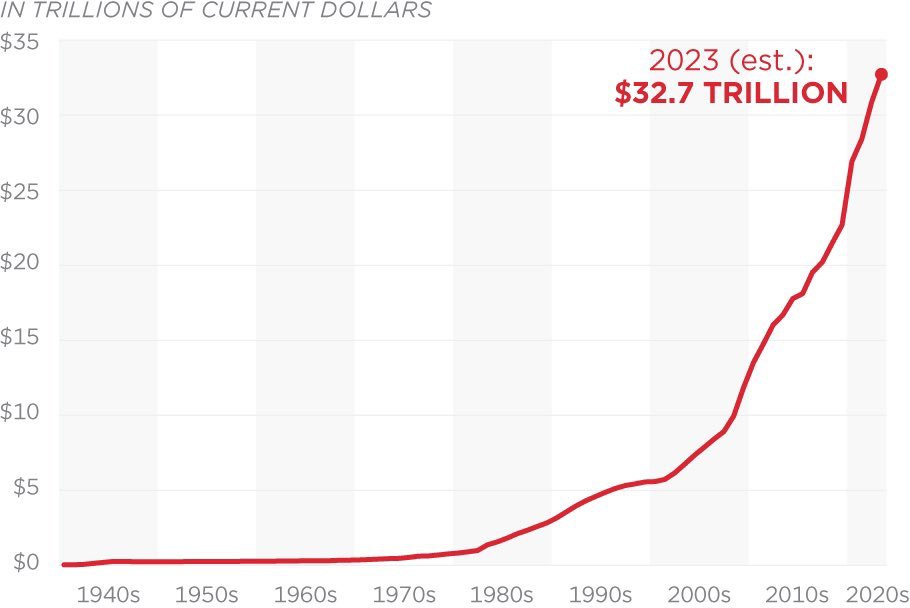

We have clearly entered an exponential phase of debt growth. Estimates for the end of 2023 now stand at well over $30 trillion, up sharply on last year's forecasts.

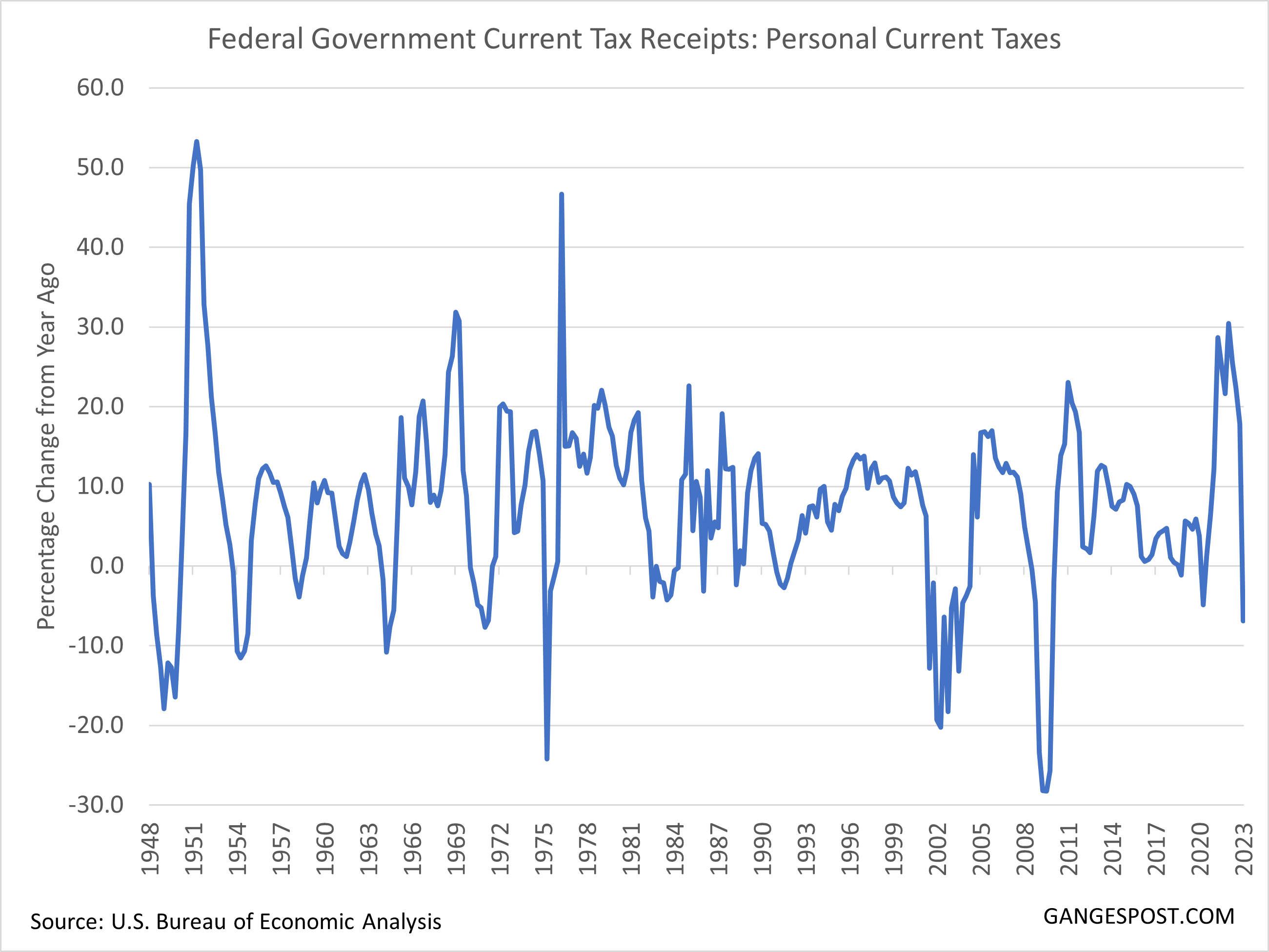

In June, against all expectations, US spending climbed by 15% to $646 billion. The U.S. paid a record $652 billion in interest in the first six months of 2023, an amount likely to rise by the end of the year. This level of repayment is unsustainable at a time when the country's tax revenues are falling again.

Total tax revenues fell by 9.2%, from $461 billion to $418 billion in June. This resulted in a decline in public revenues of more than 7.3%, a record since June 2020.

Economic activity, while holding at unexpectedly high levels, is not growing fast enough to sustain the shock of rising debt repayment costs.

On the other hand, unlimited government spending is boosting inflation in the United States. In such a context, how could the Fed lower its key rate? The prospect of a rapid rate cut was one of the last sources of support for economic activity and the housing market. But that hope is fading. How many Americans are buying today in the hope of refinancing their credit with a short-term rate cut?

The measures taken by the Fed to cushion the shock of the debt wall are buying some time. But with the decision to borrow much more than expected between now and the end of the year, the Treasury is complicating the Fed's task. The more the government spends, the bigger the repayment bill, and the more difficult it becomes to buy back new debt. Now that the interest curve on the debt is hitting the steepest slope of the exponential, the central bank's ability to intervene to support the government's lifestyle is dwindling.

One might have thought that the drifting US public finances would be the headline story in the business press this summer. Not so. Another country, another central bank, is still in the news. It's Japan.

In an October 2022 article, I wrote:

"On October 26, Japan announced a new $454 billion stimulus package. An effort equivalent to the one deployed during the last financial crisis in 2008. This program is launched after the BoJ has already absorbed almost all the bonds issued by the government. The Japanese bond market is totally frozen, dependent on a single buyer. The monetization of the debt is total in the land of the rising sun.

It is as if the Japanese monetary and fiscal authorities had no choice: stopping the monetary policy started twenty years ago would collapse the whole Japanese financial system by removing the buyer of last resort. The only solution is to continue monetizing the debt, to calm the markets, at least in the short term."

The October 26 intervention followed an attack on the yen the week before. In an article published just before this intervention, I wrote:

"The BoJ was the first to apply the policy of buying back government bonds. The alchemy of quantitative easing has been most intense in Japan: the BoJ has nationalized the bond market and today, with a record debt-to-GDP ratio of 250%, the price of this monetary folly is being reflected in the value of the yen. The market is starting to blow the whistle on the endgame. The dollar continues its exponential rise against the yen. At this point, an accelerated fall in the yen would have a devastating inflationary effect. To stop the bleeding and avoid the country running this risk, the BoJ has to intervene in the foreign exchange markets and buy yen with its dollar reserves, including selling its treasury bills. But these interventions could make a securities market that is already in danger of going completely off the rails even more illiquid. There is no simple solution to stabilize the yen!"

Japan is back in the news today.

The yen is once again weakening against the dollar, mainly due to the difference in interest rates between the two countries:

Faced with a weak yen, Japan's central bank is forced to let rates rise.

The BoJ announced that it would intervene in the markets by keeping 10-year rates at 0.5%, then raising the "hard cap" on JGB intervention to between 0.5% and 1.0%.

This decision triggered an explosion in JGB yields.

Japanese rates rise sharply again:

Faced with soaring rates, the BoJ had to take emergency action to contain the collapse of JGBs.

Barely two days after giving a signal to raise rates, the Japanese central bank is forced to buy bonds on the market to prevent interest rates from soaring too far!

The BoJ seems to have even less room to maneuver than the Fed, and the episode of the last few days shows just how delicate the steering of Japanese monetary policy has become.

The BoJ's intervention was intended to strengthen the yen, but ended in failure. Japanese interest rates have risen again, without the Japanese currency benefiting. Problem: a prolonged weakening of the yen would have disastrous consequences for inflation in Japan, against a backdrop of rising oil prices.

The calm waters of Japanese monetary policy are over. This failed intervention implies much more radical positioning in the future, both by the BoJ and by participants in the Forex and bond markets.

Doubts surrounding the BoJ's policy reinforce the risk of upsetting the very fragile equilibrium supporting the yen Carry Trade, a veritable reservoir of liquidity for world markets.

The Bank of Japan is getting its feet wet, which is good for gold. The price of gold in yen has broken an all-time record, amid complete media indifference:

More than ever, physical gold is the ultimate insurance against the ever-increasing likelihood of monetary policy errors by central banks.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.