Let’s start this article with a little bit of analysis of the charts. Yesterday, the technological stocks reached a new height in relation to the mining stock index, and this corresponds to a double top after the first summit reached in March 2020. The bearish divergences, the shooting star that is in the process of forming and the very high level of the RSI indicate that a turnaround is on the cards. The technological stocks ought therefore to underperform the mining stocks from now on.

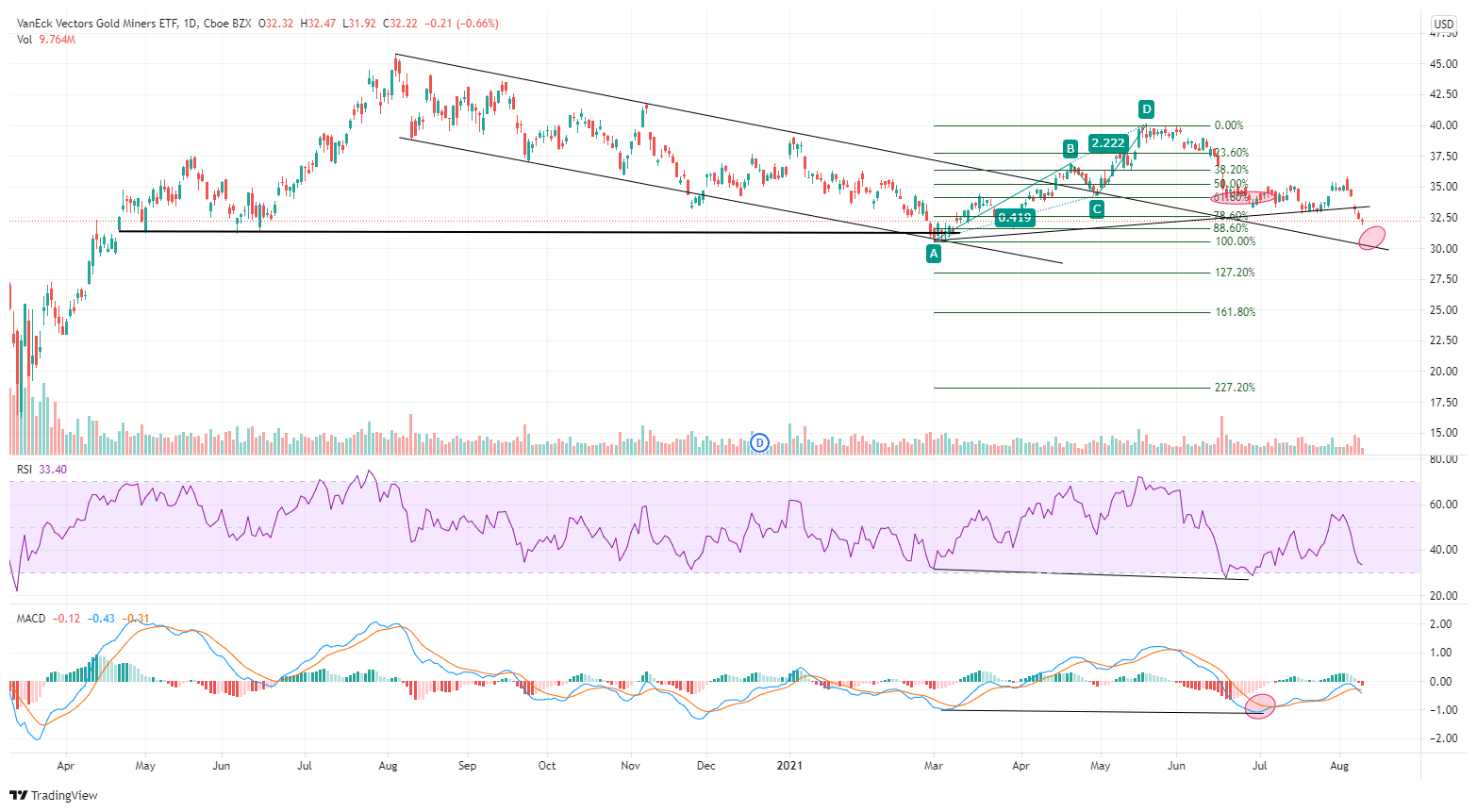

The mining stocks have now been continuing their correction in “Chinese torture” mode for several months, but the last violent correction to gold has not managed to provoke a capitulation in the sector. Some bearish observers will see confirmation that there is still a bearish leg, but with an optimism index that has been brought down to its lowest since March 2020 and with such a situation of over-selling. The margin for these shorts funds is becoming increasingly reduced.

On the charts, the 30-32 zone for GDX offers a good support for recovery:

The strong correction on gold recorded this Monday has undermined the morale of the Gold bugs a little more. 12 billion dollars’ worth of sales of futures contracts on the night of Sunday to Monday, when the stock markets in Tokyo and Singapore were closed, finally managed to break a major support in the gold price which is now at around $1700 / $1750 per ounce, after a plunge of $100 in a matter of minutes… followed by a recovery of $50 minutes later!

It is no use waiting for any explanation whatsoever on the part of the authorities, who are supposed to be overseeing this market. The CFTC (Commodity Futures Trading Commission) had not been able to come up with the slightest explanation in 2011, when a flash sale operation like this had caused irreversible damage to the prices. Anyone seeking one would have had to wait for a court action brought by fleeced investors to see the situation resolved, 10 years after this kind of manipulation began. The long investigation finally managed to locate the traders behind these flash sales, all of whom were acting on behalf of the bullion banks. The institutions incriminated eventually got off with a fine that was derisory, compared to the huge amounts of money that were made in these operations in which futures markets were manipulated. It was not really an outcome that was likely to act as a disincentive for carrying on illegal operations like this with complete impunity. Numerous observers of the market think it is highly likely that the flash sales seen in recent months, at a time when there is very little liquidity in the markets, are the fault of the bullion banks that have to cover significant short positions. Others claim that this type of intervention looks like a classic intervention in the exchanges market. Gold is increasingly seen as a currency that is competing with the fiduciary currencies, and that needs to be controlled. Others attribute this sudden plunge to a massive sale by an Asian fund that was caught in a margin call. Other operators attribute this movement to an intervention by the IMF in relation to an African bank. The opaque nature of the exchanges on this futures market means that the identity of the party behind this massive sale cannot be ascertained.

The only thing that can be said with any certainty is that not a single physical ounce was exchanged in this transaction. 12 billions’ worth of gold sold without a gram of gold changing hands: that’s the magic of the derivatives markets! The other lesson to be learned from this lightning fall is that 12 billion is not doing the same amount of damage to the gold price charts as it could have caused in 2011. But 12 billion in 2021 is not the same as 12 billion in 2011! However, this discount brought about on the prices risks once again triggering a run on physical gold in Asia, and particularly in India, where the economy is picking up again amid much fanfare, after the latest wave of the epidemic, which finished as quickly as it had begun.

This game that is taking effect on the paper gold market will have enabled a transfer of physical gold from the West to the East, at a rate never seen before in the last ten years. In 10 years, China has accumulated over 10,000 tons of gold in ingots. This gold was in the West, but it has now gone into the vaults in Asia.

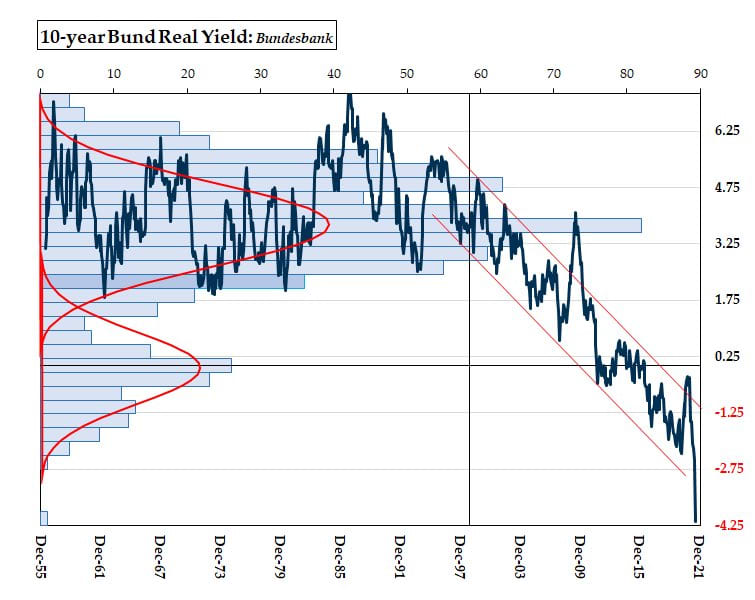

While this consolidation movement on the part of gold has managed to reduce the U.S. funds’ interest in precious metals significantly, this is far from being the case in Europe. The Financial Times reveals that more than a billion dollars were invested by European funds in ETFs associated with gold in July. This seems to make quite a bit of sense when one sees how European savers, dependent as they are on fixed income, are being treated. The German real yields, for instance, are in freefall:

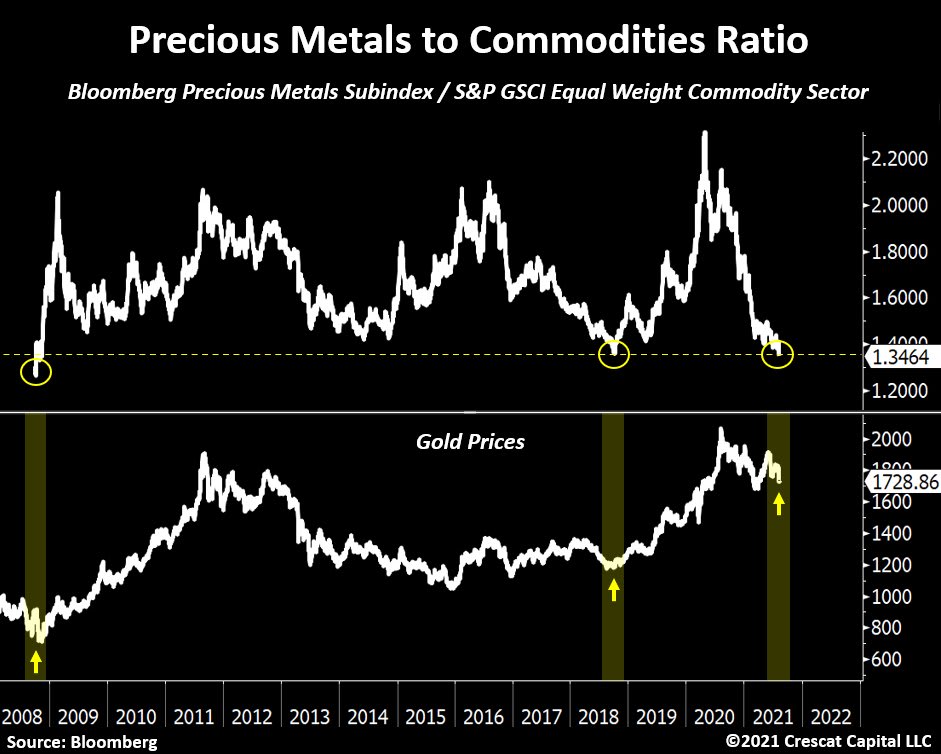

This movement towards physical gold risks accelerating after this flash sale on futures. Gold has come back to a record low in relation to the other commodities. The last time this happened, gold initiated a new upward leg in the next few months that brought it up towards historic highs.

While, for the time being, the price of gold remains under control thanks to the mechanism of the futures market, inflation, for its part, remains, conversely, beyond the control of the monetary and fiscal authorities.

The latest publication of the CPI index, at 5.65%, attests to this. The United States is continuing to record persistently high inflation figures. More than this gross figure, though, it is the perception of inflation in the minds of consumers that is causing the Fed even more consternation.

Inflation forecast, measured in terms of the consumer price index (CPI), is at its highest since 2013. 25% of U.S. consumers, indeed, are expecting double-digit inflation within the next 3 years. This index measures the perception of inflation and it is understandable to see this index, greatly used by the Fed, react, in its turn, to the rise. The inflation is now making itself felt in real life, as the latest figures attest.

Invitation Homes, the biggest U.S. home leasing company, has just hiked its rents by 8% throughout the country. As for private landlords, they are being heavily penalized by a new law that makes them liable to a criminal fine if they fail to abide by the new notice period for evictions. The U.S. housing stock is currently undergoing a consolidation toward giants like Blackstone, who are the only ones that can pass on the rise in inflation they are enduring in their costs, by increasing the price of the accommodation they lease.

This week, coal is once again reaching record prices.

President Biden must appeal to OPEC to try to calm the rise in petrol... (while at the same time announcing the launch of the Green Deal!)

Inflation is also out of control in the field of transportation by sea. The freight tariffs for transporting a 40-foot container between the United States and China are at a record high, and now exceed $20,000.

The Fed cannot print shipping containers. Inflation in real economic life cannot be controlled.

Faced with these costs that have become uncontrollable, several companies have already warned that they are going to have to increase their sales prices significantly this fall.

These price rises are occurring against the backdrop of a partial recovery.

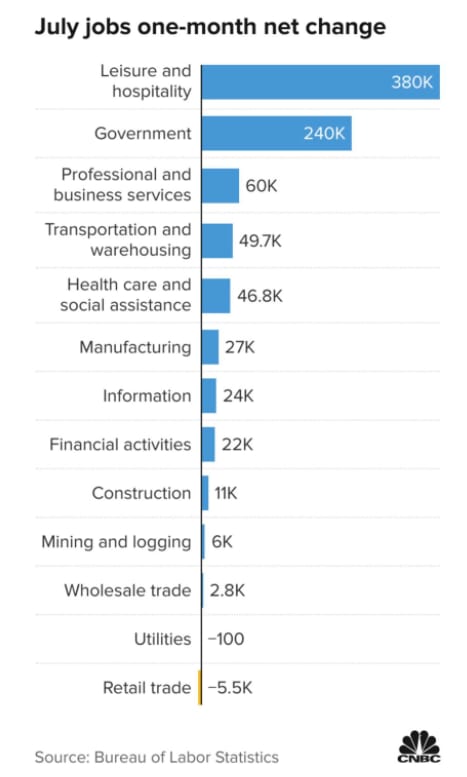

The employment figures, once again on the rise, conceal a problem that one encounters over and over again in this recovery: the jobs are not sufficiently associated with the most stable and perennial sector, namely that of services and industry. The jobs created are concentrated in the public sectors and in tourism, and this is not traditionally a particularly healthy thing for the U.S. economy:

The U.S. employment data reveal the astonishing figure on unfilled vacancies: there are currently 1.75 job offers for every person out of work. This is most apparent in the hospitality sector, where plenty of vacancies remain unfilled. This is the characteristic sign of an inflationary effect that is now spreading to the labor market: jobs that don’t pay well enough are simply no longer finding any takers. In such cases, working is more costly than doing nothing...and continuing to receive unemployment benefits. If there is a disinclination to touch the benefits, the only way to resolve the situation will be to increase salaries, and this would constitute an additional threat on top of the level of inflation to come...

The figures on growth, evaluated at 6.5% this quarter, can no longer be read with any clarity at all, because in the same period inflation has brought about a seismic change to real disposable incomes, which have been falling at an annual rate of 30% this quarter. GDP is growing, but not enough to check the fall of real incomes. Consequently, without a savings reserve, consumption risks simply coming to an abrupt halt.

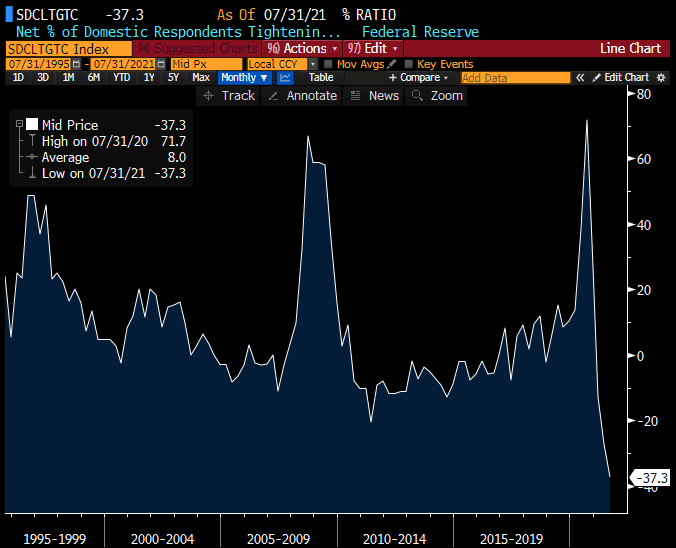

Faced with this fall in revenues and in order not to destroy the engine of U.S. consumption, the banks are drastically lowering their conditions for accessing credit, just as they did at the time of the crisis in 2009.

It is against this backdrop that the Biden plan has just been passed in the Senate: over a trillion dollars of extra spending (including 500 billion in new spending) to stimulate demand through public investment, with an implicit commitment to a further $4 trillion of additional spending. The goal is, sure enough, to prop up demand and therefore consumption, the driver of the U.S. economy.

But this umpteenth stimulus plan is now confronted with a completely different context than the one that obtained during the previous stimulus attempts. The inflation has already spread to all assets and is in the process of swelling the prices of most consumer goods in an uncontrolled manner. Between the time this plan was written and the date it is implemented, inflation will have pushed prices up. Building a bridge today, with inflation going at such a gallop, is a hazardous gamble. Between the moment the budgeting is finalized, the plans drawn up, the materials ordered and shipped, and the workers paid...the price has enough time to shoot up, because each cost heading is enduring double-digit hikes right now. This can currently be seen in any construction project, where the CAPEX of each development project is enduring a minimum extra cost of 20% in the best-case scenario.

The taxpayer will have to foot the bill for this extra cost.

One mustn’t forget that a new cost, for a piece of equipment, has come from a new debt... that the Fed is going to have to monetize... thereby accentuating the inflationary effects even more...

There are no two ways about it: this inflation is a tax in disguise. In total, this bridge, even if it temporarily makes it possible to distribute the income associated with public demand, is going to be far more costly for the taxpayer than planned, due to an inevitable extra cost associated with the inflation and due to the disguised tax associated with the source of financing for this project. At the current pace of inflation, this awareness is usually quite rapid. In cases of hyperinflation, the shock is immediate, in fact, because the bridge cannot be built. Indeed, no developers are going to risk opening a construction site that could lose them money between the moment they order their materials and hire their staff, and the moment they have to pay them.

The Democrats who are applauding this stimulus plan do not yet realize the true price to be paid. It will be the U.S. consumer that will be sent the bill, and that will have to cancel their investments tomorrow. (Incidentally, the Republicans who backed the stimulus plan that Trump was unable to get passed when he was in office were equally unaware of the real cost...proof that it is often dangerous to subject these kinds of plans to a political reading. One does not attempt a Keynesian recovery when inflation is out of control, whatever the political colors of the government that is behind it.)

In an economic sense, just as the accumulated debt is amputating future efforts to save, future consumption is already reflected in the bubble-like value of assets. This bubble is the reservoir of the inflation that is to come. This stimulus plan will be financed by the minting press and the resulting inflation therefore risks reducing households’ future consumption even further. The attempts to solve a problem in the short term are putting it off to a later time, while also amplifying it. This has been a constant in the fiscal and monetary policies followed for more than ten years. Now, however, as inflation is transmitted to the real economy, the nefarious effects may make themselves felt more quickly. Inflation is the sign that a monetary and fiscal policy has failed - this has been shown to be the case in each crisis.

The U.S. monetary and fiscal interventions have sabotaged the current generation’s future capacity to save. The massive stimulus plans, in an inflationary environment, may now sabotage their future buying power, and pose a real risk in terms of the level of U.S. consumption in the next few years. There is nothing to stop the governments and central banks artificially propping up the prices of the assets that have been propped up thus far, nothing to stop them continuing to manipulate the bonds market or intervening on the monetary markets, and nothing to stop them continuing to prop up a consumer on life support who is living without any savings at all. On the other hand, there is nothing that can be done to counter the nefarious effects of inflation without immediate, firm action on the rates. As we have seen, this inflation is a risk for U.S. consumption, the primary driver of the world’s economy. By letting inflation run wild, one risks an engine failure, irrespective of the tools used. But acting straight away on the rates would have an even more devastating effect on the system as a whole; and the central bankers are well aware of this. This is the impasse that the central banks have now got themselves into, in their interventionist policies. Acting straight away will break the engine, while doing nothing will result in a malfunction. That’s what the math is telling us.

Gold and silver directly owned in your name or held in an allocated account (and certainly not in an unallocated one) are the only insurance policies against the upcoming breaking or malfunctioning of the engine.

For the directors of the central banks, it is better to take the risk of a future malfunction, while praying that a hypothetical solution of replacement falls from the sky (and that another driver will be found responsible for the breakdown of this crazy machine), rather than break everything straight away. The strategy is therefore to promise that action will be taken very soon on the rates, and that the buying up of assets will stop, while continuing to do the opposite: not touching the rates and continuing, or even stepping up, the purchases of bonds. The strategy, then, is still to buy time. It is by no means certain that the current pace of inflation leaves us much time to play with.

Original source: Recherche Bay

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.